- Bitcoin investment funds saw $751 million in outflows last week, making up 94% of the $795 million total withdrawn from crypto funds, amid a broader trend of declining investor sentiment since February.

- Despite a late-week recovery in prices and continued positive year-to-date inflows for some assets like XRP, total crypto fund inflows for 2025 have now dropped to just $165 million.

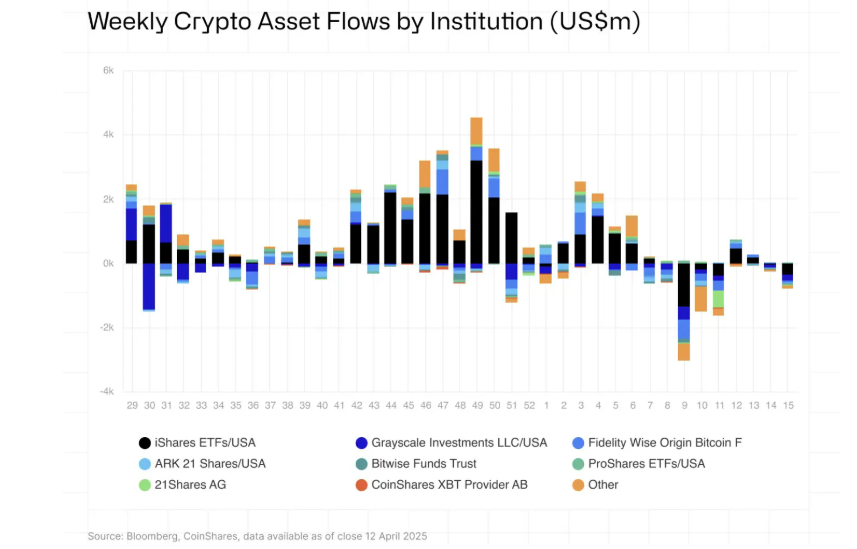

The crypto market witnessed a significant setback last week as investors pulled $795 million from digital asset investment products — with Bitcoin alone accounting for a staggering $751 million of those outflows. According to CoinShares, this marks the third consecutive week of withdrawals, driving total outflows to $7.2 billion since early February.

Bitcoin Dominates the Outflows

Bitcoin was by far the hardest hit, with its $751 million in outflows representing 94% of the total. This massive single-week retreat comes despite Bitcoin maintaining a positive year-to-date inflow of $545 million. However, sentiment around the asset has clearly turned cautious. Over the past month alone, Bitcoin has shed $890 million in investments, raising red flags about investor confidence.

Ethereum also suffered outflows of $37.6 million, while Solana, Cardano, Sui, Litecoin, and Short Bitcoin products saw smaller but still notable capital withdrawals.

![FLOWS by Assets [US$m]](https://cryptonewsfocus.com/wp-content/uploads/2025/04/image-120.png)

XRP and Multi-Asset Funds Buck the Trend

Not all digital assets faced redemptions. XRP led the minority of gainers, pulling in $3.45 million in inflows. Multi-asset funds also managed to attract $1.05 million, while Ondo, Algorand, and Avalanche each drew modest investments.

This divergence highlights a shift in investor focus toward altcoins and diversified products, possibly reflecting growing skepticism around Bitcoin’s short-term trajectory.

U.S. at the Center of the Storm

The outflows were heavily concentrated in the United States, which accounted for 96% of the weekly total — or $763 million. Switzerland, Hong Kong, Sweden, and Germany saw comparatively smaller outflows, while Canada, Brazil, and Australia registered modest inflows, offering a glimpse of regional divergence in sentiment.

The broader market context has been shaped by policy-related headwinds, with CoinShares attributing part of the pressure to recent tariff developments. Still, a late-week recovery in crypto prices helped lift total assets under management back to $130 billion — up from a low earlier in the week.

Despite the recent turbulence, the crypto investment fund sector remains sizable, and Bitcoin still holds the largest assets under management at $112.96 billion. However, if the current trend continues, it could erase the limited gains achieved in early 2025, with total YTD inflows already dwindled to just $165 million.

For now, all eyes are on whether this outflow trend is a temporary retreat — or a signal of deeper market realignment.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.