- Ethereum surged 25% in August, reaching a new all-time high above $4,867.

- Analysts warn of a possible September correction, though strong ETF inflows and institutional demand could offset the trend.

Ethereum’s Strong Surge in August

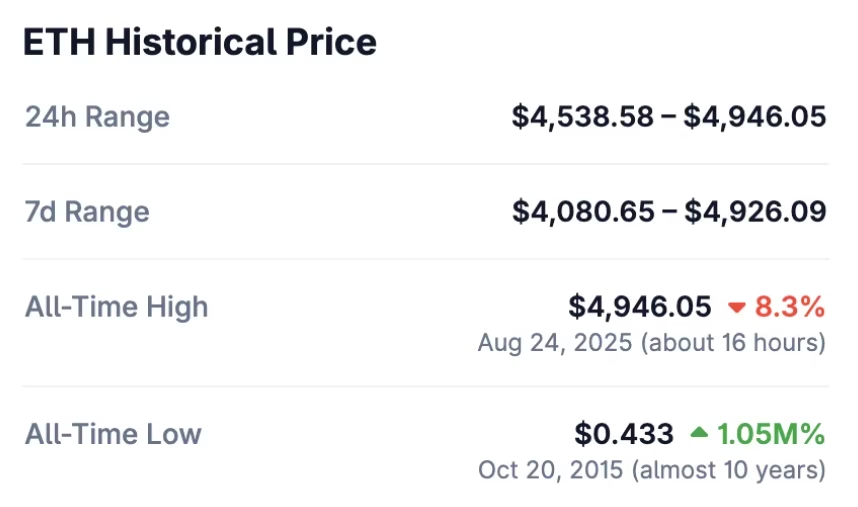

Ethereum has been on an impressive run this month, gaining 25% since the start of August and breaking a new all-time high above $4,867. This surge highlights renewed confidence in the second-largest cryptocurrency by market capitalization, driven largely by institutional interest and ETF inflows.

However, analysts caution that September may not be as bullish. Historically, Ethereum has struggled during this month, with past data showing consistent corrections after strong summer rallies.

$ETH seasonality in September during post-halving years is typically negative.

Will this time be different? pic.twitter.com/h9hJ40V3np

— CryptoGoos (@crypto_goos) August 22, 2025

Historical September Pattern for Ethereum

Since 2016, Ethereum has only recorded growth in September three times. Each of these rare rallies was followed by a sharp decline of 12–21%. For example, in 2017, Ethereum’s 92% August rally was followed by a 21% drop the next month. A similar dip occurred in 2021, reflecting a repeating seasonal trend that traders are now watching closely.

With August 2025 already proving exceptional, many investors are questioning whether history will repeat itself or if this time will be different.

Institutional Demand Could Change the Trend

Unlike previous cycles, Ethereum in 2025 is experiencing unprecedented institutional involvement. Spot Ethereum ETFs have attracted $2.79 billion in inflows over the past month, while Bitcoin ETFs faced $1.2 billion in outflows.

Corporate treasuries also hold a significant stake in Ethereum, with 4.1 million ETH—worth $18.7 billion—accumulated. Notably, BitMine Immersion Tech leads public companies with 1.5 million ETH valued at $6.9 billion. Combined, ETFs and corporate holdings now represent nearly 9% of Ethereum’s total supply.

This institutional support provides Ethereum with a foundation that may help counteract the usual September downturn.

Ethereum Gains Ground Over Bitcoin

Adding to Ethereum’s strength, Bitcoin whales have begun reallocating funds into ETH, signaling shifting market preferences. Analysts point to four major factors that currently give Ethereum an edge over Bitcoin, reinforcing the idea that this rally could defy past seasonal weakness.

Will September Break the Cycle?

The coming weeks will be a crucial test for Ethereum. While history suggests a likely correction, strong institutional demand and ETF inflows could create a unique market environment that breaks the September trend. Investors are now watching closely to see if ETH will maintain its gains or face another seasonal pullback.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.