- Ripple (XRP) saw increased trading activity over the weekend, with its price holding above $0.60 amid expectations for a key legal ruling from the SEC by the end of July.

- The outcome of the lawsuit could be influenced by upcoming political changes, with Donald Trump’s potential presidency promising a shift in crypto regulations.

Trading Activity Peaks as Ripple Faces Legal Uncertainty

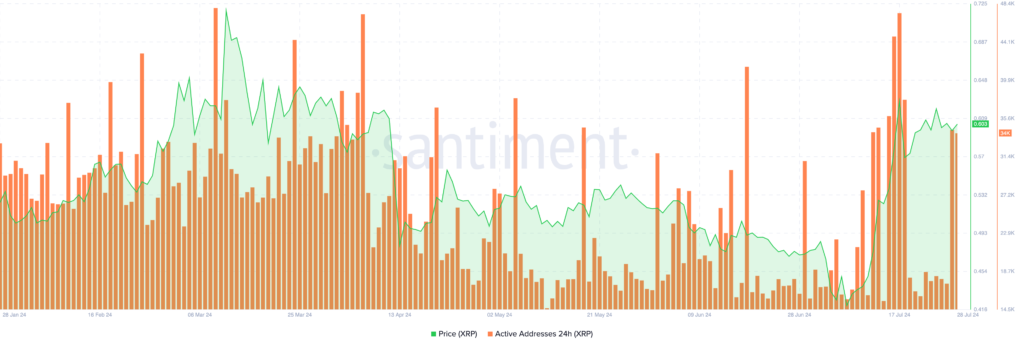

Ripple (XRP) has seen a dramatic uptick in trading activity over the past weekend, with active addresses doubling, according to Santiment data. This surge in address activity highlights a growing interest and engagement among traders. Despite this, XRP traders have been actively taking profits, creating an increased selling pressure on the altcoin.

Price Performance and Legal Expectations

XRP managed to sustain itself above the critical psychological support level of $0.60, extending gains by nearly 2% on Sunday. This stability comes amidst a backdrop of optimism fueled by Donald Trump’s recent speech at the Bitcoin conference. Trump’s remarks included a promise to fire SEC Chair Gary Gensler if elected, potentially influencing the ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC).

Ripple’s lawsuit with the SEC, which is under Judge Analisa Torres’ review, is expected to see a resolution by the end of July 2024, as per attorney Fred Rispoli’s prediction. The timing of this ruling could be significantly impacted by political shifts, especially with Trump’s promise to alter the SEC’s stance on crypto regulations if he wins the November elections.

Market Dynamics and Future Projections

Recent weeks have seen XRP traders taking profits, as indicated by positive spikes in the Network Realized Profit/Loss metric. This trend has contributed to the selling pressure on XRP. However, the rise in active address count suggests that XRP remains a point of interest among traders.

On the technical front, XRP is likely to navigate through the Fair Value Gap (FVG) between $0.5945 and $0.5783. If it manages to fill this gap, the altcoin could potentially bounce off the support level at $0.5632. This support level aligns with the 50% Fibonacci retracement from the decline of $0.7440 on March 11 to the low of $0.3823 on July 5.

If XRP can stabilize and recover, it might target the 78.6% Fibonacci retracement level of $0.6666, representing an almost 11% gain from its current level. The Moving Average Convergence Divergence (MACD) indicator is showing green histogram bars, signaling positive underlying momentum. Nevertheless, if XRP closes below the support level at $0.5632, it may face a bearish trend, with potential support found at the July 19 low of $0.5404.

As we approach the anticipated lawsuit ruling and monitor XRP’s price movements, traders should remain vigilant of both legal and market developments that could influence Ripple’s trajectory in the coming weeks.