- Bitcoin’s price struggles to reclaim $90,000 amid market uncertainty, with analysts warning of a potential drop to the $62,000 support zone due to bearish sentiment, long-term holder inactivity, and macroeconomic concerns.

- However, some experts remain optimistic, viewing 2025 as a foundational year for Bitcoin’s long-term growth despite short-term volatility.

Bitcoin’s (BTC) recent price movements have left investors and traders on edge as the cryptocurrency struggles to regain bullish momentum. After a series of failed attempts to break the $90,000 mark, Bitcoin’s price has slipped, leaving market participants concerned about a potential breakdown toward the $62,000 support zone.

Bitcoin’s Struggle Amid Market Uncertainty

Bitcoin started the week with hopes of pushing past $90,000 but instead dropped 7% from a high of $88,060 on March 26 to $82,036 by March 29. This decline resulted in $158 million in long liquidations, highlighting market fragility. Meanwhile, gold surged to a record $3,087 on March 28, reinforcing its status as a safe-haven asset and questioning Bitcoin’s “digital gold” narrative.

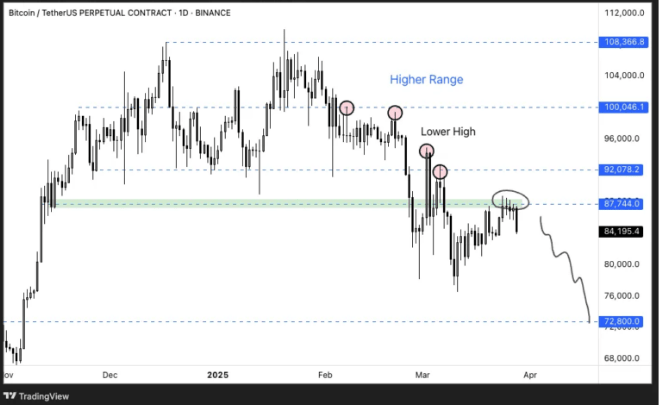

Koroush AK, a well-known trader and researcher, observed that Bitcoin had formed its sixth lower high of 2025, describing the rally as a “dead cat bounce.” He emphasized that Bitcoin’s failure to close above $90,000 for five consecutive days signaled a lack of buying strength.

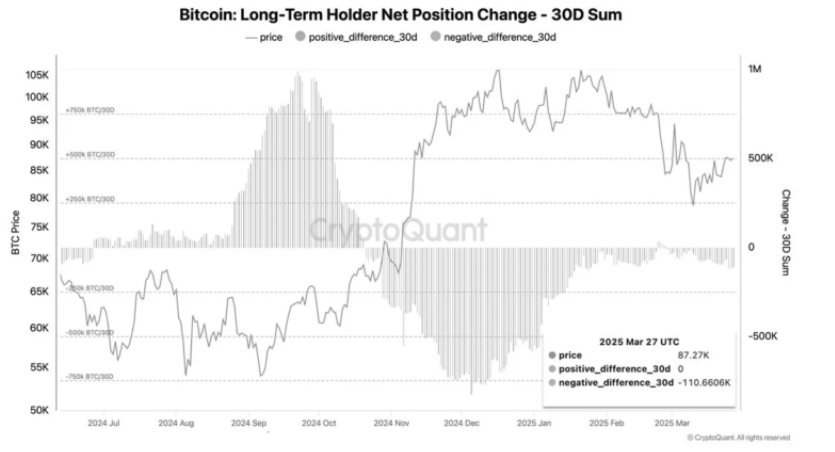

Long-Term Holders Stay on the Sidelines

On-chain data from CryptoQuant reveals that long-term Bitcoin holders have been inactive since November 2024, reflecting uncertainty and a cautious outlook. Market analyst Ali Martinez pointed out that a reactivation of these dormant wallets could indicate a significant trend reversal. Meanwhile, reduced exchange inflows suggest declining investor participation, which often precedes major price moves.

Bearish Sentiment and Potential Downside Targets

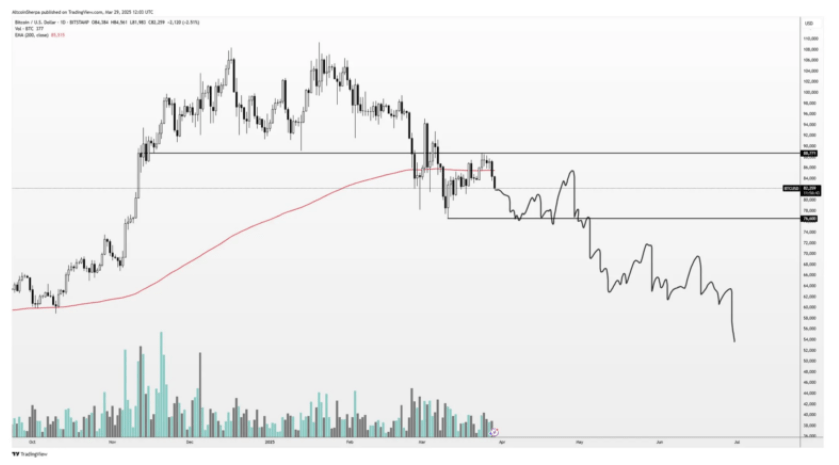

Several analysts have warned of bearish scenarios. Altcoin Sherpa described Bitcoin’s current weekly chart structure as a confirmed bear market, with the price potentially dropping to the $50,000–$60,000 zone depending on macroeconomic conditions.

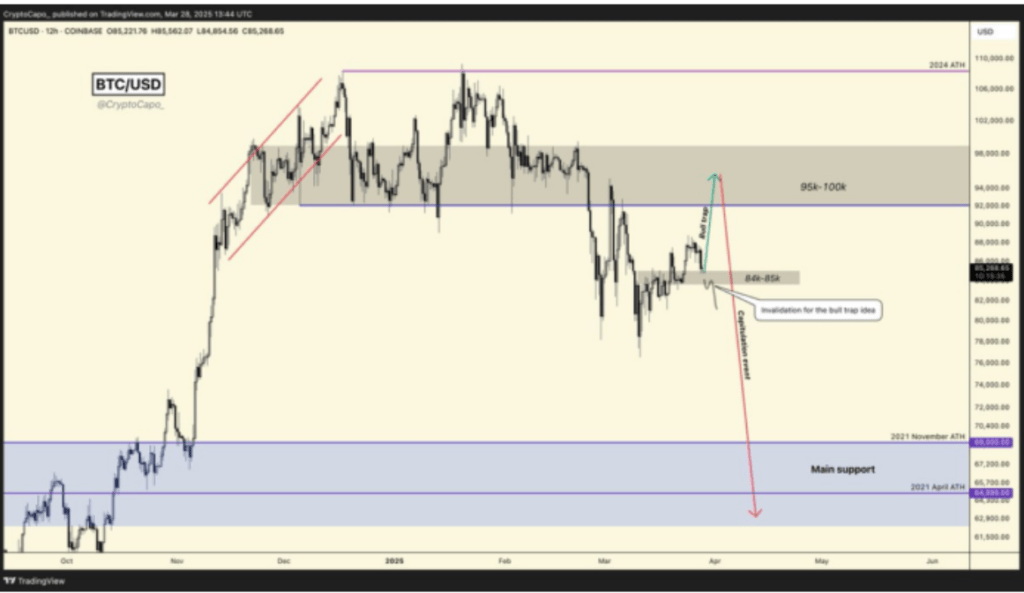

Similarly, Crypto Capo stated that a close below the $84,000–$85,000 range could trigger a plunge toward support levels from April and November 2024.

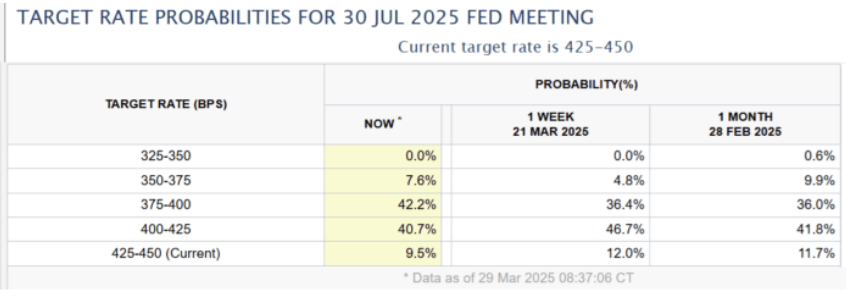

Adding to selling pressure, Bitcoin exchange-traded funds (ETFs) recorded $93 million in net outflows on March 28. Concerns about a recession and uncertainty around U.S. Federal Reserve rate cuts have driven caution among institutional investors.

A Glimmer of Hope for Bitcoin’s Future?

While the outlook appears bearish, some experts believe Bitcoin’s volatility is a reflection of its early-stage growth. Alexandre Vasarhelyi of B2V Crypto remains optimistic, stating that 2025 is a foundational year for Bitcoin, not a tipping point. He suggests that whether Bitcoin’s bottom is $77,000 or $65,000, long-term adoption remains the focus.

As Bitcoin struggles to regain strength, eyes remain on macroeconomic factors, long-term holder activity, and potential policy shifts. A significant change in sentiment or renewed buying from long-term holders could alter the current outlook and prevent a drop to $62,000.