- Solana is approaching the $200 resistance after rebounding from key support, with technical indicators showing growing bullish strength.

- Upcoming upgrades and rising institutional interest could drive SOL to new highs if it breaks this level.

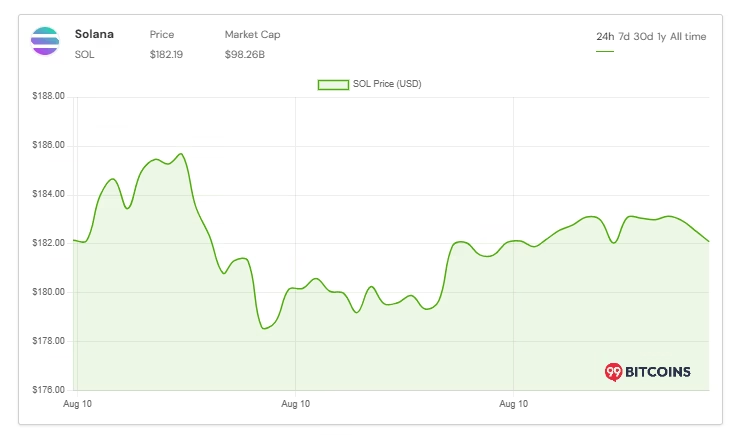

Solana is once again closing in on the $200 resistance level after rebounding from the $155–$165 support zone earlier this month. At the time of writing, SOL trades near $185 with a market capitalization of around $99 billion, still 37.5% below its January 2025 all-time high (ATH). The price has been forming higher lows since March, with bearish pressure gradually fading. A clean breakout above $200 could unlock a push toward new highs, though short-term risks like profit-taking remain.

Bulls Test the $190–$200 Barrier

The weekly chart shows a developing cup-and-handle pattern, a bullish formation that often precedes strong upward moves. Key support lies between $160–$170, aligning with the 50-day moving average, while deeper pullbacks could attract buyers near $130–$140.

Technical indicators also point to growing strength. The 14-day RSI has climbed above the midpoint to 55, suggesting rising buying pressure. MACD readings indicate waning bearish activity, while the stochastic RSI hints at early bullish divergence. The upper range of the volume profile—currently acting as resistance—appears to be weakening as bulls retest the zone.

Forecasts vary, with conservative targets near $225 and more optimistic projections reaching $260. In extremely bullish scenarios, cycle tops could even push toward $400–$500.

Catalysts Fueling Market Confidence

The upcoming Alpenglow upgrade, expected in Q4, promises transaction speeds up to 100x faster, which could significantly boost DeFi and NFT adoption on the solana network. Institutional interest is also on the rise, with over $591 million in SOL held collectively by Upexi Inc., DeFi Developments Corp, SOL Strategies, and Torrent Capital. Together, these entities control more than 3.5 million SOL.

Solana Labs spinout Anza proposes Alpenglow, 'the biggest change to Solana’s core protocol' https://t.co/tLthoWlfah

— The Block (@TheBlock__) May 19, 2025

Cautious Optimism Ahead

While sentiment on X (formerly Twitter) leans bullish, failure to decisively break $200 could see SOL drop back toward $170 or lower. With Bitcoin approaching its ATH, market-wide strength may increase the likelihood of a breakout, but traders are advised to watch price action closely.

If solana clears the $200 barrier in the coming days, it could set the stage for a strong rally and possibly new all-time highs before year-end. Until then, the $190–$200 range remains the critical battleground between bulls and bears.

ALSO READ:IOTA Launches TWIN to Revolutionize Global Trade with WEF

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.