- TRON gained 0.6% as the broader crypto market declined, showing strength and defying the trend.

- Analysts highlighted TRON’s shrinking drawdowns and record USDT activity as signs of growing stability and adoption.

As most of the crypto market reels from a 2.7% dip in total market capitalization over the past 24 hours, TRON (TRX) stands out with a rare 0.6% gain, currently trading at $0.2788. Zooming out, TRON has managed a 2.4% weekly increase, outperforming major digital assets during an otherwise sluggish period.

This divergence has drawn the attention of on-chain analysts who see deeper signals of growth and resilience in the TRON ecosystem—especially through the lens of historical drawdowns and Tether (USDT) transaction volume.

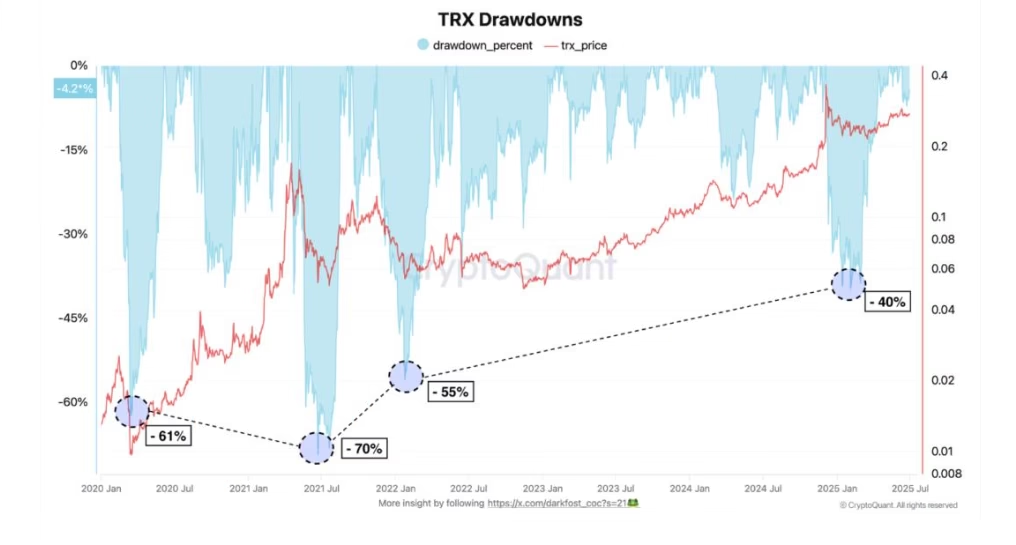

Drawdowns Reveal TRON’s Growing Stability

CryptoQuant analyst Darkfost shed light on TRON’s performance through a long-term drawdown analysis. The drawdown metric, which captures an asset’s peak-to-trough decline, shows a clear trend: TRON’s corrections are getting shallower over time.

TRX has followed each major dip—from a 61% plunge in March 2020 to a 40% drop in January 2025—with a strong recovery.According to Darkfost, this pattern signals increasing market maturity, investor confidence, and capital retention.

“With TRX now trading around $0.27, each of these drawdowns has proven to be profitable in hindsight,” he noted, adding that TRON may now be viewed as a more stable asset class.

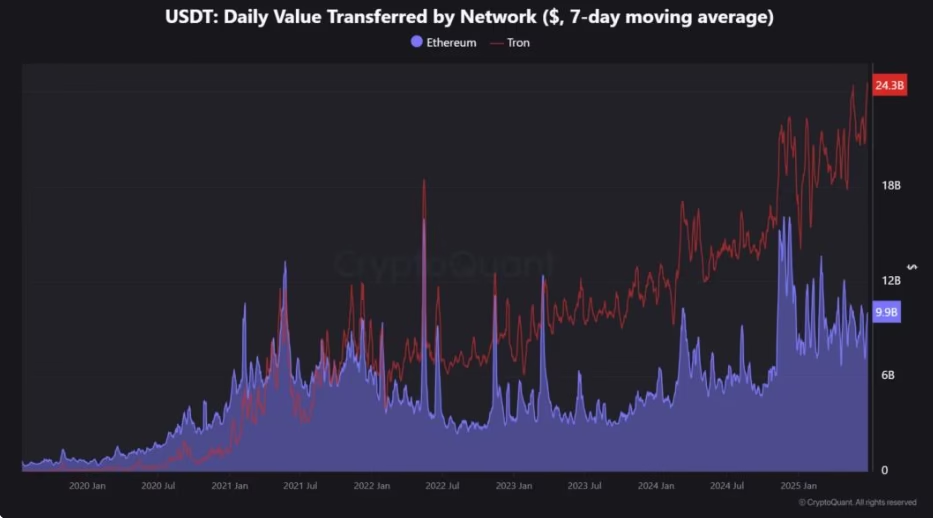

TRON Tops Ethereum in USDT Transfers

Adding to TRON’s growing credibility is its dominance in the stablecoin transaction space. CryptoQuant analyst Maartunn revealed that TRON set a new record on June 25, 2025, by processing $23.4 billion in daily USDT transfers—more than double Ethereum’s $9.9 billion on the same day.

The chart doesn’t just reflect a single-day spike. Since mid-2022, TRON has consistently outpaced Ethereum in USDT activity, and the gap keeps widening. While Ethereum’s stablecoin volume has dropped 39% since its November 2024 peak, TRON’s metrics point to a continual upward trend.

A Stronger Future for TRON

TRON’s performance during a market dip, its shrinking drawdowns, and dominance in Tether transactions all signal stronger fundamentals and growing investor trust. While the broader market stumbles, TRON appears to be carving out a unique position as a resilient and increasingly vital blockchain in the digital finance space.

ALSO READ:Dogecoin Sets Sights on $0.20 as Market Cap Chases Tron

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.