- Ethereum is showing strong potential to reach $5,000, driven by declining exchange supply, increased whale accumulation, and record-high futures open interest.

- A breakout from a bull flag pattern and rising ETF inflows further support the bullish outlook.

Ethereum is showing signs of a strong breakout, with analysts pointing to a possible climb toward the $5,000 mark. Several on-chain and market indicators suggest ETH is preparing for a significant price expansion, driven by a tightening supply, institutional interest, and bullish technical patterns.

ALSO READ:Ripple (XRP) Eyes $3.50 Comeback as Wave CEO Highlights Historic Opportunity

Shrinking Ethereum Exchange Supply Signals Investor Confidence

One of the clearest indicators of growing bullish sentiment is the declining supply of ETH on crypto exchanges. According to Glassnode data, the balance of ETH on exchanges has fallen to a nine-year low of 16.34 million. This 10% drop over the past 90 days suggests investors are moving their assets into self-custody, indicating a reluctance to sell and a belief in future price growth.

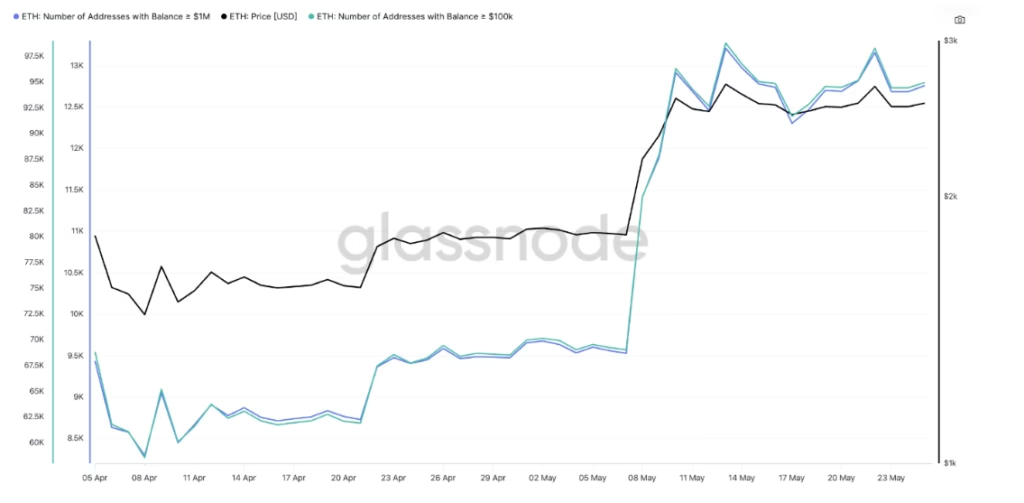

Moreover, wallets holding $100,000 or more in ETH surged from 58,565 in early April to 94,976 by May 26. Wallets with balances over $1 million have also risen by 53% during the same period. This accumulation by large holders—or “whales”—indicates confidence in further gains rather than profit-taking during the recent rally.

Record-Breaking Open Interest Reflects Rising Demand

The futures market is also flashing bullish signals. Ethereum’s open interest (OI) in futures contracts reached a record $33.1 billion on May 23 and remains high at around $32.85 billion. This nearly 91% rise since early April suggests an influx of leveraged bets on ETH, pointing to elevated demand and investor optimism.

Institutional inflows further back this sentiment. U.S.-listed spot Ethereum ETFs recorded $307.6 million in net inflows between May 13 and May 26, according to SoSoValue. This level of investment adds considerable demand-side pressure, potentially accelerating Ethereum’s next price leg higher.

Bull Flag Breakout Points to $4,000 and Beyond

Technically, Ethereum has broken out of a classic bull flag formation on its daily chart, clearing resistance at $2,550. This bullish pattern implies a projected price near $4,000—about 56% above the current level. With RSI levels still in positive territory around 64, market conditions support further upward movement.

Beyond the $4,000 target, the next logical stop is Ethereum’s previous all-time high close to $5,000, last seen in November 2021. However, if the price drops back below $2,550, a return to lower support levels near $2,000 could unfold.

As of now, Ethereum remains well-positioned for a major breakout—one that could push it to new highs in 2025.

ALSO READ:VeChain Hires Former IBM and Deloitte Leader Anthony Day as Marketing Director

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.