- VeChain is struggling to hold the $0.020 support level as bearish indicators and a falling channel pattern point to a possible drop to $0.017.

- With minimal bullish activity in the derivatives market and a rising short position ratio, further downside pressure appears likely.

VeChain (VET) is teetering on the edge of a key psychological support at $0.020, with bearish indicators flashing red. A 40% drop over the past month has traders questioning whether the token can hold this line or slide further to $0.017.

VeChain Price Stuck in a Falling Channel

On the daily chart, VeChain continues to trend lower within a falling channel, reversing from the 38.2% Fibonacci retracement level at $0.031. Currently priced around $0.02099, the token faced rejection near $0.02210 in the past 24 hours, forming a long upper wick that suggests further selling pressure.

MACD and RSI indicators confirm this bearish bias. The MACD and signal lines are deep in negative territory, while the RSI hovers between neutral and oversold—signaling weak buyer interest and sustained downward pressure.

If VET fails to break the channel and dips below $0.020, the next likely stop is the $0.017 level, which marks the year’s low recorded in April. Conversely, a reversal could retest the upper boundary near $0.031, but only if VeChain can clear the immediate resistance at $0.024.

Derivatives Show Bearish Lean

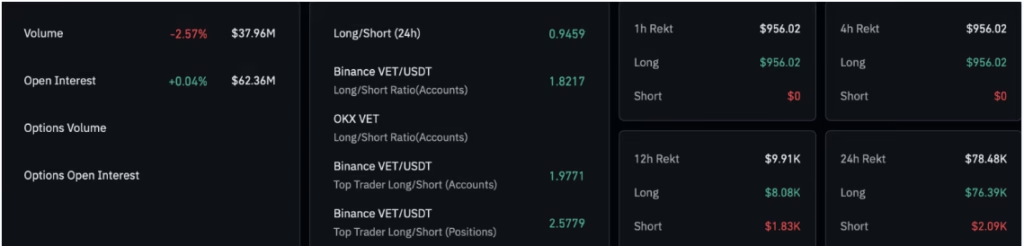

In the derivatives market, traders appear hesitant. Open interest for VET has increased only slightly, rising 0.04% to $62.36 million. However, liquidation data reveals an imbalance in sentiment—$76,390 in long positions were wiped out compared to just $2,000 in shorts.

This skew has pushed the long-to-short ratio down to 0.9459, confirming that bearish positions are currently dominating the market.

For now, VeChain’s future hinges on whether bulls can defend the $0.020 level. If not, the downtrend could accelerate toward $0.017. A rebound, on the other hand, would need to break $0.024 resistance convincingly to retest the $0.031 region.

With technicals and derivatives leaning bearish, VeChain holders face a critical juncture—hold and hope for reversal, or brace for a deeper dip.