- Ethereum’s performance against Bitcoin has reached a five-year low, with ETH dropping 39% against BTC in Q1 2025, marking its worst Q1 since 2018.

- Despite the challenging start, some analysts remain optimistic about a recovery in Q2, citing potential resolutions to economic uncertainties and accumulating BTC holdings by experienced traders.

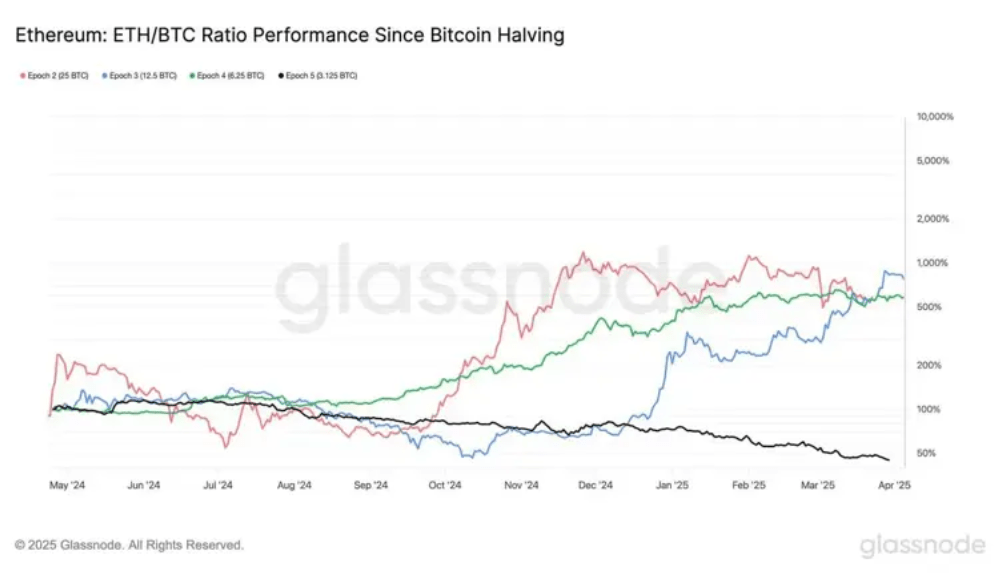

Ethereum’s recent performance compared to Bitcoin has reached a concerning milestone, hitting its lowest level in five years. According to data from Glassnode, the ETH/BTC ratio is now at 0.02191 after Ethereum (ETH) dropped a staggering 39% against Bitcoin (BTC) in the first quarter of 2025. This marks the first time ETH has underperformed BTC in a post-halving year, raising questions about the altcoin’s future.

A Historic Struggle for Ethereum and Bitcoin

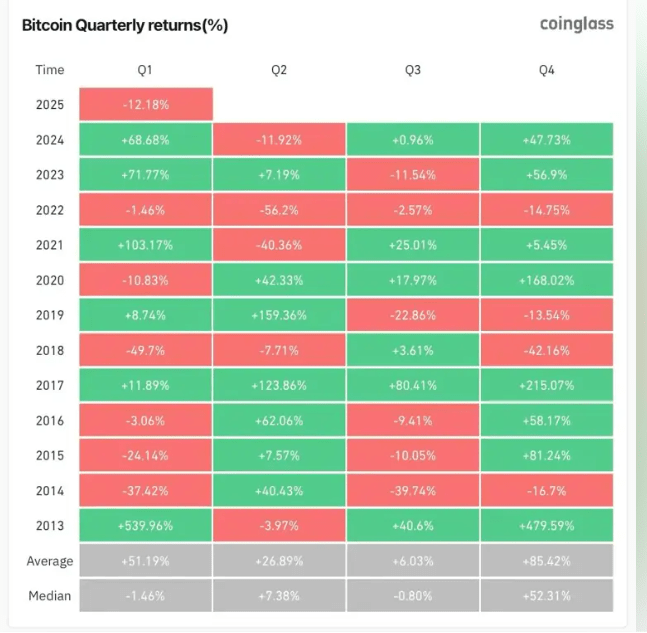

The first quarter of 2025 has proven challenging for the crypto market. Ethereum’s 45.98% drop in Q1 makes it the worst-performing first quarter since 2018, when it experienced a 46.61% decline. This outcome is particularly surprising, given Q1’s historical strength for ETH, which typically averages a 77% gain. Bitcoin, too, is facing its worst Q1 since 2018, with a 12.18% decline, despite a promising start to the year when it reached $108,000. Currently, BTC hovers around $82,000, struggling to regain momentum.

Shifting Investor Sentiment

Institutional interest in both cryptocurrencies has waned, evident in the prolonged outflows from ETH and BTC ETFs. Ether ETFs, in particular, faced 17 consecutive days of outflows, a trend that only ended on March 27. Meanwhile, Bitcoin ETFs saw limited inflows, with the longest streak this year being ten days. The ongoing trade wars and economic uncertainties have further clouded market prospects.

Is There Hope for a Q2 Recovery?

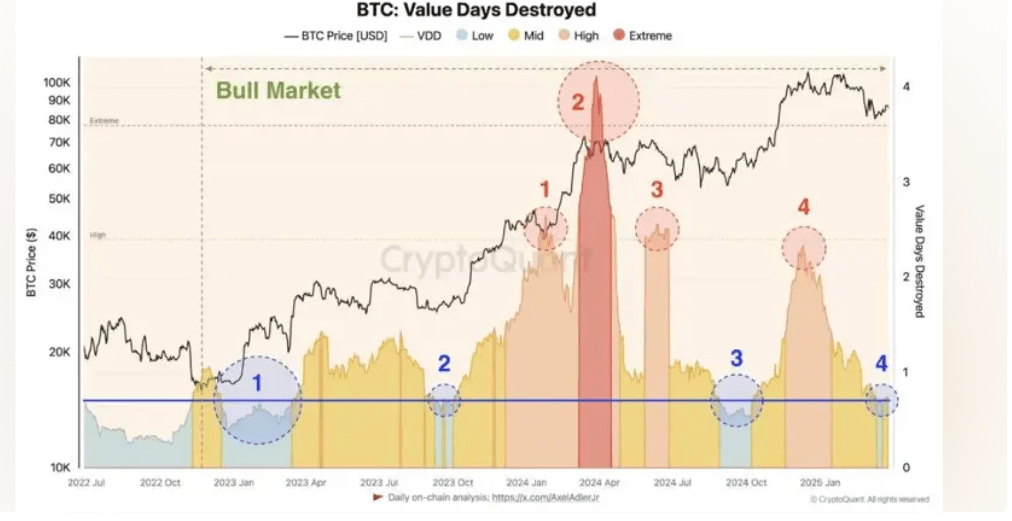

Despite the turbulent start to 2025, some market analysts remain optimistic. 21st Capital co-founder Sina G predicts that a resolution to trade wars and economic uncertainty could ignite a rally. Others, such as Colin Talks Crypto and CryptoQuant analyst Axel Adler Jr., suggest that experienced traders accumulating BTC signal a potential upward trend. In the past week, over 30,000 BTC have been moved off exchanges, reflecting confidence in a long-term recovery.

However, risks loom ahead. President Trump’s upcoming reciprocal tariffs announcement on April 2 and the release of US inflation data on April 10 could further impact the market. As the second quarter begins, investors should brace for volatility while remaining vigilant for opportunities.

Ethereum’s sharp decline against Bitcoin underscores the importance of cautious decision-making in the crypto market. While some predict a rebound, the road ahead remains uncertain. Investors should keep an eye on macroeconomic factors, regulatory updates, and market trends to navigate the volatile landscape effectively.