Chainlink Cryptonewsfocus.com

- Chainlink (LINK) has been struggling to stay above $22, with market trends indicating potential upward movement if it holds this level, though resistance remains strong.

- While short-term fluctuations may see LINK between $18 and $25, long-term predictions suggest a modest increase to $21.69 by March 2025, though market sentiment remains cautious.

The cryptocurrency market has been buzzing with volatility, and Chainlink (LINK) is no exception. Over the past 24 hours, LINK has been struggling to stay above the $22 mark but has faced resistance. Despite the hurdles, there remains optimism among buyers, as market trends hint at a potential recovery. Let’s take a closer look at LINK’s price movements and what to expect next.

Chainlink’s Price Struggles and Market Trends

At the moment, Chainlink is trading at around $20.3, reflecting a 3.5% gain in the past 24 hours. However, its trading volume has dipped by 17.2%, settling at $1.78 billion. The Fear and Greed Index currently sits at 45, indicating neutral market sentiment.

Despite the recent downtrend, LINK’s overall market activity remains strong, with its market capitalization growing by 9% to reach $12.78 billion. This suggests that investor interest has not waned, and the token remains within a potential buying range.

Liquidations and Open Interest Surge

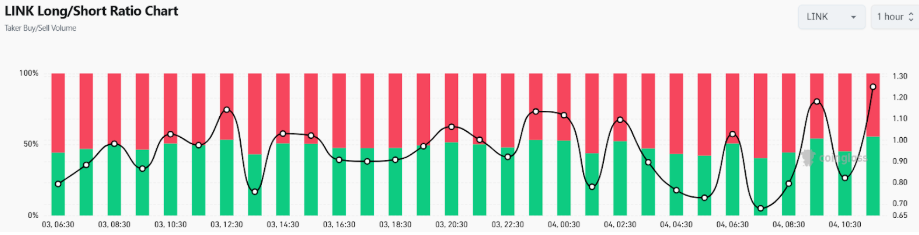

The recent market rally has led to significant liquidations, with around $3.44 million worth of LINK trades being wiped out. Notably, $2.6 million came from buyers closing long positions.

Interestingly, open interest in Chainlink derivatives has surged to $628 million, marking a 3.58% increase. This indicates that despite liquidations, traders remain engaged, anticipating a price swing in the near term.

Technical Analysis: Will LINK Rebound?

Chainlink is currently hovering above a critical support zone. The LINK/USDT pair is maintaining a position above $18, with its RSI (Relative Strength Index) heading toward the buying zone. If LINK successfully holds above $22, it could see a price rally toward $25-$27.

However, if the price fails to sustain above the 20-period Exponential Moving Average (EMA20) on the 1-hour chart, there is a risk of a downturn, with the price possibly falling to the $18 range.

Short-Term and Long-Term Price Predictions

Short-Term: LINK’s price could continue fluctuating below $22. A breakout above this level may drive it toward $25, while failure to sustain momentum might push it down to $18.

Long-Term: According to Coincodex, Chainlink’s price is expected to grow by 7.70%, potentially reaching $21.69 by March 6, 2025. However, the current market sentiment remains bearish, and the Fear and Greed Index sits at 72 (Greed), suggesting caution.

Final Thoughts: Is Now the Right Time to Buy?

With mixed signals in the market, investors should tread carefully. While technical indicators suggest potential upward movement, the market remains uncertain. Traders should closely monitor resistance levels and key indicators before making any investment decisions. For now, Chainlink’s ability to stay above $22 will be a crucial factor in determining its next move.