- TRON has become a leading blockchain for stablecoin activity, with over 99% of its network transactions driven by USDT, largely through peer-to-peer transfers.

- Its recent growth is fueled by zero-gas USDT transfers, enabling efficient, low-cost transactions and boosting daily volumes to over 9 million.

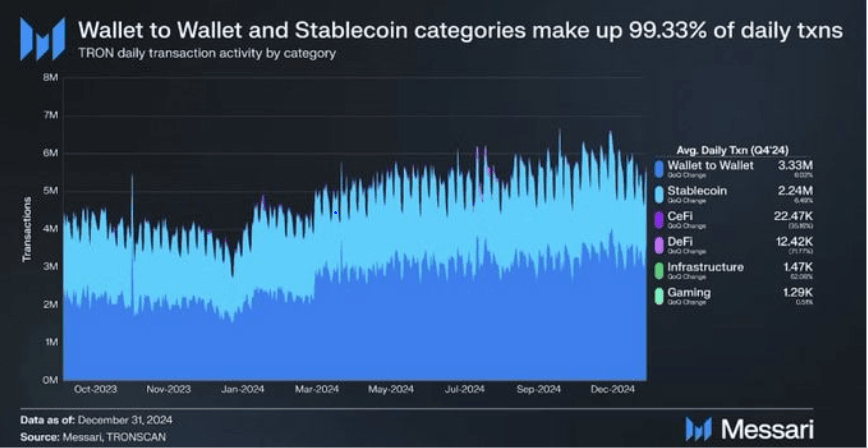

TRON is rewriting the rulebook on stablecoin dominance. In 2024, it emerged as a powerhouse in the world of crypto transactions—thanks almost entirely to Tether (USDT). With over 99% of its network activity centered on USDT, TRON’s ecosystem is being driven by an overwhelming surge in peer-to-peer transfers.

At the core of this growth is a major game-changer: zero-gas USDT transfers. This innovation has attracted a growing number of users looking for fast, cost-effective crypto transactions. Unlike networks bogged down by hefty gas fees or complicated smart contracts, TRON allows users to move funds directly between wallets without spending a dime on transaction fees.

The Numbers Tell the Story

In 2024 alone, TRON processed around $17.9 million in daily token transfers and saw its DeFi and trading volume soar to $5.46 trillion. This performance places TRON firmly among the top blockchain platforms for stablecoin transactions. Recent data shows that the network now averages over 9 million daily transactions, with 2.38 million of them in USDT alone.

The daily USDT transfer volume on TRON fluctuates between $14 billion and $28 billion, depending on market conditions. That’s a staggering figure, highlighting just how pivotal TRON has become for stablecoin liquidity and movement in the crypto ecosystem.

TRON’s Strength Lies in Simplicity

While TRON might lack the complex ecosystems of Ethereum or Solana, it’s winning by doing one thing exceptionally well: enabling fast, simple payments. Most transactions on TRON don’t even touch centralized exchanges or DeFi platforms—they’re wallet-to-wallet, peer-driven transfers.

Despite having a relatively small DeFi footprint and meme tokens that don’t break out beyond its own chain, TRON continues to shine through strong on-chain metrics and steady user growth. Its native token, TRX, is also gaining attention for its deflationary model and price stability, trading at around $0.23 during recent market turbulence.

TRON is not trying to be everything. Instead, it’s mastering the niche of stablecoin utility, particularly through USDT. By focusing on real-world use cases like zero-gas payments and lightning-fast transfers, it’s building a robust, user-focused network that keeps growing even when the broader market stumbles.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.