- Crypto whales sold $760 million worth of MANTRA (OM) tokens, leading to a 10% price decline and strong resistance around $7.40-$7.52, with technical indicators suggesting a possible drop to $6.65 or lower.

- However, if large investors resume accumulation, OM could regain momentum and potentially reach $10.

MANTRA (OM) has been one of the best-performing cryptocurrencies of 2025, experiencing an impressive surge of nearly 95% year-to-date. However, the token’s bullish momentum has hit a roadblock due to massive sell-offs by crypto whales, putting its rally toward the $10 mark at risk.

Whales Cash Out, OM Takes a Hit

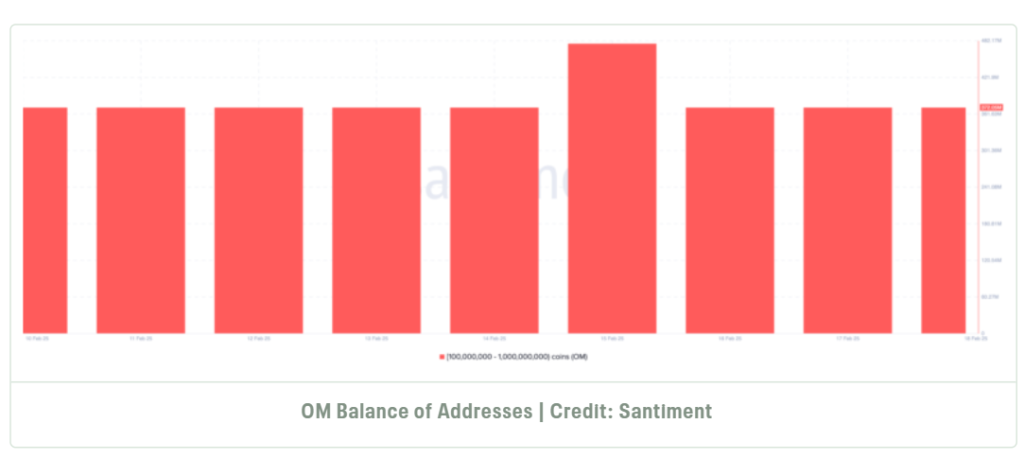

On February 15, OM reached an all-time high of $7.95, prompting large holders to take profits. As a result, the price declined by 10%, struggling to maintain its position above $7. On-chain data from Santiment revealed that addresses holding between 100 million and 1 billion OM tokens reduced their holdings from 477 million to 272 million tokens. This translates to a whopping $760 million in sell-offs, adding substantial selling pressure that continues to impact OM’s price.

Resistance Looms Large

Adding to the challenge, data from IntoTheBlock indicates a major resistance level between $7.40 and $7.52. Around 285 addresses hold over 21 million OM tokens at a loss in this range, suggesting that any attempt to surpass these levels could trigger further selling. Additionally, between $6.19 and $7.28, the volume of tokens out of profit is significantly higher than those in profit, reinforcing the difficulty in breaking past this resistance.

Technical Indicators Point to a Potential Drop

OM’s technical outlook suggests that a further decline could be imminent. The Bollinger Bands indicate high volatility, and with the upper band hitting OM’s price at $7.50, the token appears overbought. A correction could send OM to the 0.786 Fibonacci retracement level at $6.65. If this support fails, the price might drop further to $5.49.

Can OM Rebound to $10?

While the current trend points toward a downturn, a resurgence is possible if whales return to accumulation. Should large investors start buying back OM in significant volumes, the token could regain momentum and aim for the $8.12 level. If buying pressure intensifies, a move toward $10 could still be within reach.

Final Thoughts

For now, OM’s fate remains uncertain. The combination of whale sell-offs, strong resistance, and technical overbought conditions makes a short-term rally unlikely. However, a shift in whale activity could change the trajectory, allowing OM to reclaim its bullish stance. Traders and investors should keep a close eye on whale movements and key support levels to determine the next major move in OM’s price action.