- Dogecoin faces potential price pressure as miners offload 65 million DOGE, increasing supply and raising concerns about a downturn.

- However, strong investor interest and rising Open Interest suggest optimism, with analysts predicting a possible climb to $1.50 in the near term.

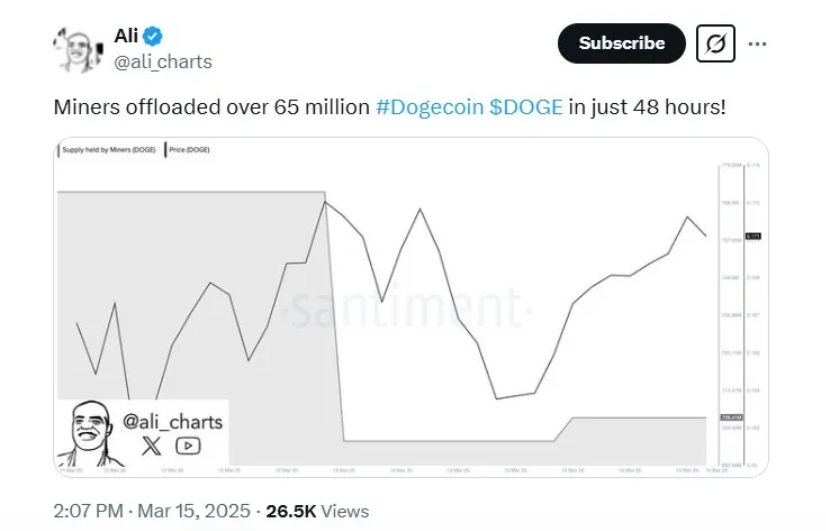

Dogecoin (DOGE), the popular memecoin, is experiencing turbulence as miners offloaded a staggering 65 million DOGE in just 24 hours. This massive selloff has raised concerns among investors and market watchers, leading to speculation about the potential impact on the asset’s price trajectory.

Will Miner Selloff Trigger a Price Crash?

DOGE has been on a recovery path, climbing from a low of $0.1465 over the past week. However, the sudden liquidation by miners could disrupt this rebound. Typically, miners earn DOGE as a reward for validating transactions, but when they offload large quantities into the market, it increases the circulating supply. Without a corresponding surge in demand, this could place downward pressure on prices.

On-chain analyst Ali Martinez highlighted the recent miner activity, emphasizing how such selloffs can create uncertainty. Market participants often view such moves as a signal that miners expect lower prices, which could further contribute to bearish sentiment.

Despite this, some analysts argue that if the market absorbs the excess DOGE efficiently, it could instead serve as a bullish indicator. This would demonstrate strong demand, potentially leading to a rebound.

Investors Remain Bullish Despite Volatility

While miners are selling, Dogecoin’s Open Interest has shown a different picture. Open Interest, which measures the number of open futures contracts, has risen by 3% in the last 24 hours. This suggests that traders are still betting on DOGE’s price to increase despite the volatility.

According to CoinGlass, Dogecoin futures traders have committed approximately 8.43 billion DOGE, valued at $1.49 billion. This renewed interest is particularly strong on major exchanges such as Gate.io, Binance, Bybit, and OKX.

- Gate.io traders contributed 2.52 billion DOGE, making up nearly 30% of the total Open Interest.

- Binance followed closely with 25.57%, amounting to 2.16 billion DOGE.

- Bybit and OKX accounted for 16.89% and 10.68%, respectively.

This sustained investor interest signals confidence in Dogecoin’s long-term potential, despite the short-term selloff pressure.

DOGE Price Outlook: Can It Reach $1.50?

At the time of writing, Dogecoin is trading at $0.1772, reflecting a 2.67% increase in the last 24 hours. However, the trading volume has dipped by 27.64% to $801.55 million, indicating reduced market activity.

Analysts remain divided on DOGE’s future. While some speculate a long-term rise to $5, Ali Martinez predicts a potential climb to $1.50 within the next 30 days, with an eventual target of $3.

For now, Dogecoin’s fate depends on whether the market can absorb the miner selloff and if investor interest continues to grow. If demand outweighs the excess supply, DOGE could still be on track for significant gains in the coming weeks.