- Bitcoin hits a new record above $112,000 as traders liquidate shorts.

- Analysts cite safe-haven demand and reduced exchange reserves as bullish drivers.

Bitcoin has reached a historic milestone, breaking above $112,000 for the first time. This new all-time high follows a weekly gain of nearly 6% and a massive $200 million in short liquidations, pushing prices higher.

Traders Exit Shorts, Bitcoin Breaks Resistance

Bitcoin’s rapid surge past $112K was fueled by a significant liquidation of bearish positions. As short sellers rushed to exit, strong buying pressure pushed the price upward. Analysts from Bitfinex highlighted that the rally is not just speculation but is supported by genuine capital inflows.

They stated that on-chain accumulation and solid exchange activity indicate a more sustainable rally. This suggests that Bitcoin’s growth is built on long-term investor interest rather than temporary leverage.

Safe-Haven Demand Drives Bitcoin Higher

Bitcoin’s rally has been further supported by its growing role as a safe-haven asset. Since Donald Trump’s April 2 “Liberation Day” speech and new tariff plans, Bitcoin has been outperforming traditional assets like the S&P 500.

According to Sygnum Bank’s research head, Katalin Tischhauser, Bitcoin is increasingly seen as a hedge against fiat currency devaluation. She also pointed to new legislation, including a U.S. state adopting Bitcoin as a reserve asset and a federal Bitcoin reserve initiative, which reinforce this safe-haven narrative.

Falling Exchange Reserves Signal Long-Term Confidence

Another key indicator supporting the price rally is the decline in BTC reserves on exchanges. Data from Glassnode shows that reserves dropped from 3.11 million BTC in March to 2.99 million BTC by late May.

This steady withdrawal suggests that investors are moving their assets into long-term storage, which reduces available supply. As supply shrinks and demand grows, Bitcoin is likely to experience further upward price pressure.

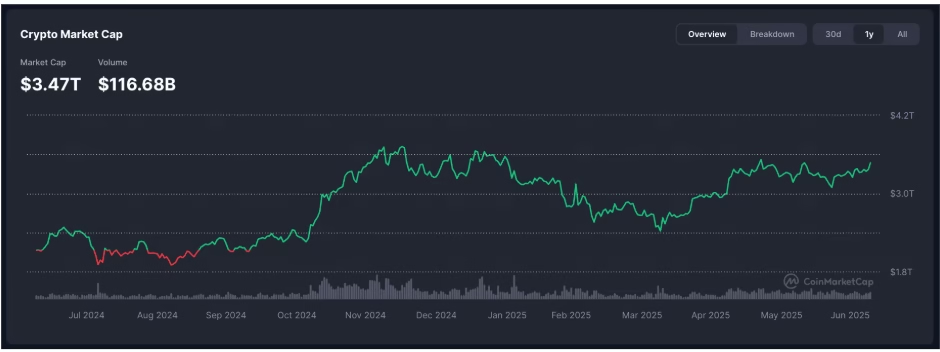

Total Market Cap Nears Previous Peak

The total cryptocurrency market capitalization has climbed to $3.47 trillion, nearing its December 2024 peak of $3.73 trillion. Bitcoin’s breakout, supported by institutional interest and macroeconomic shifts, signals a strong foundation for continued growth.

ALSO READ:Bitcoin Ownership Uncovered: Who Really Holds the $2 Trillion Asset?

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.