- Pi Network PI token faces increased selling pressure as large deposits to centralized exchanges signal a bearish sentiment.

- Technical indicators suggest the token could test new record lows near $0.2700 if support at $0.3220 fails.

Pi Network’s PI token is showing signs of continued weakness, hovering near its record low amid rising bearish sentiment in the market. Investors are closely watching large deposits to centralized exchanges (CEXs), which signal growing selling pressure and potential for further losses.

ALSO READ:How Pi Network’s Second Migration Could Impact Investors

Large Deposits Signal Increased Selling Pressure

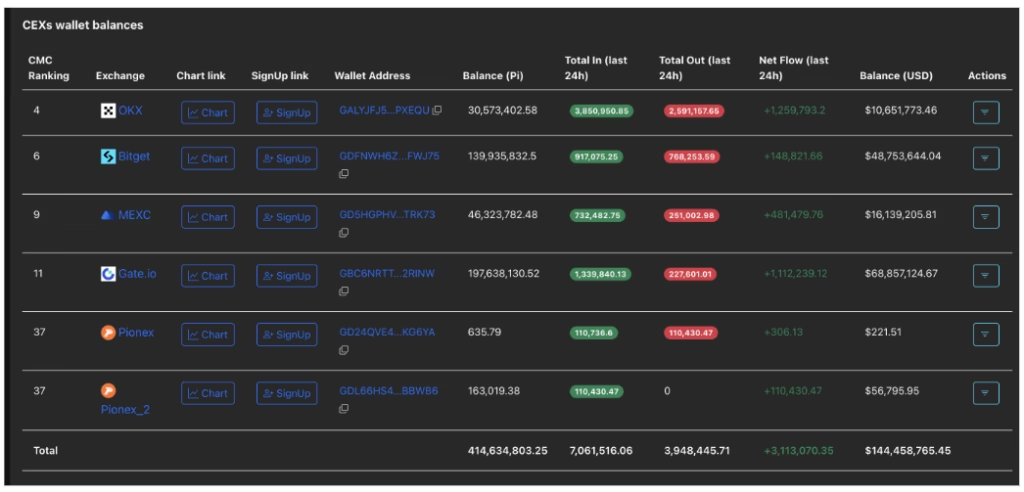

Data from PiScan reveals that 7.06 million PI tokens flowed into CEX wallets over the last 24 hours, compared to only 3.94 million PI outflows. This results in a net inflow of 3.11 million tokens, valued at approximately $1.08 million at current prices. As a result, total CEX wallet balances have risen by 0.75%, reaching 414.63 million PI tokens.

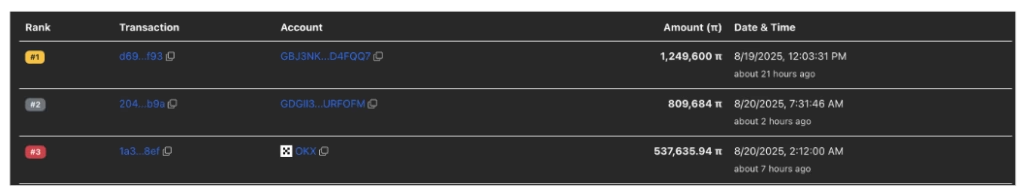

Notably, two of the three largest Pi Network transactions recently occurred on the OKX exchange, involving 1.24 million and 809,684 PI tokens. Such significant deposits usually indicate a risk-off sentiment, where investors are offloading holdings, fueling further downward pressure on the token.

Falling Channel Pattern Suggests Further Declines

At the time of writing, PI trades at $0.3481, recovering slightly after two days of near 10% cumulative losses. However, price action remains within a falling channel pattern, leaving the token vulnerable to further declines. The immediate target for bears is $0.3220, the all-time low recorded on August 1.

If PI breaks decisively below this level, it could retest the lower boundary of the falling channel near $0.2700, potentially establishing a fresh record low. Technical indicators reinforce the bearish outlook: the Relative Strength Index (RSI) stands at 42, indicating room for further correction, while the Moving Average Convergence Divergence (MACD) has crossed below its signal line, signaling a bearish trend.

Key Levels to Watch

On the upside, bulls would need to reclaim $0.4000 to challenge the overhead trendline at $0.4342. Until then, the PI token remains in a correction phase, with selling pressure from large CEX inflows likely to dominate.

Pi Network faces a critical period as bearish signals intensify. Large deposits to exchanges and technical indicators point to potential further losses, and investors will be closely monitoring whether PI can stabilize above key support levels or risk dipping to new lows.

ALSO READ:Pi Network Expands into Tokenized Asset Markets with Stellar Partnership

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.