- Owning 1 Bitcoin in 2025 puts you among the rarest crypto holders globally, with fewer than 850,000 people reaching that mark.

- With extreme scarcity, price volatility, and access barriers, joining the 1 BTC club is no small feat.

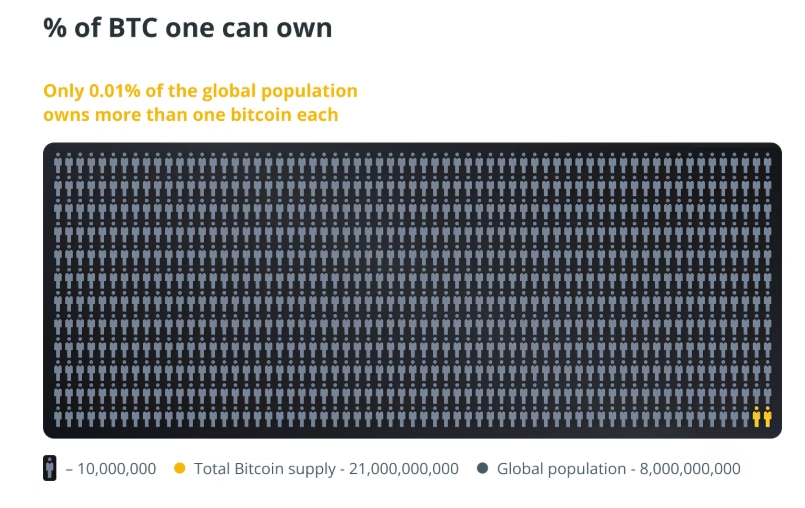

In a world of over 8 billion people, fewer than 850,000 individuals own one full Bitcoin (BTC). That puts you in a club so exclusive, it’s more elite than being a millionaire. While over 16 million people worldwide hold millionaire status, just 0.01%–0.02% of the global population can say they own 1 BTC.

But the story goes deeper than ego. It’s not just about price — which, as of mid-2025, has climbed above $120,000 — it’s about access, risk tolerance, and global inequality. Bitcoin’s hard cap of 21 million coins means scarcity is built into its DNA. With over 19.8 million already mined, and many lost or hoarded, the remaining supply is razor-thin.

Bitcoin Ownership: The Harsh Reality

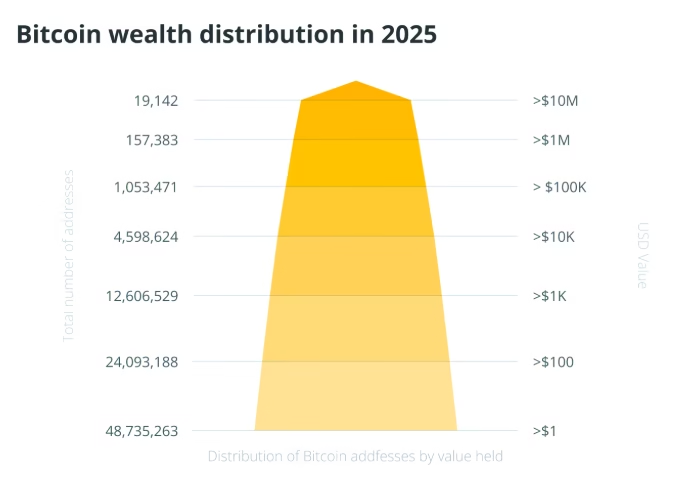

Even within crypto circles, owning a full Bitcoin is rare. Out of the millions who dabble in digital assets, only 0.18% actually hold 1 BTC or more. Most wallets contain mere fractions. The majority of Bitcoin is concentrated in a few hands: 1.86% of addresses control 90% of the total supply. In fact, the top 100 addresses hold over 58% of all BTC.

That means if you hold 1 BTC, you’re wealthier — in Bitcoin terms — than nearly every other crypto investor.

Why Most People Will Never Own One

Reaching the 1 BTC milestone isn’t just financially difficult. Billions remain unbanked, and even those with internet access often face high fees, complex regulations, and lack of crypto infrastructure. In places like Sub-Saharan Africa or South Asia, access is improving — but slowly.

Plus, Bitcoin’s volatility still scares off many. With price swings between $70,000 and $123,000 in mere weeks, and critics like Warren Buffett and Robert Shiller calling it a “bubble,” the hesitation is understandable.

Want to Own 1 BTC? Here’s How

If you’re aiming for full-coin status, dollar-cost averaging (DCA) remains the safest strategy: invest small, consistent amounts over time. Others use crypto yield platforms, convert salaries paid in stablecoins like USDT, or take advantage of new Bitcoin ETFs like BlackRock’s IBIT.

However you approach it, remember: owning one Bitcoin in 2025 isn’t just rare — it’s elite.

ALSO READ:Why Bitcoin Isn’t Ready to Replace Gold Just Yet

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.