- Whales have accumulated 520 million XRP tokens amid a recent price dip, signaling renewed investor confidence and a potential market recovery, supported by strong fund inflows and oversold technical indicators.

- Additionally, regulatory developments, including a possible XRP ETF and an expected resolution in the Ripple vs. SEC case, could further drive XRP’s price upward.

The cryptocurrency market is known for its volatility, and XRP, the native digital asset of Ripple, is no exception. Recently, large investors, commonly referred to as ‘whales,’ have made significant purchases of XRP, fueling optimism for a potential price rebound. The latest data indicates that whales have bought a staggering 520 million XRP tokens amid the recent price dip, signaling renewed confidence in the asset.

Whales Make Bold Moves in the XRP Market

Crypto market expert Ali Martinez highlighted a surge in whale activity, revealing that these major investors have accumulated 520 million XRP tokens. This pattern of large-scale buying suggests that influential players in the market see potential for a strong recovery. Historically, when whales accumulate assets during a downturn, it often precedes a price surge, making this development a significant indicator of market sentiment.

XRP Maintains Strong Inflow Despite Market Volatility

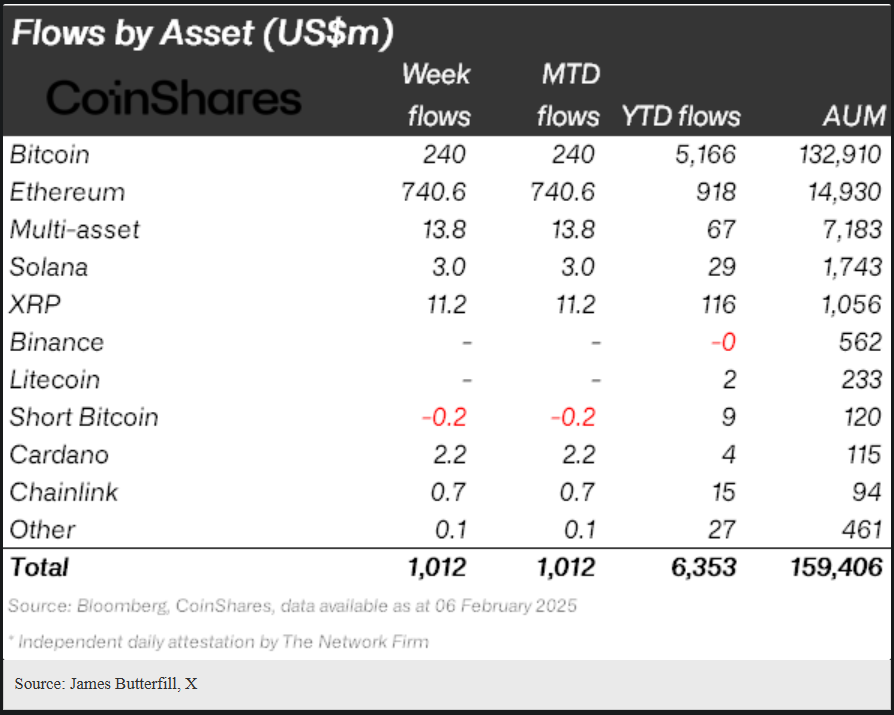

Despite the price decline, XRP has continued to see a substantial influx of funds. According to CoinShares Head of Research James Butterfill, XRP recorded an inflow of $11.2 million over the past week, outperforming Solana’s $3 million influx. Additionally, on a year-to-date basis, XRP has attracted $116 million in investments, solidifying its position as one of the more resilient cryptocurrencies in the market.

Technical Indicators Point to a Potential Breakout

Currently, XRP is experiencing a price drop of 6%, bringing its value down to $2.34. However, technical indicators suggest that a reversal may be on the horizon. The Relative Strength Index (RSI) for XRP sits at 32, placing it in the ‘oversold’ category. Historically, assets in this zone tend to experience a price rebound, making XRP an asset to watch closely in the coming weeks.

What’s Next for XRP?

Beyond the whale accumulation and strong fund inflows, XRP’s future could be influenced by regulatory developments. The Chicago Board Options Exchange (CBOE) has recently submitted 19b-4 filings to the U.S. Securities and Exchange Commission (SEC) to launch an XRP-focused exchange-traded fund (ETF). Additionally, ongoing legal proceedings between Ripple and the SEC may soon reach a resolution, with speculation that a settlement or dismissal could happen by 2025. If these developments unfold favorably, they could act as catalysts for a significant price surge.

Final Thoughts

The substantial purchase of 520 million XRP tokens by whales, combined with strong fund inflows and promising technical indicators, suggests that a recovery for XRP could be imminent. While regulatory uncertainties remain a factor, the positive sentiment in the market indicates that XRP may soon be poised for a breakout. Investors should keep a close eye on upcoming developments as they could shape the future trajectory of this popular cryptocurrency.