- The article explores XRP’s potential with the XRP Ledger (XRPL) capable of processing 3,400 transactions per second (TPS), facilitating a remarkable 293 million daily transactions.

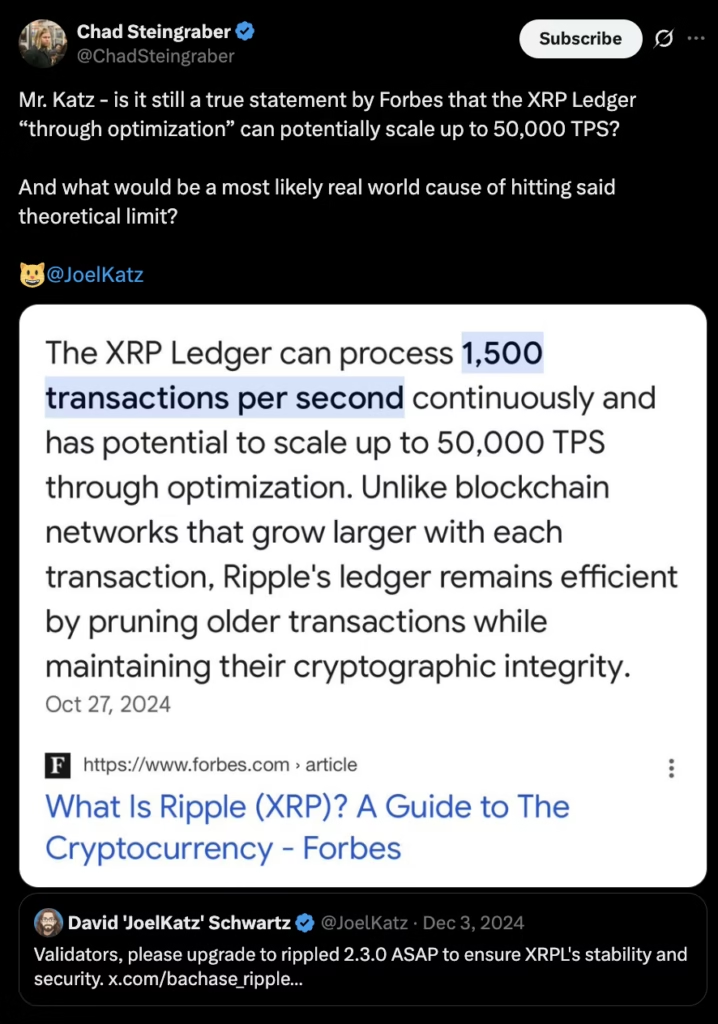

- Despite bullish claims, analysts like Daniel Keller challenge the statistics, citing real-world transaction speeds ranging between 500 and 700 TPS, adding a layer of skepticism to XRP’s transformative capabilities.

XRP, the digital currency associated with Ripple’s XRP Ledger (XRPL) blockchain has had a remarkable processing capacity. Recent insights shared by XRP influencer Alex Cobb shed light on the blockchain’s capability to handle a staggering 293 million transactions daily, positioning XRP as a formidable global utility asset.

| Scenario (2025) | Transactions per Second (TPS) | Key Context |

|---|---|---|

| Base-layer theoretical ceiling | 3,400 TPS | Limit observed under Ripple-run stress tests on the public ledger |

| Payment Channels feature (parallel off-ledger streams) | ≈ 50,000 TPS | High-speed micro-payments; capacity is live but only engaged in niche use-cases today |

| Real-world peak (Apex 2025 & recent mainnet spikes) | ~ 1,500 TPS | Sustained throughput reported by analysts during June 2025 high-traffic events |

| Typical day-to-day range | 500 – 700 TPS | Average load seen on public nodes outside of stress tests |

A Global Utility Asset

Designed with a focus on global utility, XRP has become a favorite among banks seeking to digitize their services for worldwide accessibility. The XRPL blockchain can process 3,400 transactions per second (TPS). The figures, presented by Cobb, illustrate that XRP can facilitate 204,000 transactions per minute, 12.24 million per hour, and an impressive 293 million per day. This data reinforces the notion that XRP is engineered to be a cornerstone in the digital transformation of banking services globally.

Banking on XRP: A Basel III Perspective

XRP’s significance is further underscored by a report from the Basel Committee on Banking Supervision (BCBS), revealing that 19 out of 182 banks participating in the Basel III exercise are investing in crypto assets. Among these, XRP stands out alongside Bitcoin and Ethereum, constituting 2% of the total crypto asset exposure, equivalent to €188 million. This positions XRP as a leading altcoin in the eyes of banks, ranking second only to Bitcoin and Ether.

Analyst Challenges and XRPL’s Evolution

Despite these optimistic claims, some analysts, like Daniel Keller, an XRPL ambassador, and CTO at Eminence, challenge the statistics. Keller argues that the quoted figures are based on ideal conditions, whereas real-world transaction speeds typically range between 500 and 700 TPS. However, Ripple’s official page maintains that the XRPL can achieve the touted 3,400 TPS.

Notably, the XRPL’s capabilities underwent a recent enhancement, increasing from 1,500 to 3,400 TPS. This development marks a significant milestone for the project, signaling its commitment to pushing the boundaries of blockchain technology.

XRP Ledger Challenges

As investors eagerly anticipate the potential value surge around the XRP project, short-term challenges persist. Over the last seven days, XRP has experienced an 8% decline in value, currently exchanging at $0.56. Despite this, with an all-time high of $3.40 reached six years ago, optimism remains high among investors who anticipate a resurgence in the next bull market. The journey ahead for XRP holds both promises and challenges, as it continues to carve its niche in the ever-evolving landscape of digital assets.