- Binance’s BNB token has faced a recent dip, but experts predict a strong rally ahead, with BNB expected to break the $1000 mark and reach a new all-time high of $1068 by April 2025.

- However, the token’s future performance may be influenced by the Federal Reserve’s monetary policy and broader market conditions.

Binance’s BNB token has faced significant price fluctuations recently, but predictions point to a major rally in the coming months. While the coin has seen a dip in recent weeks, experts anticipate that BNB will reach new all-time highs soon, possibly hitting $1068 in April 2025. Here’s what investors can expect in the near future for Binance’s native token.

BNB Faces a Recent Dip, But Momentum Could Be Building

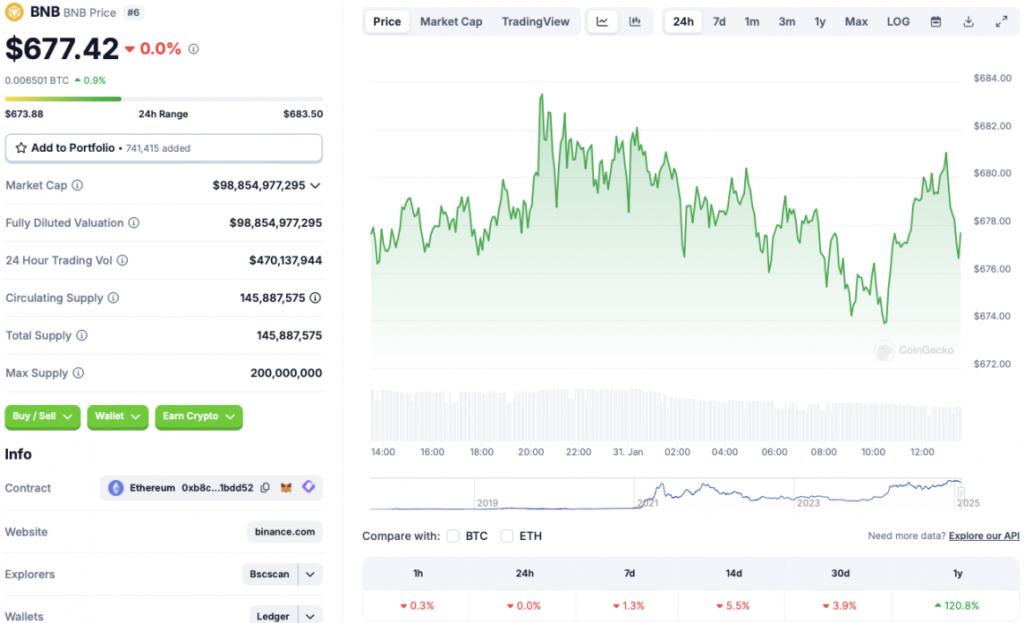

Over the past few weeks, BNB has been struggling with a downward trend. The token has seen a 1.3% drop on the weekly charts, a 5.5% decrease in the 14-day charts, and a 3.9% decline over the past month. However, this dip comes after an impressive 120.8% surge in the first month of 2024.

The cryptocurrency market as a whole has been sluggish, with Bitcoin trading around $104,000 and the global crypto market cap dipping by 1.8%. Investors, in response to these market conditions and the strengthening of the US dollar, have been shifting funds to safer assets, dampening the crypto market’s performance. Despite these setbacks, BNB’s resilience is evident, with many believing that the dip is just temporary.

A Promising Forecast: BNB’s Path to $1068

Despite recent challenges, the outlook for BNB is incredibly positive. According to CoinCodex, the token is expected to enter a strong rally within the next few months. By early April 2025, BNB is predicted to break the $1000 mark and hit a new all-time high of $1069.21 by April 26, 2025. This would represent a 57.84% price increase from its current value, signaling potential gains for investors who hold onto their assets during this phase.

Potential Obstacles to Watch Out For

While the future of BNB looks bright, there are factors that could affect its trajectory. The US Federal Reserve’s monetary policy decisions will play a significant role. If the Fed fails to announce further interest rate cuts soon, investor sentiment could be impacted, potentially causing BNB to experience a price correction instead of the predicted rally.

Conclusion

Binance’s BNB token has shown impressive growth in 2024, and with predictions pointing toward a new all-time high in 2025, now may be a good time for investors to keep an eye on this asset. However, as with all cryptocurrencies, market volatility is a constant, and BNB’s future performance will be influenced by broader economic factors. Stay informed and prepared as the crypto market continues to evolve.