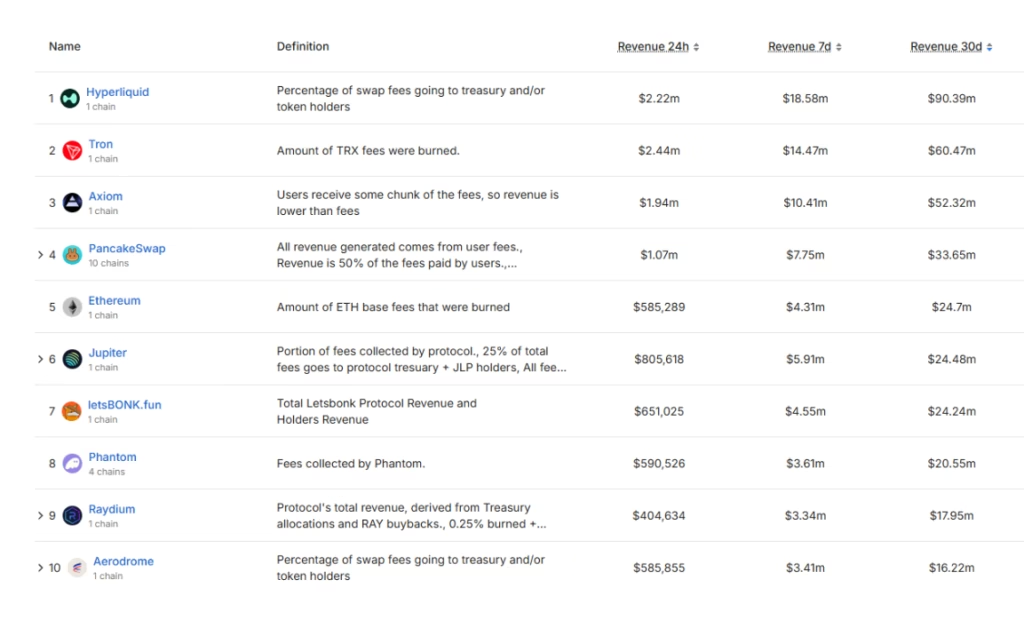

- Hyperliquid leads the DEX market with $90 million in monthly revenue.

- Its aggressive buybacks suggest HYPE may be undervalued.

Hyperliquid is making waves in the decentralized finance (DeFi) world. Its HYPE token has gained attention for generating a record $90 million in monthly revenue. This decentralized perpetual exchange dominates the market, with a current market cap of $13.7 billion.

Hyperliquid’s Market Leadership

Hyperliquid stands out as the most valuable decentralized exchange (DEX) token, with a market cap more than twice that of Uniswap (UNI).

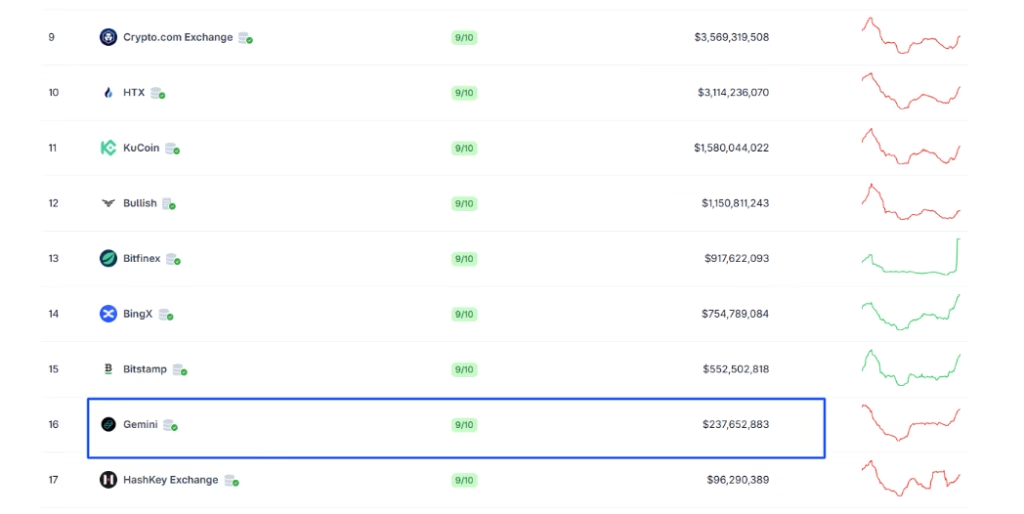

In the last 30 days, Hyperliquid processed over $11.7 billion in trading volume, beating even major centralized exchanges like Gemini. The platform controls over 75% of the perpetual DEX trading market, showing strong user demand and growth.

Powerful Buyback Program Drives Value

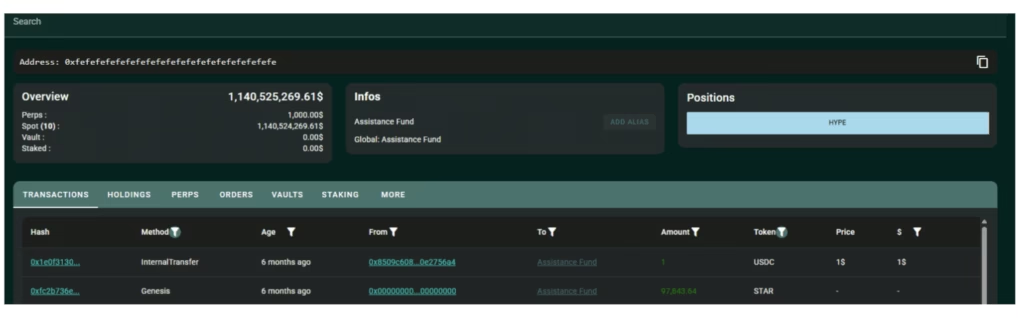

One key factor making HYPE special is its aggressive buyback program. Hyperliquid uses 97% of its fee revenue to repurchase HYPE tokens from the market. This strategy reduces the number of tokens in circulation, creating upward price pressure. So far, Hyperliquid’s buyback fund has bought over $1.1 billion worth of HYPE tokens. Analysts estimate that at this rate, the exchange could buy back all circulating tokens within four years.

Strong Long-Term Potential

Hyperliquid tightly manages its token supply. Only 34% of the total 1 billion HYPE tokens circulate currently. The team locks their tokens until 2027 to prevent early sell-offs. This supply control, along with record revenues and growing market share, strengthens long-term value for HYPE holders.

Hyperliquid is proving to be a leader in DeFi with its high revenue and unique buyback system. The HYPE token may be undervalued given its market position and aggressive token buybacks. If Hyperliquid continues its growth, HYPE could be a top-performing crypto to watch in 2025 and beyond.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.