- XRP remains range-bound between $2.03 and $2.30, with network activity hitting multi-month lows and daily active addresses dropping significantly.

- Despite decreased usage, recent protocol launches and Ripple’s acquisitions could spark renewed interest, but the token’s short-term outlook remains neutral-to-bearish.

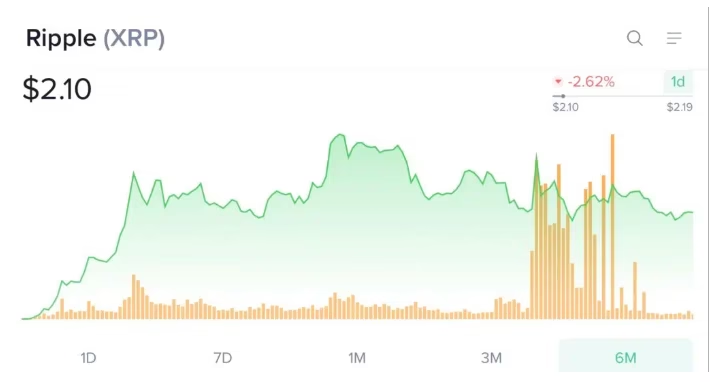

XRP remains stuck in a tight trading range, struggling to make significant moves in either direction.. For the past month, XRP has been oscillating between $2.03 and $2.30, failing to break out of this corridor despite initial momentum. As of now, the price is around $2.14, reflecting a 1.2% drop in the last 24 hours and more than an 8% decline over the past week.

RELATED:Why is XRP Price at Risk of a 45% Plummet to $1.20?

Declining Network Activity Raises Concerns

XRP’s price movement seems to mirror its on-chain activity, which has experienced a sharp decline. Data from Santiment reveals that daily active addresses on the XRP Ledger have dropped to an average of 40,000, the lowest level since November 2024. This represents a stark contrast to the activity in March, when daily addresses hovered around 300,000, peaking at over 612,000 on March 19.

Alongside this drop in user activity, the number of large transactions over $100,000 has also decreased. From more than 1,500 daily large transactions in March, this number now averages around 1,000. Despite these concerning figures, XRP’s development activity is on the rise, with a 196% increase in developer contributions over the past 30 days. This suggests that, while usage has declined, there are ongoing improvements and updates to the network, potentially signaling future growth.

Technical Indicators Point to a Bearish Bias

From a technical standpoint, XRP’s outlook remains neutral-to-bearish. The relative strength index (RSI) sits at 44.7, indicating a neutral market condition, while the stochastic RSI suggests the token may be oversold. The Moving Average Convergence Divergence (MACD) indicator also points to a short-term downward trend.

Most of XRP’s short- to mid-term moving averages are trending lower, signaling potential selling pressure. However, the 200-day moving average, positioned at $1.99, provides some support, and if XRP drops below the $2.03 level with significant volume, it could trigger further declines toward this key support zone.

New Developments Could Spark Interest

Despite the current lull, recent developments could reinvigorate interest in XRP. Two new protocols, Vaultro Finance (a tokenized index fund) and XpFinance (a decentralized lending protocol), launched on the XRP Ledger on May 5, potentially bringing new use cases and network activity. Ripple’s acquisition of prime broker Hidden Road also stands to create more opportunities and may help reignite investor enthusiasm.

If XRP can break above the $2.30 resistance level, it might trigger a breakout toward the next significant resistance near $2.45. However, with the ongoing weak network activity, the token’s price trajectory may continue to be constrained unless these developments begin to gain momentum in the coming weeks.

XRP’s journey in the short term seems uncertain, with market sentiment likely dependent on the broader adoption of new projects and the general direction of on-chain activity.

ALSO READ:XRP Price Under Massive Pressure- Too Much to Handle?

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.