- Bitcoin has surged above $59,000, showing signs of recovery and market resilience as traders anticipate a potential rebound.

- However, a breakout above $61,000 is crucial to regain momentum and avoid continued downward pressure.

Bitcoin, the original and leading cryptocurrency, has recently climbed above the $59,000 mark, showing signs of a potential recovery. This resurgence comes as the S&P 500 pauses trading due to Labor Day in the United States, allowing Bitcoin to exhibit strength independently of traditional markets.

Signs of Resilience Amid Market Pause

According to the crypto analysis tool Santiment, Bitcoin’s recent performance highlights the inherent strength of the cryptocurrency market. The firm noted that the growth observed in cryptocurrencies, even without the influence of traditional equities, signals a robust sector. This resilience is further emphasized by the growing bearish sentiment and fear, uncertainty, and doubt (FUD) among traders. These factors often precede a market rebound, indicating that Bitcoin might be on the brink of a significant upward movement.

Santiment’s analysis also revealed that, around August 4, the market was highly polarized, with many dip buyers stepping in and eventually being vindicated. Currently, for the first time since mid-July, crypto investors are showing signs of bearishness, which historically increases the likelihood of a price surge.

Market Trends and Long-Term Holder Behavior

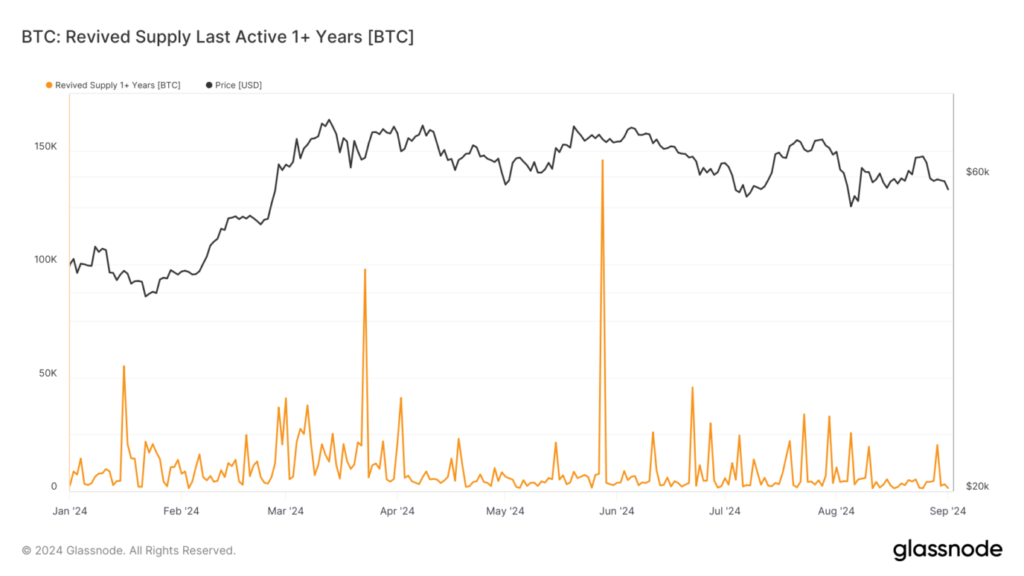

As of now, Bitcoin is trading at $59,097.73, reflecting a 3.1% increase. This uptick is not just a result of market trends but also due to the activity of long-term holders. Bitcoin’s revived supply, which tracks the reactivation of coins that have been inactive for over a year, has shown notable fluctuations in 2024. Periodic spikes were observed around April to June, as long-term holders sought to capitalize on market rallies. However, many of these holders are now opting to hold onto their bitcoins, signaling increased confidence in Bitcoin’s maturity as an asset.

The Importance of the $61,000 Mark

Despite the positive signs, some analysts believe that Bitcoin needs to clear a significant hurdle to sustain its recovery. Market analyst Michael van de Poppe recently commented on the importance of Bitcoin breaking above the $61,000 mark. He emphasized that a breakout above this level is crucial to regaining momentum in the market. Without this breakout, Bitcoin may continue to experience downward pressure for a while longer.

While Bitcoin’s recent performance above $59,000 is a positive sign, the next crucial test lies at the $61,000 level. If Bitcoin can surpass this barrier, it could signal the start of a more sustained recovery and renewed market optimism.