- XRP faces significant resistance at around $6, with analysts suggesting it must consolidate through 2025 to reach its full potential of $30.

- The recent listing of Ripple’s RLUSD stablecoin and broader altcoin market trends provide a more favorable outlook for XRP’s long-term growth.

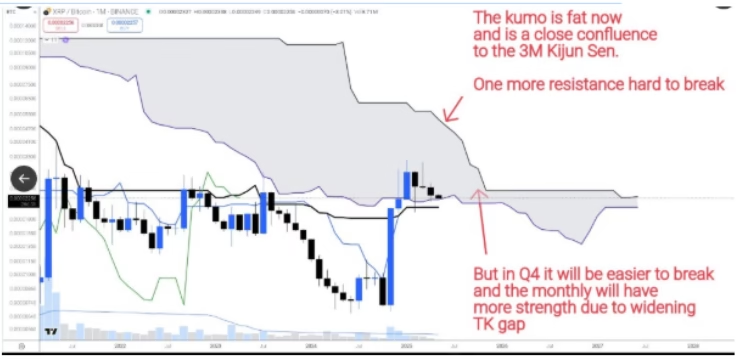

As XRP continues to make waves in the cryptocurrency market, analysts are watching closely to see if it can overcome its resistance levels and deliver significant growth. According to Ichimoku Cloud analysis, Ripple’s price could potentially skyrocket to $30, but only if it consolidates in 2025 before breaking resistance against Bitcoin. Let’s break down the key factors shaping XRP’s price trajectory.

ALSO READ: Ripple and SEC Settle $1.3 Billion XRP Lawsuit with $50 Million Deal

XRP Price Analysis: The Role of Ichimoku Cloud in Future Movements

Recent charts reveal that XRP is encountering significant resistance, especially against Bitcoin. The Ichimoku Cloud analysis indicates that XRP is facing a critical level of resistance at around 5200 sats, roughly equating to $6. This resistance, formed by the Kijun Sen and a bearish TK gap, presents a formidable challenge to any potential rally. Analysts predict that without a period of consolidation, XRP could struggle to break past this level, risking a major price rejection.

However, the good news for XRP holders is that the outlook for late 2025 is more promising. Analysts suggest that if Ripple can consolidate through 2025, it may position itself to overcome these barriers and potentially rally to $30. But this isn’t going to be easy; XRP must clear multiple layers of resistance, particularly on the BTC pair, to sustain a bullish trend.

A Strong Rejection or A Long-Term Breakout?

If XRP tries to break past the 5200 sats level too early in Q2 2025, analysts are forecasting a 90% chance of rejection. The Kumo cloud’s thick resistance suggests that an early breakout could encounter significant headwinds. However, as the year progresses, the cloud is expected to thin, providing a more favorable environment for upward movement. This could allow XRP to push past its resistance and unlock its full potential later in 2025.

RLUSD Stablecoin and Market Expansion

Aside from technical analysis, Ripple has also been making strides in expanding its ecosystem. On May 5, Gemini listed Ripple’s RLUSD stablecoin, marking its 15th exchange. This increased exposure is likely to contribute to Ripple’s growing adoption, as more users gain access to RLUSD. The stablecoin’s market cap currently sits at $317 million, with 24-hour trading volume seeing a 28% increase following the Gemini listing.

Ripple’s continued expansion into new networks, including Ethereum and the Root Network, further strengthens its position in the cryptocurrency space. This broader adoption could contribute to a more bullish sentiment around XRP, offering additional support for future price growth.

The Broader Altcoin Market and XRP Future

Some analysts are also looking at broader trends in the altcoin market, particularly noting that April 2025 could be a key turning point for many cryptocurrencies, including XRP. Historical trends show that altcoins tend to experience a surge after consolidation phases, and the current market conditions are showing similar patterns to those seen in April 2017 and April 2021. If this trend continues, XRP could see significant gains, especially if it consolidates long enough to reset momentum.

In conclusion, while XRP faces tough resistance in the near term, there is hope for a breakout in late 2025. If it can consolidate and reset key momentum indicators, XRP’s price could rise significantly, potentially reaching $30. However, much will depend on the broader market environment and Ripple’s continued expansion.

MIGHT ALSO LIKE: Bitcoin Surpasses $103K as Bullish Signals Point to $130K–$160K Rally

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.