- XRP has experienced a sharp 28.5% decline due to macroeconomic uncertainties and bearish market sentiment, with futures open interest collapsing by over 50% and technical indicators suggesting a potential 30% drop to $1.63.

- However, a price rebound could occur if XRP reclaims key moving averages or benefits from a favorable outcome in the Ripple vs. SEC case.

The cryptocurrency market is in turmoil, and XRP is no exception. The digital asset has experienced a sharp decline, losing 28.5% of its value since its January peak. Several factors, including macroeconomic uncertainties and political delays, have contributed to this bearish momentum. With XRP futures open interest collapsing by over 50% and technical indicators pointing to further downside, investors are left wondering—how low can XRP go?

XRP’s Decline: A Combination of Market and Political Factors

XRP reached a high of $3.40 on January 16 but has since plummeted to approximately $2.42 as of February 10. This sharp decline is partially attributed to former U.S. President Donald Trump’s hesitation in outlining a definitive pro-crypto policy. His ongoing trade war with China has further dampened investor confidence, leading to increased risk aversion in the market.

XRP Futures Open Interest and Bearish Sentiment

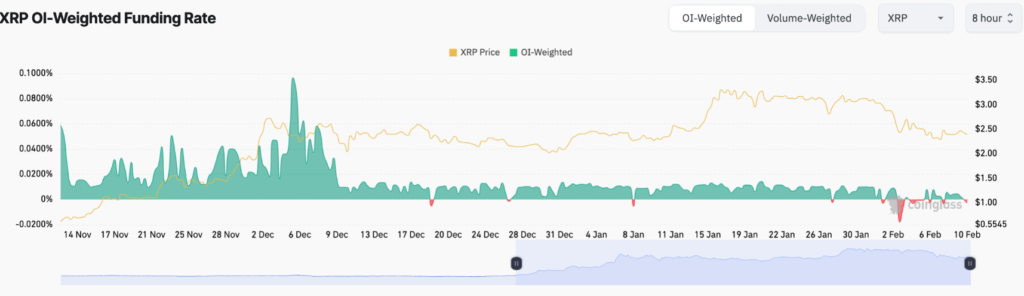

One of the most alarming signals for XRP is the collapse in its futures open interest. Since January 17, open interest has dropped from $7.62 billion to a monthly low of $3.52 billion—a 52% decrease. Open interest represents the total number of outstanding futures contracts, and a sharp decline typically suggests traders are closing their positions, reflecting weakening confidence in the asset.

Additionally, XRP’s funding rates have turned negative. In futures trading, negative funding rates indicate that short sellers (those betting against XRP) are paying fees to long-position holders. This further confirms the market’s prevailing bearish sentiment.

Bear Pennant Pattern Signals a Potential 30% Drop

Technical analysis suggests that XRP is forming a bear pennant pattern—a continuation pattern that often precedes further declines. This pattern consists of a steep price drop (the flagpole) followed by a period of consolidation (the pennant). If XRP breaks below the lower trendline of this pattern, it could trigger another downward move, potentially pushing the price down to $1.63—approximately 30% lower than current levels.

However, not all hope is lost. If XRP can reclaim key moving averages—particularly the 50-period exponential moving average (EMA) at $2.52—the bearish outlook could be invalidated. In that scenario, XRP could see a rebound towards the 200-period EMA at around $2.68.

A Glimmer of Hope: SEC vs. Ripple Developments

In regulatory news, recent internal shifts at the SEC have sparked speculation about a potential change in the agency’s stance on cryptocurrency. The reassignment of Jorge Tenreiro, a key figure in the SEC’s litigation against Ripple, has led some analysts to believe the agency may drop its appeal against Ripple. If this materializes, it could provide a much-needed boost for XRP.

Final Thoughts

XRP remains in a precarious position. While technical and market indicators suggest further downside, reclaiming critical price levels or a favorable outcome in the Ripple vs. SEC case could shift sentiment in XRP’s favor. Until then, traders should brace for potential volatility and further price declines.