- The Bitcoin futures funding rate has dropped to neutral across major exchanges, historically signaling potential bullish momentum as neither longs nor shorts hold a clear advantage.

- If past trends repeat, Bitcoin could soon experience an upward surge, but traders should stay cautious and monitor market movements closely.

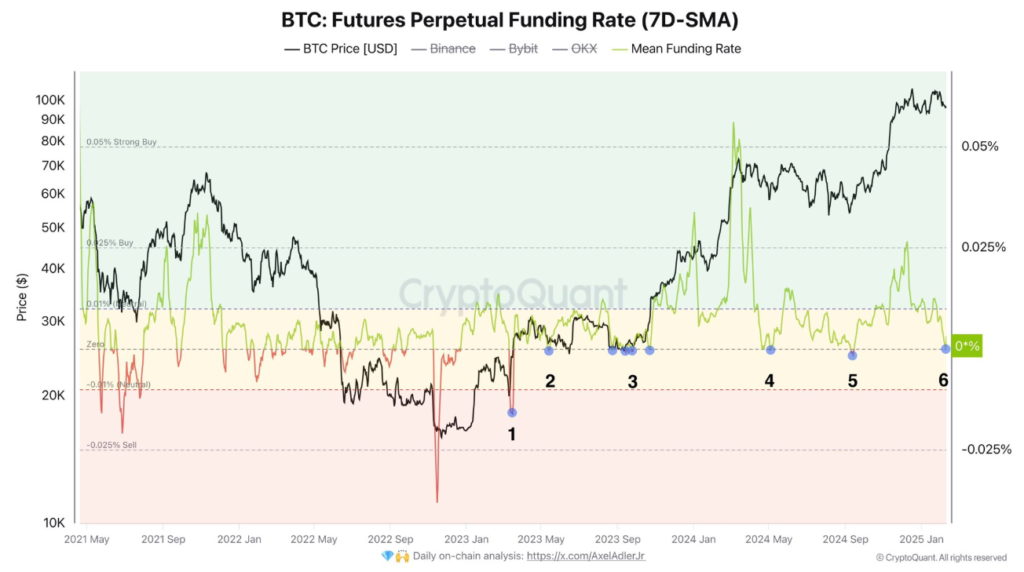

Bitcoin’s futures market has seen a notable shift, as the funding rate across the top three cryptocurrency exchanges—Binance, Bybit, and OKX—has dropped to neutral. Historically, such a move has been a precursor to bullish momentum. Could this pattern repeat itself? Let’s dive in.

Understanding the Bitcoin Funding Rate

The funding rate in Bitcoin futures trading measures the periodic payments exchanged between long and short position holders. A positive funding rate means long traders (betting on price increases) are paying a premium to short traders (betting on price decreases), signaling a bullish market sentiment. Conversely, a negative funding rate indicates a bearish sentiment, where short traders pay a premium to longs.

Currently, the 7-day simple moving average (SMA) of the mean Bitcoin Funding Rate has returned to the 0% mark, meaning that the market is evenly split between bulls and bears. This shift reflects a phase of uncertainty, with traders unsure of Bitcoin’s next move.

Historical Trends: What Happens When the Funding Rate Hits Neutral?

According to market analysts, Bitcoin has consistently experienced bullish momentum when the funding rate has previously tested the neutral mark during this market cycle. The reason? A phenomenon known as a short squeeze or long squeeze, depending on market conditions.

In bullish cycles, when the funding rate is highly positive, a long squeeze can occur, leading to a cascade of liquidations and downward price movements. However, with the funding rate currently at neutral, the risk is balanced between long and short traders, making it easier for Bitcoin to rise without significant downward pressure.

What’s Next for Bitcoin?

Bitcoin is trading at around $98,260, reflecting a decline of over 2% in the past week. While the current price action is uncertain, historical data suggests that Bitcoin could soon gain upward momentum. If past patterns hold, the neutral funding rate could set the stage for a bullish breakout.

Traders and investors should keep a close eye on how Bitcoin reacts to this market shift. If a rally follows, it would align with previous instances where neutral funding rates have signaled an upcoming surge.

Final Thoughts

The Bitcoin funding rate hitting neutral on major exchanges presents an interesting opportunity. While past trends indicate potential bullish momentum, market conditions can always change. As always, investors should conduct thorough research and consider risk management strategies before making any trading decisions.

Will Bitcoin follow history and rally from here? Only time will tell, but all eyes are now on the funding rate’s next move.