- Ondo Finance (ONDO) has faced significant selling pressure, but a 390% surge in new addresses suggests growing investor interest, potentially signaling future recovery.

- Despite the broader market downturn, ONDO remains a strong contender in the real-world assets (RWA) sector, driven by its institutional finance innovations and expanding network activity.

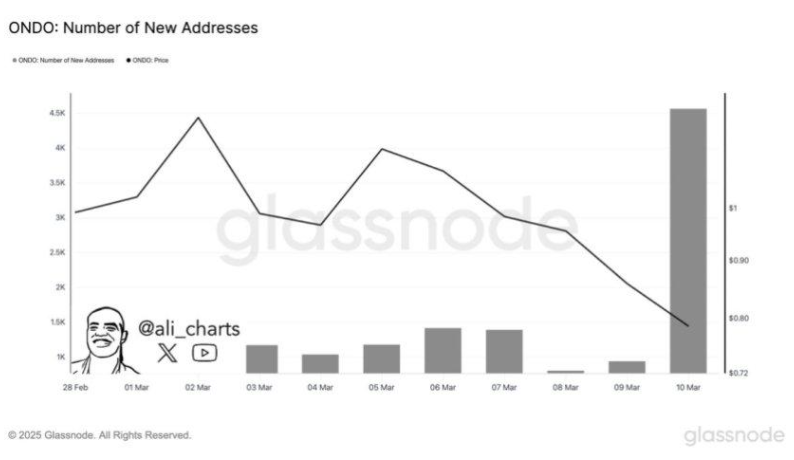

Ondo Finance (ONDO) has been facing intense selling pressure, with its price declining by over 40% since March. The broader crypto market downturn has further fueled investor uncertainty, keeping many traders on the sidelines. However, a surprising development has emerged amid the bearish sentiment—a 390% surge in new ONDO addresses within just 24 hours.

A Spike in Network Activity: A Bullish Sign?

Despite ONDO’s price struggles, on-chain data from Glassnode has revealed a significant uptick in network activity. The number of new ONDO addresses recently skyrocketed from 935 to 4,559 in a single day. Historically, such increases in network activity have been strong indicators of rising adoption and potential price recoveries.

Analysts are closely monitoring whether this surge in new addresses translates into renewed demand for ONDO. While prices remain weak, growing interest in the project could signal a shift in investor sentiment, setting the stage for future gains once the market stabilizes.

ONDO’s Position in the RWA Market

Over the past year, Ondo Finance has solidified its position as a leader in the real-world assets (RWA) market. By offering tokenized financial products, the project has successfully bridged the gap between traditional finance and blockchain technology.

Recently, Ondo Finance introduced Ondo Chain, a permissioned Layer-1 blockchain designed for institutional finance. This move is expected to enhance efficiency, security, and regulatory compliance, making it an attractive option for financial institutions looking to enter the digital asset space. As institutional interest in blockchain solutions grows, ONDO remains well-positioned for long-term success.

Key Support Levels to Watch

ONDO is currently trading at $0.83, retracing all its gains from the post-election rally in late 2024. To regain bullish momentum, the token must hold above the crucial $0.75 support level. If this support holds, it could provide a strong foundation for price stabilization and recovery. However, failure to maintain this level could lead to further downside risks.

For a potential rebound, bulls must push ONDO’s price toward the $0.95 resistance level. Breaking above this barrier could confirm a recovery phase, especially if the recent surge in new addresses translates into increased buying pressure.

While the broader market remains in a downtrend, ONDO’s growing network activity is a promising sign. The project’s fundamentals remain strong, and its innovative approach to institutional finance continues to attract attention. If market conditions improve, ONDO could emerge as a top performer in the next bull cycle.

For now, traders and investors are closely watching whether ONDO can defend its key support levels or if selling pressure will continue to weigh on its price action. With institutional adoption on the rise and network growth surging, ONDO remains a project to watch in the evolving crypto landscape.