- Bitcoin plunged to just over $90,000, triggering over $1 billion in liquidations, with altcoins suffering even greater losses.

- The downturn, driven by a major Bybit hack and market volatility, wiped out over 310,000 traders, though analysts remain optimistic about Bitcoin’s long-term prospects.

The cryptocurrency market has experienced a major shakeup in the past 24 hours, with Bitcoin (BTC) leading the downward trend. The primary digital asset plummeted to just over $90,000, marking its lowest point since January 13. This sharp decline has triggered widespread liquidations, totaling over $1 billion, as traders struggle to navigate the volatility.

Bitcoin’s Price Takes a Hit

Just last Friday, Bitcoin was enjoying a steady climb, reaching a weekly peak of $99,500. This surge was fueled by positive news from Coinbase regarding its two-year-long legal battle with the SEC. However, the bullish sentiment was short-lived. Over the weekend, the market was rocked by one of the largest cryptocurrency hacks in history, with Bybit losing over $1.4 billion, primarily in Ethereum (ETH). This event sent shockwaves across the industry, leading BTC to drop to $95,000 almost instantly.

After a relatively stable weekend hovering around $96,000, Bitcoin took another hit on Monday, slipping to $94,000. The downward momentum continued into Tuesday morning, with BTC sinking to just over $90,000. This marks a staggering loss of over $9,000 in just a few days. Despite these drastic movements, many market analysts remain unfazed, viewing the dip as part of Bitcoin’s natural volatility cycle.

Altcoins Face Even Greater Losses

While Bitcoin’s decline is notable, the situation is even grimmer for altcoins. Major cryptocurrencies like Ethereum (ETH), Dogecoin (DOGE), Solana (SOL), Chainlink (LINK), Cardano (ADA), XRP, Stellar (XLM), Avalanche (AVAX), and Litecoin (LTC) have all suffered significant double-digit percentage losses. The broader market downturn has wiped out billions in market capitalization, leaving traders in a precarious position.

Liquidations Exceed $1 Billion

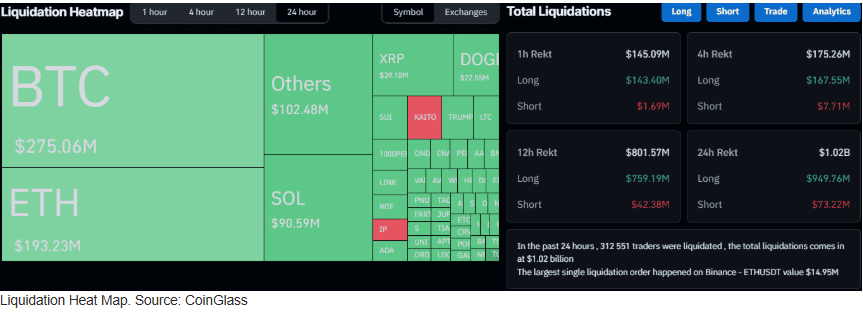

As a result of these dramatic price swings, the total value of liquidated positions has surged past the $1 billion mark. A staggering $950 million of these losses came from long positions, indicating that many traders were betting on Bitcoin’s price continuing to rise. The largest single liquidation occurred on Binance, where a trader lost $15 million in a single position.

According to data from CoinGlass, over 310,000 traders have been wiped out in the past day alone. This highlights the extreme risks associated with leveraged trading in the crypto market, where rapid price movements can lead to devastating losses.

What’s Next for Bitcoin and the Crypto Market?

Despite the turbulence, many experts believe Bitcoin’s long-term fundamentals remain strong. Market corrections of this magnitude are not uncommon, and seasoned traders understand that volatility is part of the game. However, with ongoing regulatory scrutiny and security concerns looming over the industry, the coming weeks will be crucial in determining the next direction for Bitcoin and the broader crypto market.

For now, traders are advised to proceed with caution, keeping an eye on key support and resistance levels while staying prepared for further price swings. As history has shown, the crypto market is unpredictable, and anything can happen in the blink of an eye.