- Japanese investment firm Metaplanet now holds 6,796 Bitcoin worth over $707 million, surpassing El Salvador’s 6,714 BTC.

- The firm’s aggressive accumulation strategy has made it the largest BTC holder in Asia and the tenth largest globally.

Japanese investment firm Metaplanet has emerged as a dominant force in the Bitcoin space, officially surpassing El Salvador in total BTC holdings. With its latest purchase, Metaplanet now controls 6,796 Bitcoin, currently valued at over $707 million—more than the 6,714 BTC held by the Central American nation.

ALSO READ:Pi Network Price Surges 35% to $1.29 as Trading Volume Tops $1 Billion

Metaplanet Bold Bitcoin Accumulation Strategy

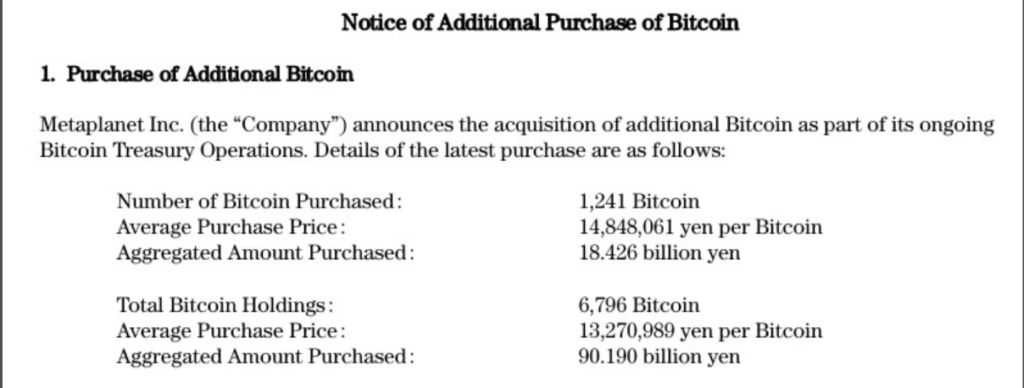

Metaplanet’s aggressive Bitcoin acquisition strategy began in April 2024 and has rapidly scaled. On May 12, the Tokyo-listed firm revealed it had purchased an additional 1,241 BTC at an average price of $101,843 per coin, totaling approximately $129 million. This buy marked the firm’s highest-ever entry point into the market, yet the momentum shows no signs of slowing.

CEO Simon Gerovich celebrated the milestone on X (formerly Twitter), stating, “Metaplanet now holds more Bitcoin than El Salvador. From humble beginnings to rivaling nation-states, we’re just getting started.”

ALSO READ:XRP Whales Accumulate $4 Million as BlackRock ETF Speculation Intensifies

Surging Ahead of Nation-States

El Salvador, once the poster child for national-level Bitcoin adoption, now trails Metaplanet by over $60 million in BTC value. According to the country’s National Bitcoin Office, El Salvador holds 6,714 BTC worth around $642 million.

Metaplanet’s strategy has been notably aggressive. In just over two months, the firm executed a series of high-volume acquisitions—5,555 BTC on May 7 alone, four separate buys in April totaling 18,586 BTC, and six in March adding up to 18,925 BTC.

RELATED:Bitcoin Eyes New ATH: 3 Factors That Could Propel It Higher

Impressive Bitcoin Yield and Market Position

The company is not just stacking Bitcoin—it’s producing strong performance metrics. It reported a Bitcoin Yield of 38% for the current quarter so far, following an impressive 95.6% in Q1 2025. This metric, which tracks the percentage change in BTC holdings per fully diluted share, underscores Metaplanet’s strategic advantage.

Now ranked as the largest BTC holder in Asia and the tenth globally, Metaplanet is setting a new standard for corporate Bitcoin investment.

Eyes on Michael Saylor’s Next Move

As Metaplanet makes headlines, all eyes turn to MicroStrategy’s Michael Saylor. On May 12, he hinted at a potential upcoming BTC purchase by posting a chart of the firm’s Bitcoin portfolio along with the cryptic phrase, “Connect the dots.” MicroStrategy, now rebranded as Strategy, currently holds 555,450 BTC valued at nearly $58 billion.

With firms like Metaplanet and Strategy leading the charge, Bitcoin’s corporate adoption wave shows no signs of slowing.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.