- Litecoin miners have been steadily increasing their LTC reserves over the past year, despite recent price declines.

- The network’s rising Hashrate suggests growing confidence and long-term bullish sentiment among miners.

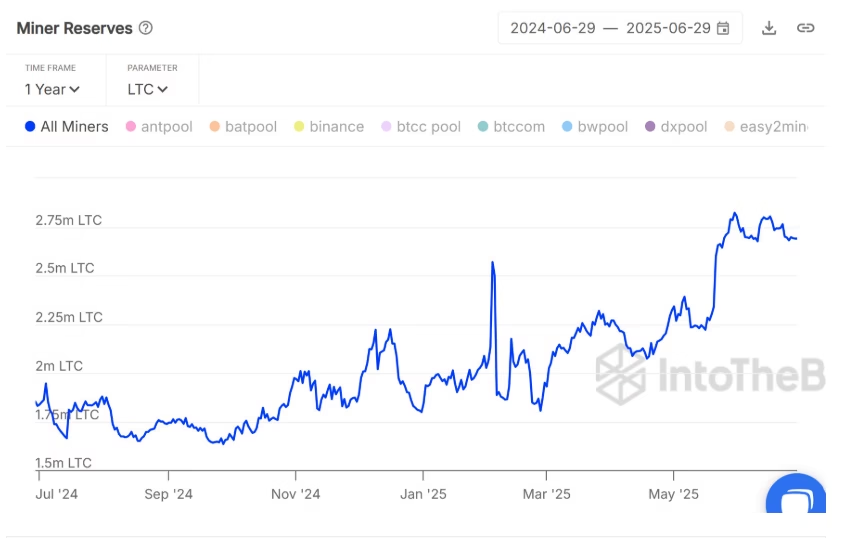

Litecoin miners appear to be making a calculated bet on the future, accumulating large amounts of LTC even as prices dip. Recent on-chain data reveals that miner reserves have steadily increased over the past year, a trend that could hint at rising confidence within the network.

ALSO READ:Litecoin Sets Privacy Record with Over 150K LTC Locked in MWEB

Miners Are Stacking Litecoin Despite Market Dip

According to data from Sentora, formerly IntoTheBlock, Litecoin’s miner reserves have been growing over the last 12 months. These reserves, which represent LTC held in wallets linked to large mining pools, include both block rewards and possibly tokens bought on the open market.

Typically, miners are known to sell portions of their rewards to cover operational costs like electricity. However, the ongoing accumulation signals that many are opting to hold instead, likely in anticipation of a future price increase. Despite LTC trading around $84 and dropping over 2% in the last 24 hours, miners continue to stockpile, suggesting long-term optimism.

Rising Hashrate Adds to Bullish Sentiment

The confidence isn’t limited to accumulation alone. Litecoin’s Hashrate—the total computing power securing the network—has also climbed significantly over the past year. This rise indicates that miners are investing more resources into the blockchain, further demonstrating faith in the protocol’s prospects.

Although the increases in Hashrate and miner reserves haven’t aligned perfectly, the combined trend presents a compelling case. Miners appear to be strengthening the network while simultaneously preparing for a potential bullish turn in the market.

Broader Implications for Crypto Mining

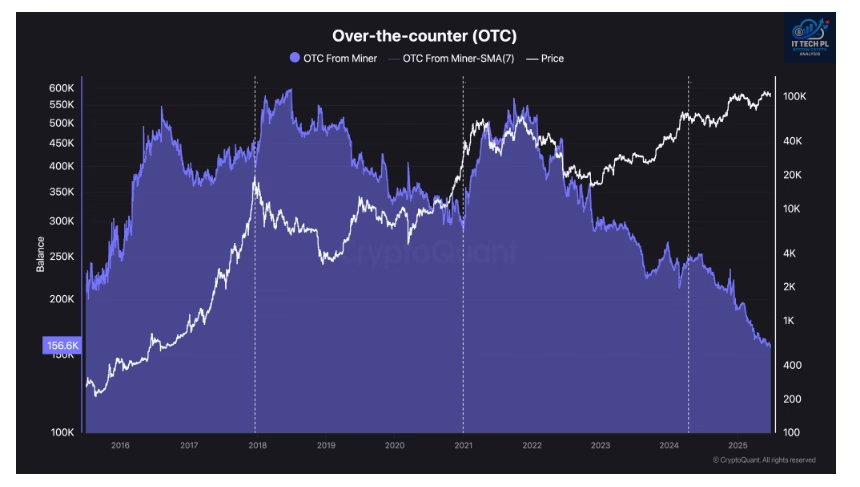

This Litecoin miner behavior reflects a larger trend across the crypto mining sector. Recent analysis from CryptoQuant shows Bitcoin miners are also pulling back from over-the-counter (OTC) selling, a move often associated with reduced sell-side pressure and upcoming supply constraints.

While it remains uncertain whether these developments will result in significant price shifts for Litecoin in the short term, miner accumulation and network strengthening are generally viewed as positive long-term indicators.

As Litecoin miners dig in and Hashrate rises, the question remains: is a major LTC breakout on the horizon?

ALSO READ:95% Points to XRP, Solana, and Litecoin ETFs Approval but is it in 2025?

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.