- The crypto market surged after the FOMC Minutes suggested a likely 25 basis point rate cut in September, with Bitcoin jumping 3% and other altcoins also rising.

- Investors are optimistic this could signal a potential bull market resumption if the rate cut is confirmed.

The cryptocurrency market experienced a significant boost after the release of the Federal Open Market Committee (FOMC) Minutes from its July meeting. The Minutes revealed that the Federal Reserve (Fed) is likely to cut interest rates by 25 basis points (bps) in September, sparking optimism across risk assets like Bitcoin (BTC) and other cryptocurrencies.

Progress on Inflation and Employment Drives Rate Cut Speculation

The FOMC Minutes highlighted encouraging progress in the fight against inflation, with price levels nearing the Fed’s 2% target. Additionally, rising unemployment rates were noted as a critical factor influencing the potential decision to ease monetary policy. The combination of these factors has led to widespread anticipation that a 25 bps rate cut could be announced as early as September.

Market analysts believe delaying a rate cut could risk economic stability. As a result, traders now see a rate cut as a near-certainty, with CNBC reporting a 100% consensus among market participants. The primary question has shifted from whether the Fed will cut rates to how significant the reduction might be.

Crypto Markets React: Bitcoin and Altcoins Rally

Following the release of the FOMC Minutes, the crypto market capitalization surged by over 2%, led by Bitcoin’s impressive 3% jump, pushing the leading cryptocurrency close to $62,000. Ethereum (ETH) also followed suit, climbing more than 2% after the news.

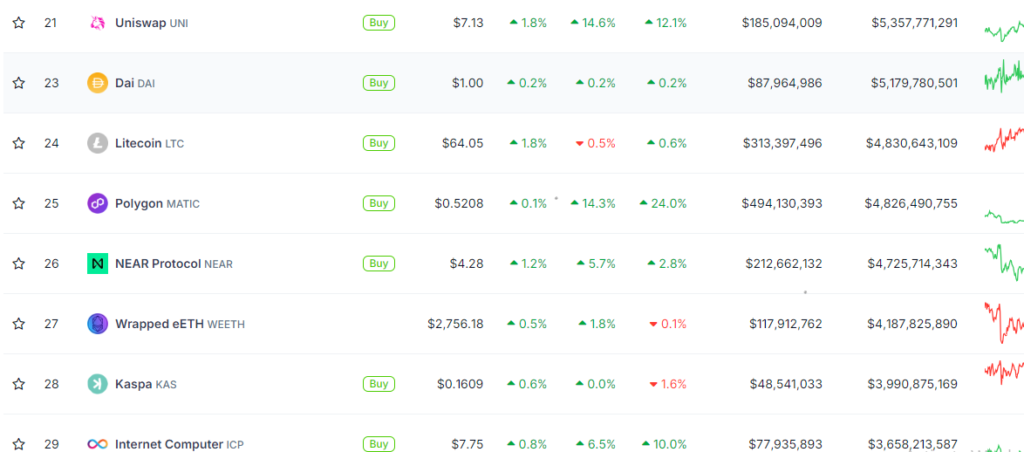

Other altcoins saw notable gains as well. Cardano (ADA) and Avalanche (AVAX) posted impressive 8% and 5% increases, respectively, marking their best single-day performances since March. Meanwhile, Chainlink (LINK), Polkadot (DOT), Uniswap (UNI), Polygon (MATIC), and Internet Computer (ICP) all recorded moderate upticks, contributing to the overall market rally.

Bull Market Resumption? Crypto Community Remains Hopeful

The sudden price surge across cryptocurrencies triggered substantial liquidations in derivatives markets, with short traders facing over $31 million in losses within just four hours. The bullish sentiment has reignited speculation about the possible return of a broader bull market, particularly if the Fed confirms the anticipated rate cut in September.

Many in the crypto community are cautiously optimistic, viewing this rally as a potential signal that the long-awaited bull run could be resuming. With the market’s focus firmly set on the Fed’s next move, the coming weeks could prove pivotal for the future direction of both Bitcoin and the broader crypto market.