- XRP and Bitcoin show bullish patterns, suggesting potential gains, while Ethereum faces a challenging outlook due to intense competition and scalability issues, with a possible 21% downside risk.

- The success of Ethereum’s upcoming Pectra upgrade could determine its performance amidst rivals like Solana and BNB Chain.

In the ever-evolving world of cryptocurrencies, Bitcoin (BTC) and XRP are showing bullish patterns that suggest potential growth, while Ethereum (ETH) could face challenges in the near future. As the crypto market experiences volatility, these top players are moving in different directions, and the dynamics of each coin’s performance are worth analyzing.

XRP: Bullish Breakout Potential

XRP has been one of the standout performers in the crypto market this year. The coin has enjoyed an impressive rise due to positive legal developments and its expanding ecosystem, which includes the launch of a stablecoin. After testing its all-time highs, XRP faced some resistance but has since formed a bull flag pattern, signaling that it may be gearing up for an explosive move upward.

This pattern indicates that XRP could break above the $3.4 level, which would likely lead to significant gains in the coming months. Given XRP’s previous surge from $0.12 to $3.4, a similar run-up could push its price much higher, with some speculating potential long-term targets as high as $19. While such a leap seems ambitious, XRP’s ability to overcome its previous hurdles makes this scenario plausible.

Bitcoin’s Resilience: A Path to New Heights?

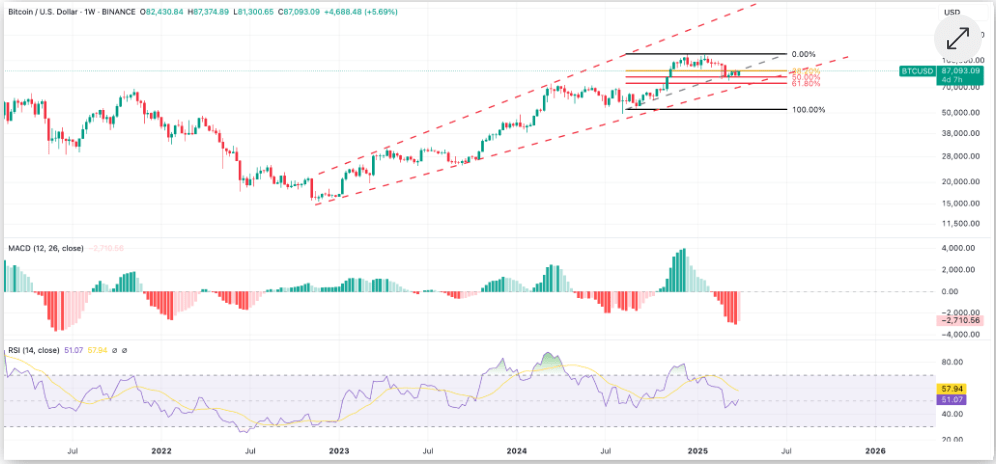

Despite the current downturn in the market, Bitcoin has maintained impressive resilience. It has experienced a modest 3.3% drop recently, especially when compared to sharp declines in altcoins like Ethereum and Solana. Bitcoin’s weekly charts reveal a bullish structure, with the possibility of reaching its all-time highs (ATH) once again.

The cryptocurrency has demonstrated a consistent uptrend over the past two years, posting four consecutive higher highs, which aligns with increasing crypto adoption. Even during the recent pullbacks, Bitcoin has managed to hold above a crucial Fibonacci retracement level, particularly around the $90,000 mark. If Bitcoin breaks above this resistance, a retest of its ATH could be imminent. Positive momentum indicators, such as the Relative Strength Index (RSI) and MACD, also suggest that BTC could continue its upward trajectory in the weeks ahead.

Ethereum: Facing Intense Competition and a Bearish Outlook

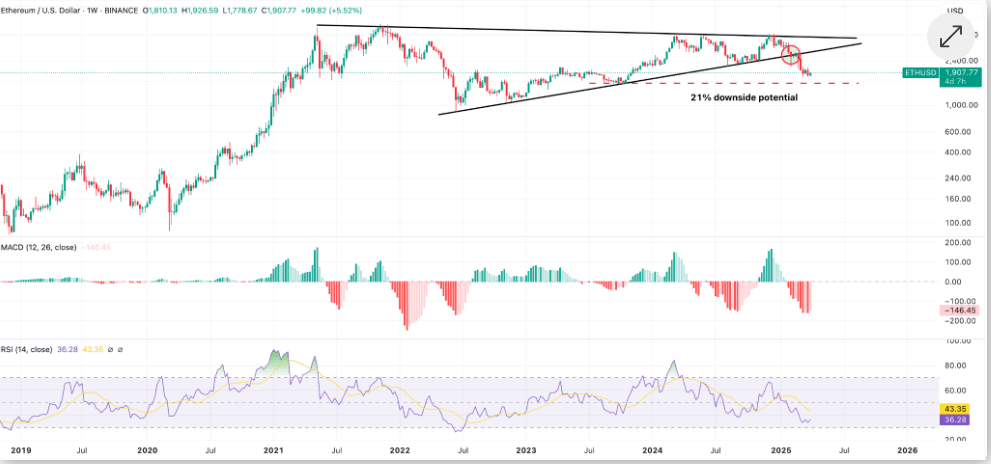

In stark contrast to Bitcoin and XRP, Ethereum’s future seems less promising in the short term. The platform, which once led the charge for smart contracts, is now struggling to maintain its dominance amid increasing competition from networks like Solana, BNB Chain, and Sui. Ethereum’s scalability issues have also contributed to its declining market value, and its weekly charts show a bearish breakout that could push the price to test key support levels around $1,550—representing a potential 21% downside from its current position.

While the upcoming Pectra upgrade could help address Ethereum’s scalability issues, the market remains cautious. If the upgrade fails to meet expectations, Ethereum could continue to underperform its rivals, even if the broader crypto market experiences a bullish cycle.

Diverging Paths for Crypto’s Big Three

While Bitcoin and XRP are showing promising bullish trends, Ethereum appears to be facing headwinds in a highly competitive landscape. Investors should remain vigilant, as the performance of these top cryptocurrencies could diverge significantly in the coming months. While Bitcoin and XRP hold potential for impressive growth, Ethereum’s fate could depend on the success of its upcoming upgrades and its ability to stay relevant in a rapidly evolving market.