- Bitcoin and Ethereum options worth over $8 billion expired today, raising the chances of short-term market volatility.

- Despite mixed price action, long-term sentiment remains bullish with traders targeting higher strike prices into mid-2025.

Over $8 billion in Bitcoin and Ethereum options expired today, sending ripples of anticipation through the crypto market. Traders are closely watching price movements as this event could lead to increased short-term volatility, especially given the massive volume and strategic positioning involved.

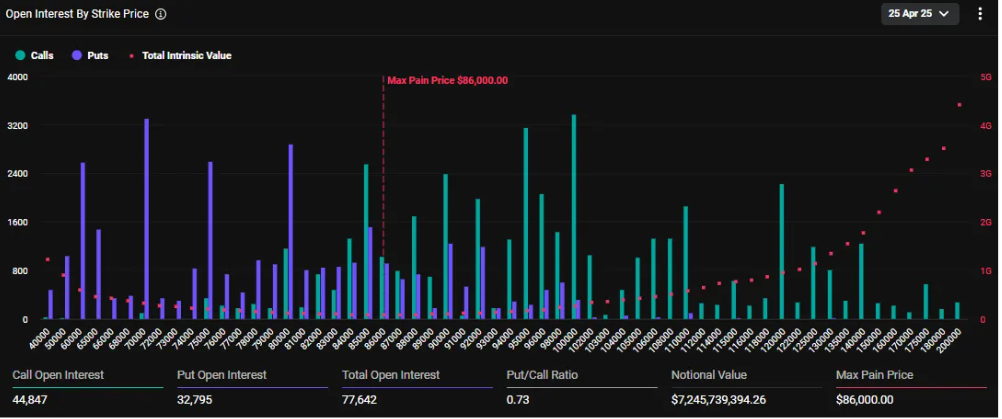

Bitcoin Options: Trading Above Max Pain

Bitcoin alone accounts for $7.24 billion of the total options expiring. With 77,642 contracts in play, the put-to-call ratio sits at 0.73, meaning bullish bets (calls) outweigh bearish ones (puts). The maximum pain point for Bitcoin stands at $86,000 — the price level where the most option holders would suffer financial losses. However, Bitcoin is currently trading well above that level at around $93,471, which could prompt some downward price pressure as market makers attempt to hedge their positions.

Traders continue to show long-term optimism. Many are selling cash-secured puts, aiming to buy Bitcoin at lower prices while collecting stablecoin premiums — a strategy that reflects confidence in BTC’s continued growth. In fact, some investors are eyeing strike prices as high as $110,000 for mid-2025 expiry dates.

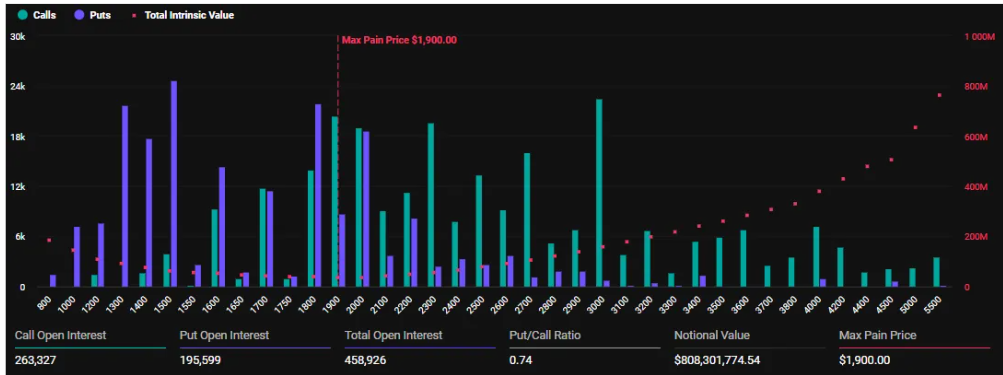

Ethereum Options: Bearish Pressure Looms

While Bitcoin may be pushing higher, Ethereum paints a different picture. Of the $808.3 million in ETH options expiring, the max pain point is $1,900 — but ETH is trading below that level at $1,764. The 458,926 expiring Ethereum contracts show a similar put-to-call ratio of 0.74, suggesting slightly more bullish positioning, yet current prices point to short-term bearish sentiment.

Compared to last week’s 177,130 ETH contracts, today’s expiration is more than double in volume, further amplifying the potential impact.

Mixed Signals but Long-Term Confidence

Despite the divergence — BTC trading above max pain and ETH below — both assets show strong open interest near their respective pain levels, indicating a likelihood of price consolidation or volatility in the immediate term.

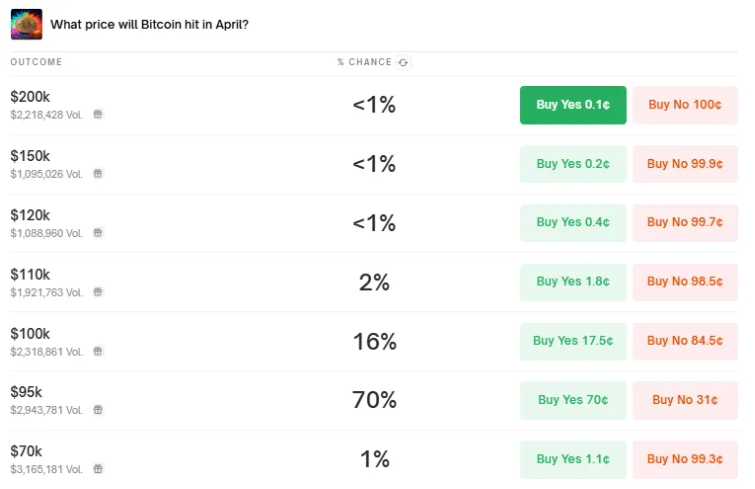

On platforms like Polymarket, only 16% of traders believe Bitcoin will hit $100,000 this April, yet Deribit data shows a surge in call options targeting that price range by next year.

In summary, today’s massive expiry event could drive short-term turbulence. But the broader sentiment, especially for Bitcoin, remains bullish as strategic traders position for gains beyond $100,000 — just not quite yet.