- The SEC’s acknowledgment of the 21Shares Polkadot ETF filing marks a key step toward integrating Polkadot (DOT) into mainstream finance, allowing investors to access it via the Cboe BZX Exchange without directly handling cryptocurrency.

- If approved, the ETF could attract institutional investors, boost Polkadot’s adoption, and pave the way for more crypto-based investment products.

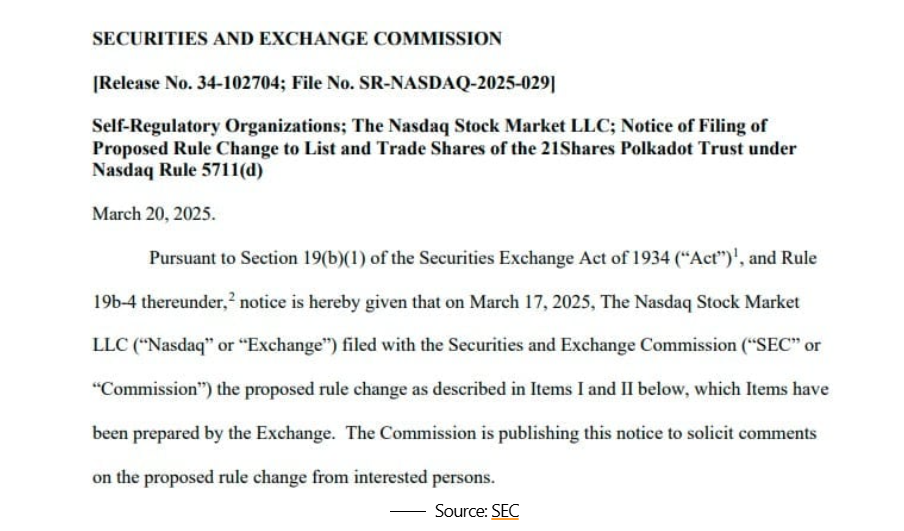

The cryptocurrency market is witnessing another significant development as the U.S. Securities and Exchange Commission (SEC) acknowledges the filing for a spot Polkadot Exchange-Traded Fund (ETF) by 21Shares. This move marks a major step in integrating Polkadot (DOT) into the traditional financial landscape, allowing investors to gain exposure to the asset without directly managing the cryptocurrency.

What the ETF Means for Investors

If approved, the 21Shares Polkadot Trust ETF will be listed on the Cboe BZX Exchange, offering a regulated avenue for investors to access DOT. This means investors can participate in Polkadot’s price movements through a standard investment vehicle rather than navigating the complexities of cryptocurrency wallets and exchanges.

This filing aligns with the broader trend of increasing cryptocurrency ETF applications, following regulatory shifts that have made such investment products more feasible. The SEC’s review process will determine whether the ETF meets regulatory compliance and market stability requirements before it can proceed toward official approval.

Institutional Investors and Market Growth

One of the most exciting aspects of the 21Shares Polkadot ETF is its potential to attract institutional investors. Historically, large financial institutions have been hesitant to invest directly in cryptocurrencies due to concerns about security, regulation, and volatility. However, ETFs provide a familiar and secure framework, allowing these investors to engage with Polkadot more comfortably.

If approved, the ETF could significantly boost Polkadot’s adoption and liquidity, integrating the network further into mainstream finance. The crypto community and investors alike are eagerly anticipating the SEC’s decision, as it will set a precedent for future digital asset investment products.

The Road Ahead for Crypto ETFs

The SEC’s stance on cryptocurrency ETFs has been evolving, with approvals for Bitcoin and Ethereum-based ETFs paving the way for other digital assets. If the 21Shares Polkadot ETF secures approval, it could encourage further diversification of crypto-related investment products in the market.

As the review process unfolds, the financial and crypto sectors will be closely monitoring the SEC’s decision. A positive outcome could not only enhance Polkadot’s market presence but also strengthen the case for additional blockchain-based ETFs in the future.

With growing anticipation and increased institutional interest, the approval of the 21Shares Polkadot ETF could mark yet another milestone in the ongoing fusion of cryptocurrency and traditional finance.