- XRP is consolidating just under $3, repeatedly testing $2.90–$2.92 resistance while bulls defend $2.86 support.

- A confirmed breakout could push the price toward $3.30–$4.50, but repeated failures may trigger renewed selling pressure.

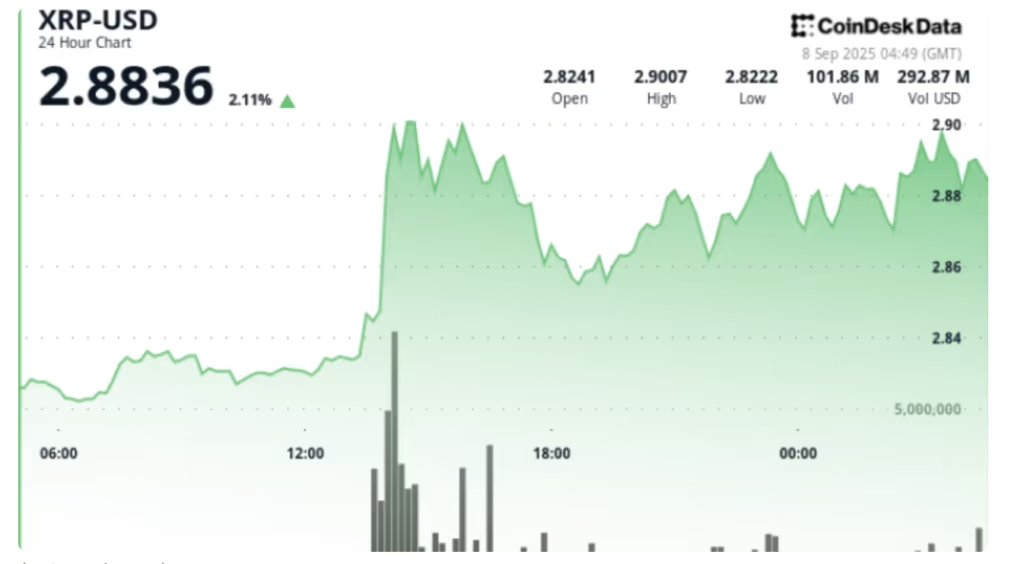

XRP is consolidating just under $3 as bulls defend critical support, with traders eyeing breakout opportunities that could set the stage for fresh gains. After surging from $2.83 to $2.88 on high volume, XRP briefly tested $2.92 but ran into repeated resistance between $2.90–$2.92, leaving momentum capped. Market participants are closely watching whether sustained buying can push the token above this ceiling or if renewed selling pressure will emerge.

The Current Price Action

Between September 7 and 8, XRP advanced roughly 3%, trading within a $0.10 range from $2.83–$2.92. A breakout sequence on September 7 lifted the token from $2.85 to $2.92 on 231.25 million XRP volume, about six times the daily average. Bulls successfully defended the $2.86 support level across multiple retests, indicating steady accumulation. However, the $2.90–$2.92 resistance has consistently capped rallies, prompting caution among traders.

ALSO READ:XRP Uncertainty: Is XRP Still Worth Holding in 2025?

Technical Indicators Suggest Neutral-to-Bullish Bias

Key indicators signal a cautiously optimistic outlook. XRP’s RSI sits in the mid-50s, reflecting a neutral-to-bullish bias, while the MACD histogram shows convergence toward a bullish crossover. The token is forming a descending triangle consolidation pattern under $3, which could extend toward $4.00–$4.50 if a confirmed breakout above $3.30 occurs. Support remains anchored at $2.86, reinforcing the importance of accumulation in sustaining near-term strength.

XRP Market Drivers to Watch

Several macro and on-chain factors influence XRP’s near-term trajectory:

- Federal Reserve Meeting: The September 17 FOMC gathering is expected to deliver a 25-basis-point rate cut, which traders anticipate could increase crypto inflows. Any deviation from this expectation could impact liquidity and XRP price movement.

- Whale Accumulation: Reports indicate 340 million XRP has been accumulated by large holders in recent weeks. Continued inflows could reinforce the $2.86 floor, while slowing accumulation may limit upside conviction.

- Regulatory Catalysts: The SEC’s October rulings on spot XRP ETF applications remain a longer-term factor. Approval could unlock institutional inflows and lift the token above $3, while delays or rejections may cap gains.

Whether XRP can sustain closes above $2.90 will determine its next move. A confirmed breakout could open the path toward $3.00–$3.30, potentially extending to $4.00–$4.50. Conversely, repeated failures at resistance may reinforce the ceiling and invite further selling pressure, keeping traders cautious as they navigate a volatile market.

ALSO READ:IOTA Security Strengthens with Keystone Wallet Firmware Update and Rumored Custom Edition

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.