- Bitcoin ETFs have experienced massive outflows, with $937 million withdrawn in a single day, signaling declining institutional confidence and pushing Bitcoin’s price below $88,500.

- Analysts warn that continued sell-offs and economic uncertainties could drive Bitcoin down to the $70,000–$75,000 range.

The crypto market is facing a storm as Bitcoin Exchange-Traded Funds (ETFs) experience their largest single-day outflows since inception. With investors pulling out a staggering $937 million on Tuesday alone, concerns are mounting over the future trajectory of Bitcoin and the broader market.

Massive Outflows Shake Investor Confidence

Bitcoin ETFs in the U.S. have recorded six consecutive days of outflows, signaling a potential shift in institutional sentiment. This week alone, total withdrawals from cryptocurrency ETFs and exchange-traded products (ETPs) have crossed the $1.7 billion mark. These outflows have coincided with Bitcoin’s price tumbling below $88,500, extending its weekly losses to over 7.52%.

Leading the exodus was Fidelity’s FBTC, which saw $344 million in outflows, followed by BlackRock’s IBIT, which recorded $144 million in withdrawals. These figures indicate sustained selling pressure, suggesting that institutional investors are reducing their exposure amid ongoing market uncertainties.

Bitcoin Exchange Activity on the Rise

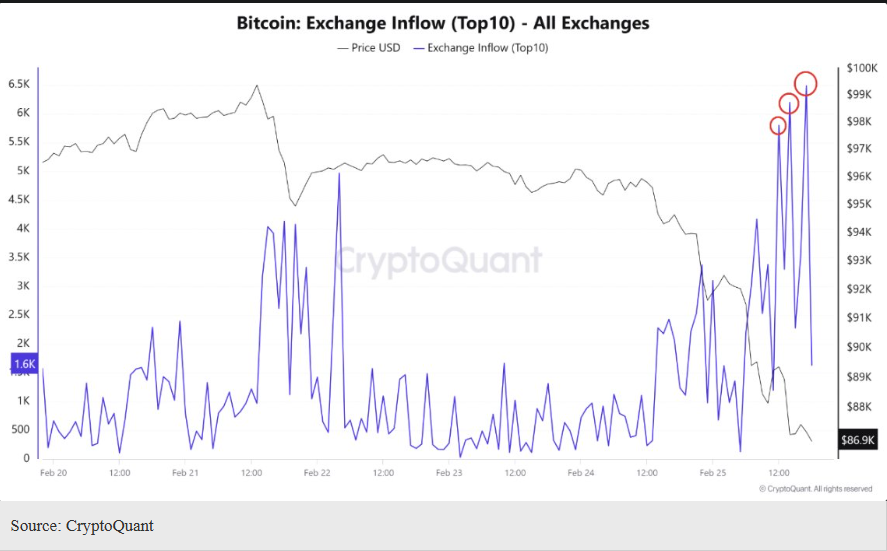

While Bitcoin ETFs are witnessing record outflows, exchange activity has surged significantly. Analysts at CryptoQuant reported that the “Exchange Inflow (Top 10)” metric spiked above 5,000 BTC three times in a single day. This trend suggests that large Bitcoin holders or institutions might be transferring funds to exchanges, potentially preparing for further sell-offs.

One major factor behind this shift is the recent decline in U.S. consumer confidence. The latest Consumer Confidence report highlighted an eight-month low, driven by inflation concerns and economic uncertainty. As investors react to these macroeconomic trends, the crypto market remains on edge.

Arthur Hayes Predicts Bitcoin Pullback to $70K

BitMEX co-founder Arthur Hayes has weighed in on the current market conditions, predicting that Bitcoin could retrace to the $70,000–$75,000 range. His forecast hinges on the U.S. budget challenges, particularly if former President Donald Trump struggles to push through his proposed spending increases and debt ceiling adjustments.

“This is a test of how strong Trump’s hold is on the Republican Party,” Hayes stated, advising traders to remain patient as the situation unfolds.

What’s Next for Bitcoin?

With Bitcoin trading around $88,488 at press time and daily volumes dropping to $68 billion, the market is at a critical juncture. If ETF outflows continue and selling pressure increases, a further decline toward $70,000 may be imminent.

However, long-term investors remain optimistic about Bitcoin’s resilience, particularly with growing mainstream adoption and upcoming developments in the blockchain space. Whether this downturn is a temporary correction or the start of a larger sell-off remains to be seen.