- Bitcoin price may drop to $111,000 as unfilled chart gaps and bearish patterns suggest a short-term correction.

- However, strong trading volume and investor interest indicate the dip could be temporary.

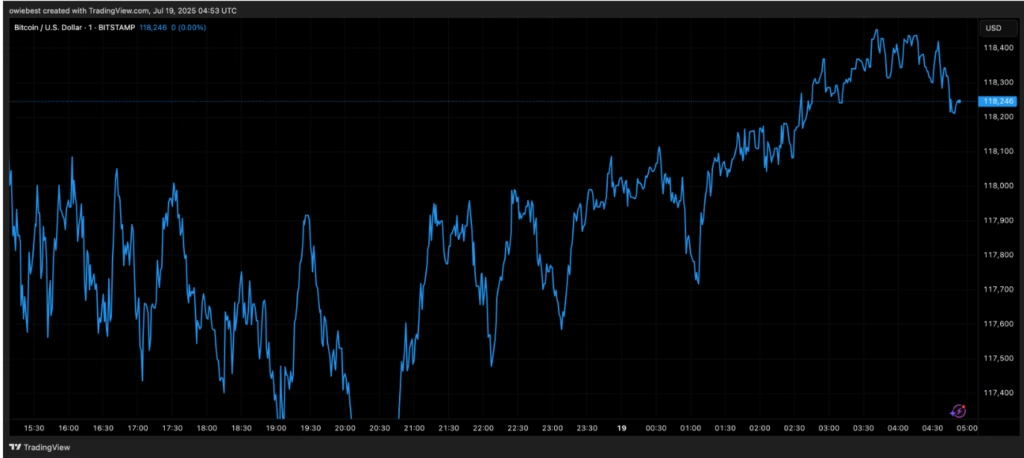

The Bitcoin price is showing signs of a potential correction, despite trading near its all-time highs. Analysts warn that the digital asset could drop to $111,000 in the short term, as technical patterns and chart gaps signal a possible retracement.

Bitcoin Price Forms Bearish Pattern

Crypto analyst Youriverse highlights a bearish V-shaped pattern that formed after Bitcoin surged past $123,000. This pattern often indicates that sellers are taking control, especially when profit-taking begins to dominate the market. It suggests that the Bitcoin price may fall before continuing its upward trend.

Two Key Fair Value Gaps to Watch

The 4-hour chart shows two Fair Value Gaps (FVGs). The first, between $119,000 and $120,000, has already been filled. However, a second gap remains open around $111,000 — a level that acted as a previous high and now serves as resistance.

This $111,000 level is considered a “magnet,” drawing the Bitcoin price lower as more traders lock in profits. If selling pressure increases, the price could fill this gap soon.

Bitcoin Price at Risk Due to CME Gap

Another concern is the CME (Chicago Mercantile Exchange) gap formed over the weekend. This gap, between $114,000 and $116,000, remains unfilled. Historically, such gaps are often closed quickly.

If the Bitcoin price retraces to this level, it increases the chances of the price falling further to $111,000 to fill the second FVG. The pattern supports the view that these unfilled areas act like targets during pullbacks.

Buyers Still Show Strength

Despite bearish signals, there are signs of strong buying interest. Trading volume has averaged over $100 billion daily, suggesting buyers remain active. The Bitcoin Fear & Greed Index still sits in the “Greed” zone, not yet in “Extreme Greed,” which usually signals a market top.

Open interest in Bitcoin futures is also near record highs, hinting at the potential for one more upward push before any major correction.

The Bitcoin price could dip to $111,000 to close technical gaps, but bullish sentiment remains strong. Traders should monitor the $114K–$116K and $111K levels closely, as movement around these points may shape Bitcoin’s next direction.

ALSO READ:Cardano Price Surges 37 Percent as ADA Targets $1

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.