- Dogecoin has plunged 24.3% over the past month due to global economic uncertainty, driven by escalating U.S.-EU trade tensions that have weakened investor sentiment.

- While some analysts predict a short-term rally to $0.60, macroeconomic challenges and market volatility could limit its long-term recovery.

Dogecoin (DOGE) has been hit hard in recent weeks, reflecting broader struggles in the cryptocurrency market. The meme coin has lost 24.3% of its value over the past month, leaving investors anxious about its future. Global economic uncertainty, fueled by a trade war between the U.S. and the European Union (EU), has driven traders away from riskier assets, including crypto.

Trade War Turmoil Weighs on Dogecoin

The ongoing economic tensions between the U.S. and the EU have added pressure to financial markets. The U.S. recently imposed new tariffs on EU goods, prompting the EU to threaten retaliatory measures. This escalating trade dispute has unsettled investors, leading to capital flight from volatile assets like cryptocurrencies.

DOGE, often favored by retail traders, has not been spared. The coin has suffered an 8.3% drop in the past 24 hours alone, adding to its sharp 17.9% loss over the past week. The trend suggests that Dogecoin’s performance is closely tied to macroeconomic conditions, which remain highly uncertain.

A Bullish Outlook? Not So Fast

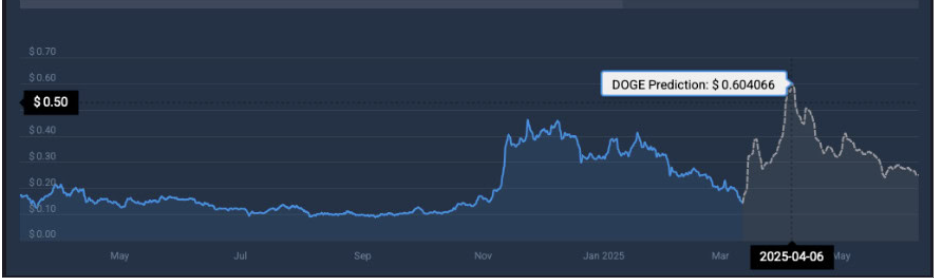

Despite the downturn, some analysts still see potential for a Dogecoin rally. Predictions from CoinCodex suggest that DOGE could surge to $0.60 by early April, marking a significant 300% increase from its current levels. However, this bullish forecast comes with a warning—macroeconomic headwinds could derail the rally before DOGE has a chance to sustain its gains.

Challenges such as rising inflation, interest rate concerns, and continued trade disputes could make it difficult for the cryptocurrency market to recover. Even if Dogecoin experiences a temporary spike, the likelihood of a subsequent price correction remains high.

Long-Term Hope for Crypto?

While Dogecoin struggles, the broader cryptocurrency market has seen some promising developments. The U.S. government recently announced plans to establish a Bitcoin reserve and build a digital asset stockpile. Although DOGE is not directly affected, this move signals growing institutional confidence in cryptocurrency as a whole. If major governments start accumulating digital assets, it could improve sentiment across the market, potentially benefiting Dogecoin in the long run.

Dogecoin is in a tough spot, with global trade tensions and economic uncertainty weighing heavily on the market. While some analysts predict a short-term rally, long-term stability remains in question. Until macroeconomic conditions improve, DOGE’s recovery will likely remain uncertain. For now, investors should keep a close watch on global events, as they will continue to play a crucial role in shaping Dogecoin’s future.