Cryptocurrency trading involves buying and selling digital currencies like Bitcoin and Ethereum to profit from market price fluctuations. With a market cap exceeding $2.74 trillion as of March 15th 2025 according to CMC data, crypto trading is a rapidly growing industry.

This guide will walk you through the basics of trading, key strategies, and step-by-step instructions to start your crypto journey.

What is Cryptocurrency and Cryptocurrency Trading?

Cryptocurrency is a digital or virtual currency secured by cryptography, operating on decentralized blockchain technology without the need for a central authority.

Cryptocurrency trading is the act of buying, selling, or exchanging digital assets such as Bitcoin, Ethereum, and other altcoins. Unlike traditional stock markets, crypto markets operate 24/7, offering traders the flexibility to buy and sell anytime.

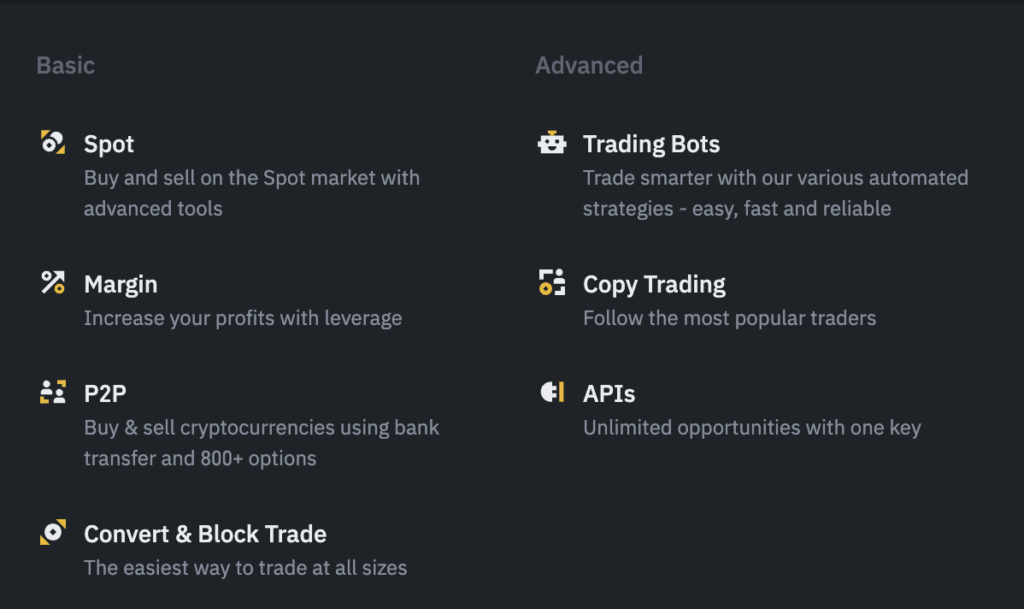

Trading occurs on crypto exchanges like Binance, Coinbase, OKX, and Bybit, where users can choose between:

✔️ Spot trading (buying and selling actual coins)

✔️ Margin trading (borrowing funds for larger trades)

✔️ Futures trading (predicting future prices with leverage)

Pros and Cons of Crypto Trading

✅ Pros:

- High profit potential – Crypto markets are volatile, leading to quick gains.

- 24/7 trading – No restrictions on market hours.

- Global accessibility – Trade from anywhere with an internet connection.

- Decentralized market – No government or central bank control.

❌ Cons:

- High volatility – Sudden price swings can lead to losses.

- Limited regulations – Some exchanges lack investor protections.

- Security risks – Hacking, lost passwords, or exchange failures can result in lost funds.

How to Trade Cryptocurrency: Step-by-Step Guide

Step 1: Create an Account on a Crypto Exchange

To start trading, sign up on a cryptocurrency exchange like Binance, Coinbase, or KuCoin. Follow these steps:

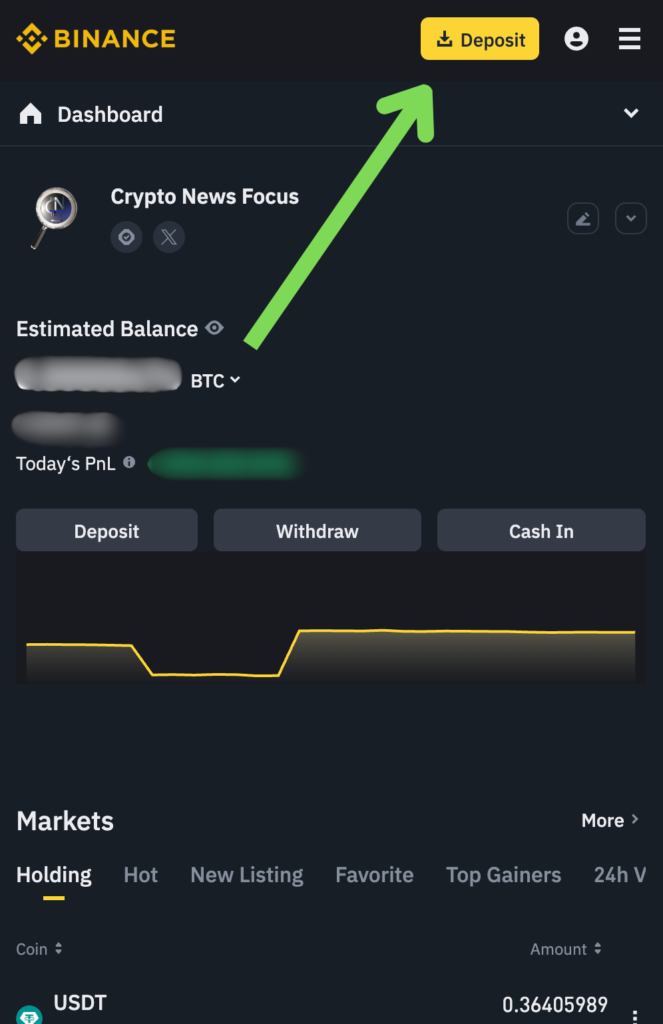

1️⃣ Visit the official website. In this case, let’s go with Binance. Open the official Binance page and click Sign Up. Please note that the dashboard page may look a bit different depending on the screen size and device.

2️⃣ Click Sign Up and enter your email/phone number. Create a strong password one that you will remember or save it somewhere safe to avoid loosing funds.

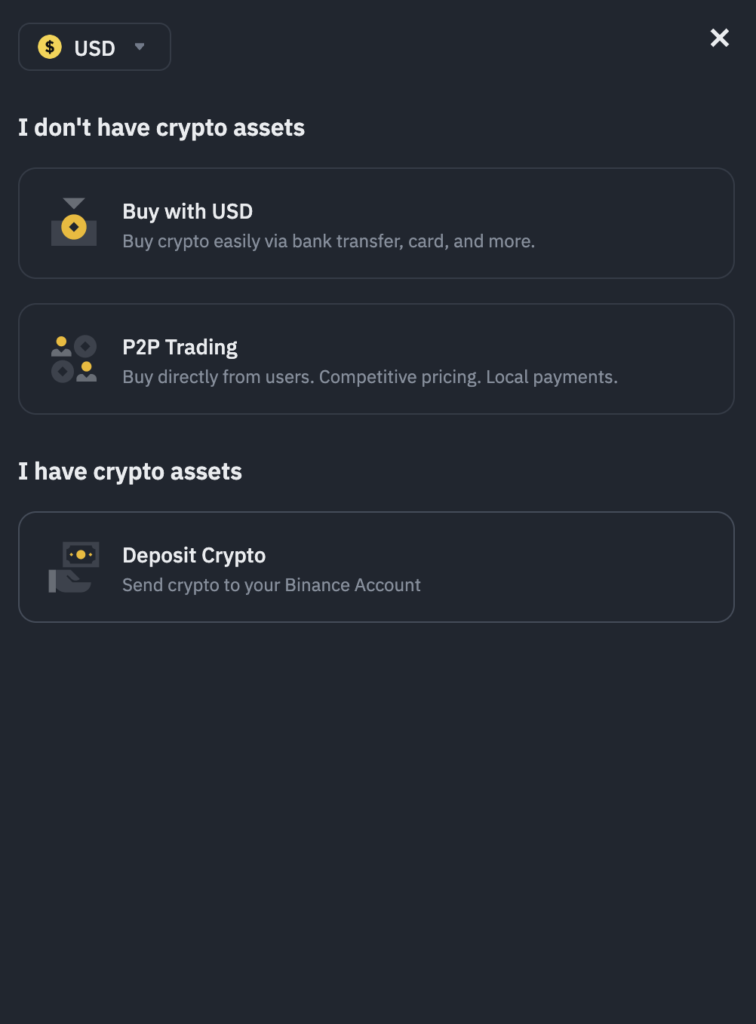

Step 2: Deposit Funds to Your Account

After registering, log in and fund your account. Exchanges allow multiple deposit methods:

💳 Debit/Credit Card – Instant but may have higher fees.

🏦 Bank Transfer – Lower fees, but processing may take 1–3 days.

📲 Crypto Deposit – Transfer funds from another wallet.

💡 Example: If you deposit $100, it will appear in your Fiat Wallet, ready for trading.

Step 3: Choose a Cryptocurrency to Trade

Go to the Markets tab on your exchange to browse available cryptocurrencies. Popular trading pairs include:

- BTC/USDT (Bitcoin & Tether)

- ETH/USDT (Ethereum & Tether)

- SOL/USDT (Solana & Tether)

For beginners, it’s recommended to trade large, stable cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Step 4: Pick a Trading Strategy

Before executing a trade, choose a strategy that fits your experience level:

📉 Day Trading – Buy and sell within hours for small, quick profits.

📊 Swing Trading – Hold crypto for days or weeks based on trends.

💰 HODLing – Long-term investment, holding for months or years.

⚡ Scalping – Make multiple small trades daily for quick profits.

🔄 Copy Trading – Follow professional traders automatically.

Please note there is simillarities accross the platforms but in this case I

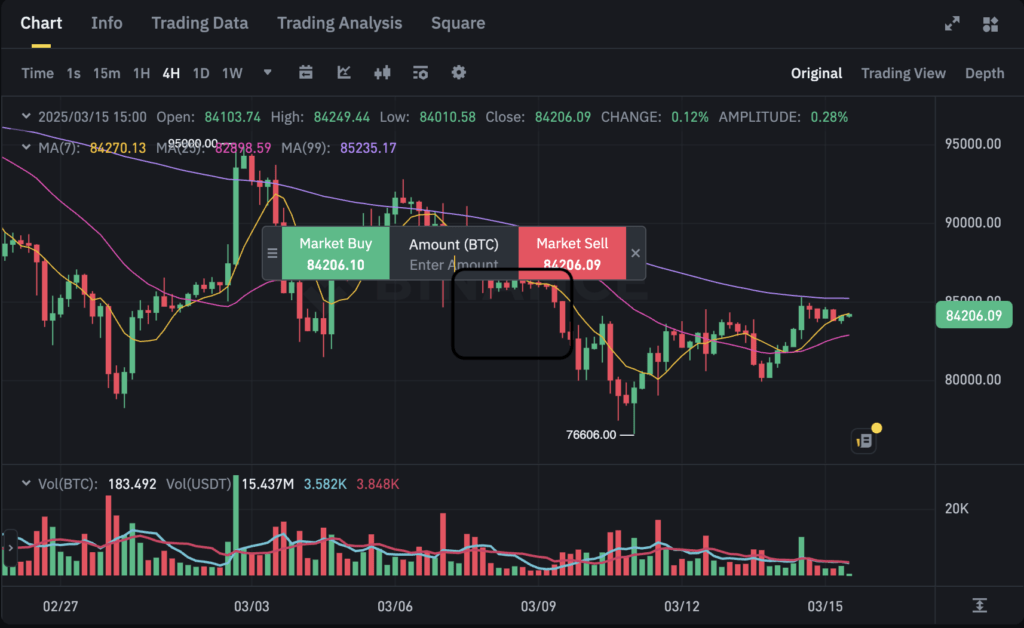

Step 5: Execute a Trade

1️⃣ Go to the ‘Trade’ section of your exchange.

2️⃣ Select your trading pair (e.g., BTC/USDT).

3️⃣ Choose a trade type:

- Market Order – Buy instantly at the current price.

- Limit Order – Set a price and buy only when it reaches that level.

4️⃣ Enter the amount and click BUY.

Step 6: Store Your Crypto Securely

After buying crypto, store it safely using a crypto wallet:

✔️ Hot Wallets (Online) – Binance Trust Wallet, MetaMask

✔️ Cold Wallets (Offline) – Ledger Nano X, Trezor

For long-term holding, a hardware wallet is the safest option.

Crypto Trading vs. Stock Trading

| Feature | Crypto Trading | Stock Trading |

|---|---|---|

| Market Hours | 24/7 | Limited (Mon–Fri, 9:30 AM–4 PM) |

| Volatility | High (10-50% daily swings) | Low (1-5% daily movement) |

| Regulation | Limited | Highly regulated |

| Liquidity | High for major coins | Higher for large stocks |

| Trading Fees | Low (0.1%-2%) | Higher broker fees |

Key Factors to Consider When Trading Crypto

✅ Liquidity – Higher liquidity (e.g., Bitcoin, Ethereum) means easier buying/selling.

✅ Trading Fees – Binance charges ~0.1% per trade; credit card fees can be higher.

✅ Security – Always use 2FA and strong passwords.

✅ Taxes – Profits may be taxed depending on your country’s laws.

Conclusion

Trading cryptocurrency can be highly rewarding if you follow the right steps. Here’s a quick recap:

✔️ Sign up on a trusted exchange (e.g., Binance).

✔️ Deposit funds and pick a stable cryptocurrency.

✔️ Choose a trading strategy that fits your goals.

✔️ Secure your coins in a safe crypto wallet.

You can start small with something like $50 or $100 and practice before risking larger amounts. Crypto trading requires patience, research, and a solid plan.

Disclaimer:

The information provided in this article is for educational and informational purposes only and should not be considered financial, investment, or trading advice. Cryptocurrency trading involves significant risk, including the potential loss of capital. Market volatility, regulatory changes, and security threats can impact the value of digital assets. Before engaging in crypto trading, conduct thorough research, assess your risk tolerance, and consult a licensed financial advisor if necessary. CoinAmigos.com and its authors are not responsible for any financial losses incurred from trading activities. Always trade responsibly.