- LUNC continues to face downward pressure despite Binance burning over 24,000 tokens in its fifth burn this month.

- Bearish technical patterns and reduced trading volume are keeping the price low.

Despite Binance burning millions of Terra Luna Classic (LUNC) tokens, the cryptocurrency’s price shows little sign of recovery. The latest burn has sparked discussions across the crypto space, but bearish technical patterns and waning interest are keeping prices low.

Binance Leads With Fifth Token Burn This Month

On June 19, Binance executed its fifth LUNC burn of the month, removing over 24,853 tokens from circulation. This adds to a monthly total of 498.6 million LUNC burned by the exchange, contributing significantly to the 73.04 billion tokens it has burned overall—about 17.8% of the community’s total burn efforts.

The LUNC community as a whole has eliminated 411.17 billion tokens so far, with an impressive 200 million tokens burned in a single day earlier this week. The current circulating supply now sits at approximately 6.49 trillion LUNC.

LUNC Community Gathers for Cosmos InterChain Summit

The Terra Luna Classic community is now turning its focus to the Cosmos InterChain Summit in Berlin, scheduled for June 20–21. Developers and key figures from both Terra and Terra Classic chains are expected to share crucial updates. One hot topic will be the proposal to reactivate the market module, championed by validator Vegas.

Another major concern is the oracle pool, which has shrunk from 115 billion to 69 billion LUNC within a year—raising questions about long-term sustainability.

Bearish Technical Indicators Weigh on LUNC Price

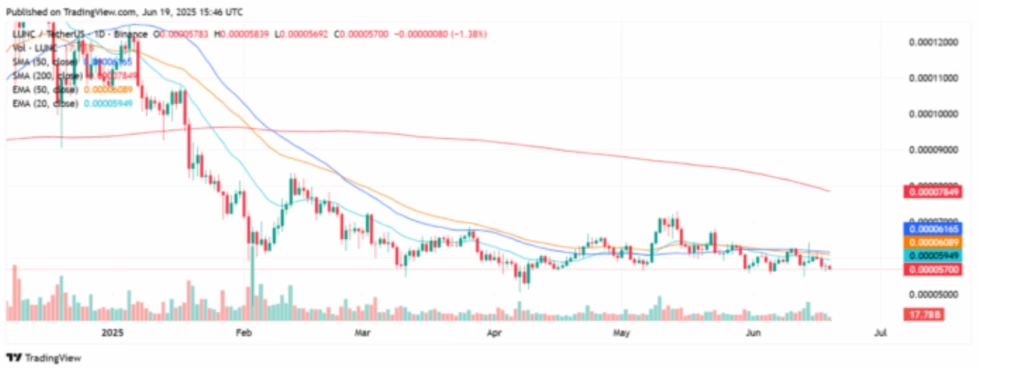

Despite the active burns and upcoming summit, LUNC’s price remains subdued, trading around $0.00005718 with minor gains of 0.5% in the last 24 hours. A major technical red flag is the “death cross” from February, where the 50-day SMA crossed below the 200-day SMA, signaling ongoing bearish pressure.

Trading volume has dropped 27%, pointing to decreased trader interest—possibly influenced by escalating geopolitical tensions involving Iran and Israel.

Additional bearish signals come from the 20-EMA crossing below the 50-EMA, reinforcing the probability of further price decline unless major positive developments emerge. The $0.000055 support remains critical; losing it could see prices dip as low as $0.000045.

Futures Market Sees Mixed Signals

While spot prices struggle, the futures market paints a more complex picture. Open interest in 1000LUNC futures on Binance rose 1.54% in four hours, suggesting a short-term rise in speculative interest. However, total futures open interest sits at $8.21 million, with slight drops across exchanges like Bybit, OKX, and Bitget.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.