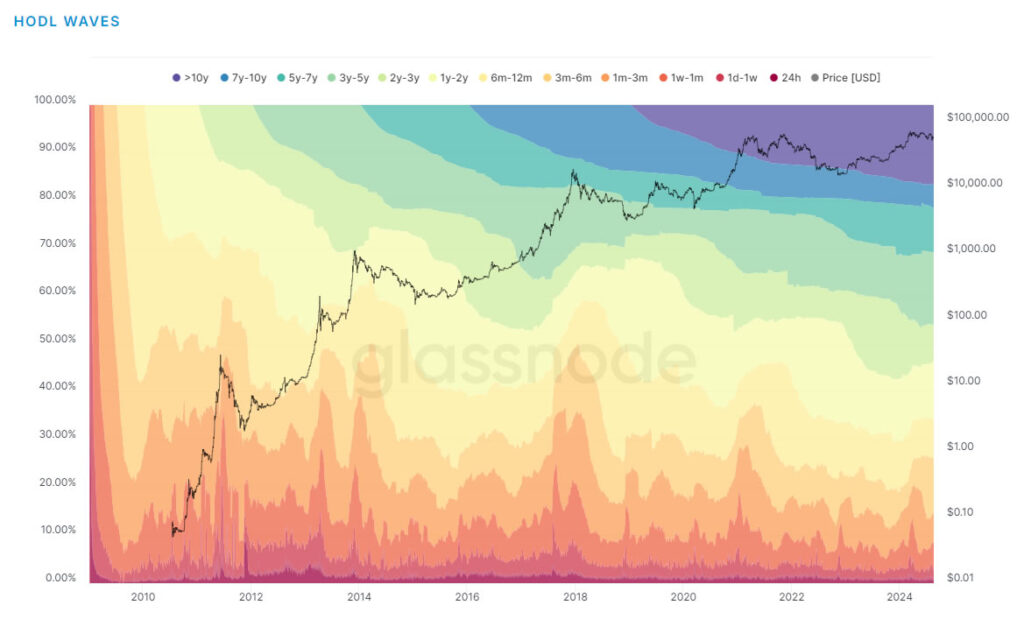

- Around 75% of Bitcoin has remained unmoved for over six months, reflecting strong long-term holder confidence despite recent price declines.

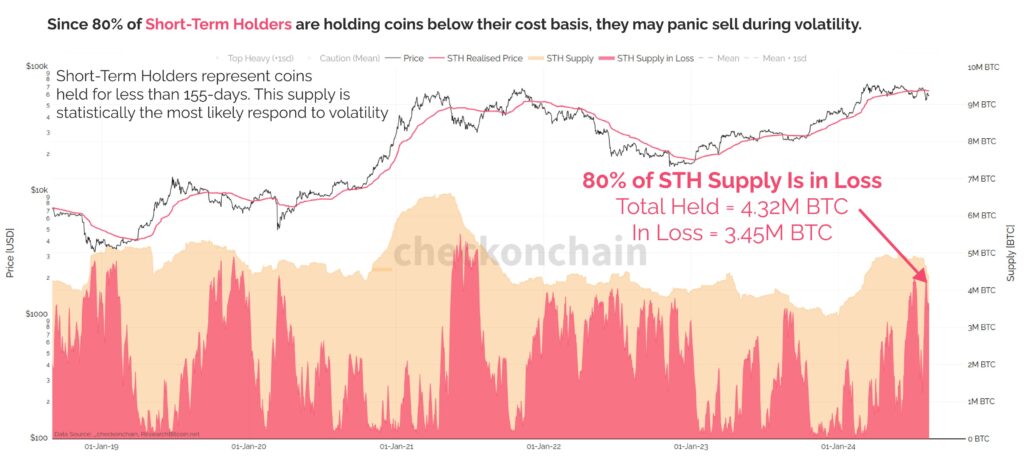

- Meanwhile, short-term holders are mostly at a loss, risking potential sell-offs amid a bearish market sentiment.

Despite the volatility in Bitcoin’s price and its 21% drop from the all-time high, a significant portion of Bitcoin remains unmoved. Recent on-chain data reveals that approximately three-quarters of all circulating Bitcoin has been held in wallets without being sold or transferred for over six months. This long-term holding trend speaks volumes about the confidence of Bitcoin investors in the asset’s future.

Long-Term Holding: A Growing Trend

According to Glassnode’s HODL wave chart, about 74% of Bitcoin has remained stationary for most of 2024. Even as Bitcoin prices saw a steep decline of 21%, these coins were left untouched. The fact that such a large percentage of Bitcoin remains in the same wallets highlights the increasing trend of viewing Bitcoin as a store of value rather than just a trading asset.

This behavior is typical among long-term holders who believe in Bitcoin’s potential for future price appreciation. By holding rather than selling, these investors reduce the supply of Bitcoin available for trading, which could lead to a supply squeeze as demand grows. With less Bitcoin circulating in the market, there’s potential for upward pressure on prices.

Short-Term Holders Face Challenges

While long-term holders appear unfazed, short-term holders are feeling the heat. On-chain analyst James Check recently shared that over 80% of Bitcoin held by short-term investors is currently at a loss. These are coins that were acquired within the last 155 days, likely at prices higher than the current market value. With market sentiment still bearish, as indicated by the Crypto Fear & Greed Index’s score of 28, these short-term holders are at risk of panic selling. This scenario has occurred in previous cycles, notably in 2018, 2019, and mid-2021, where widespread panic selling led to further price declines.

Market Sentiment and Future Outlook

Bitcoin’s market sentiment remains cautious, with the broader crypto market reflecting fear levels not seen since December 2022. Despite briefly topping $60,000 recently, Bitcoin prices have since fallen to $58,619, underlining the ongoing uncertainty.

While the long-term holding trend suggests strong belief in Bitcoin’s future, short-term holders and broader market sentiment are adding a layer of volatility. How these factors play out in the coming months will be crucial in determining the next phase of Bitcoin’s price trajectory.