- Bitcoin now accounts for 31% of crypto portfolios, led by rising institutional adoption and ETF support.

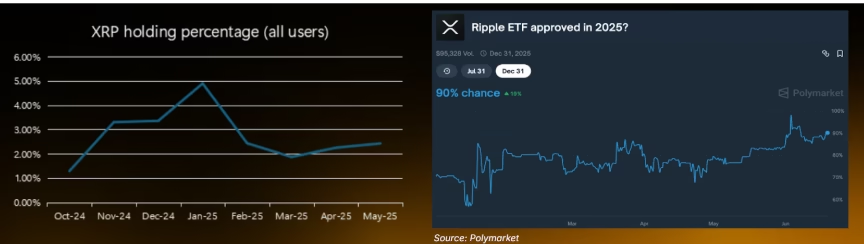

- Retail investors are shifting to XRP, expecting ETF approval.

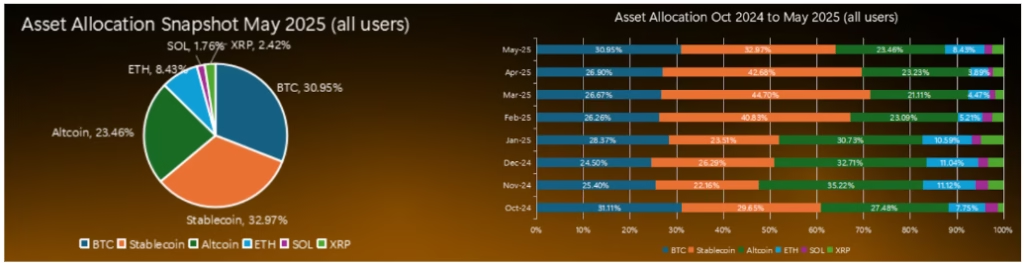

Bitcoin is taking center stage in crypto investment portfolios, making up nearly one-third of total holdings in 2025. A new report by Bybit reveals that institutional investors are leading this shift, significantly increasing their exposure to Bitcoin thanks to friendlier U.S. regulations and the successful launch of spot Bitcoin ETFs.

Bitcoin Gains Ground While Altcoins Shift

As of May 2025, Bitcoin’s represents 30.95% of investor portfolios, up from 25.4% in November 2024. This growth makes Bitcoin the single largest asset held in crypto portfolios. In contrast, the Ether (ETH) to Bitcoin ratio fell sharply to 0.15 earlier this year before recovering to 0.27. This suggests that for every $1 of ETH, investors hold about $4 worth of BTC.

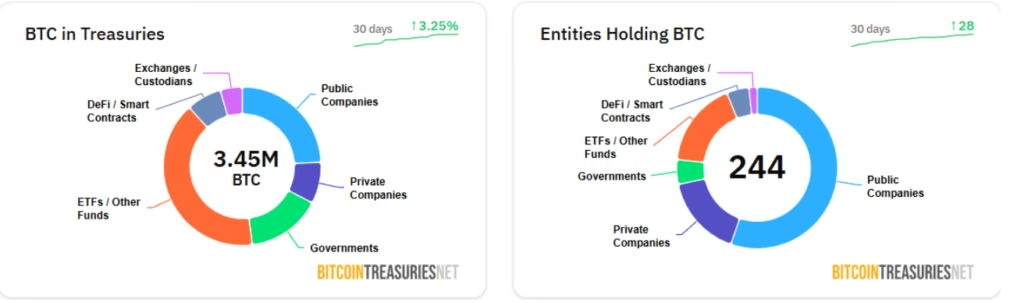

The rising value of Bitcoin’s holdings is largely driven by institutional investors. Corporate Bitcoin holding companies have nearly doubled since early June, with 244 companies now including BTC on their balance sheets. In total, treasuries now hold 3.45 million Bitcoin—6.6% of which is in spot Bitcoin ETFs and nearly 4% with public companies.

Retail Investors Favor XRP Over BTC

While institutions are embracing Bitcoin, retail traders appear to be moving in the opposite direction. Retail BTC holdings have dropped by 37% since November, now accounting for just 11.6% of their crypto portfolios. Much of this shift seems to favor altcoins with strong ETF prospects—particularly XRP.

XRP holdings have grown from 1.29% to 2.42%, driven by speculation around a potential Ripple spot ETF.

Solana (SOL), on the other hand, has seen its portfolio allocation fall by 35%, from 2.72% to 1.76%, with ome institutional capital shifting from SOL to XRP.

A Bold Prediction for Bitcoin’s Future

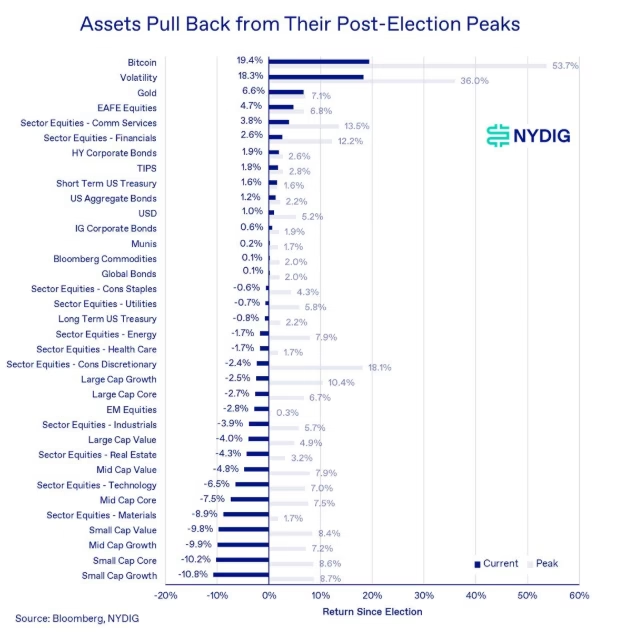

Bitcoin’s solid performance in the wake of the Trump administration’s return has outpaced equities, treasuries, and even precious metals. According to Joe Burnett of Unchained, BTC could reach $1.8 million by 2035 if it continues to evolve as a global store of value and rivals gold’s $22 trillion market cap.

As regulatory clarity continues to improve and institutional interest grows, Bitcoin’s place as the foundation of crypto portfolios seems increasingly secure.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.