- Bitcoin’s recent $12 billion open interest wipeout served as a necessary market reset, historically leading to potential buying opportunities and bullish continuation.

- Analysts suggest that while political and economic uncertainties caused volatility, Bitcoin’s recovery could depend on the Federal Reserve’s upcoming interest rate decision.

Bitcoin’s recent $12 billion open interest wipeout has left many traders wondering about the future of the cryptocurrency’s price movements. However, analysts suggest that this massive shakeout was an essential step toward sustaining a bullish momentum in the market.

A Market Reset for Growth

According to CryptoQuant contributor DarkFost, this significant drop in Bitcoin’s open interest can be seen as a “natural market reset,” which is often a precursor to further price appreciation. Historical data suggests that similar deleveraging events have presented lucrative buying opportunities in the short to medium term.

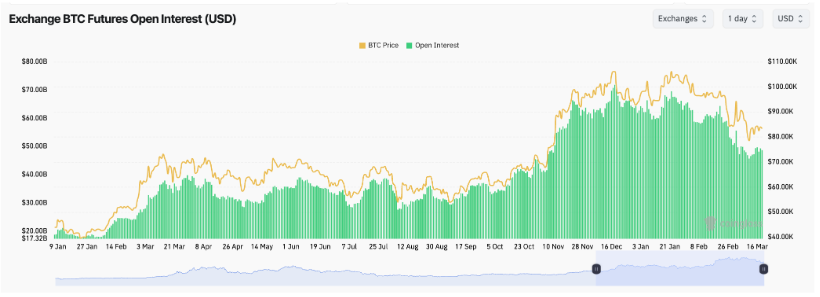

Open interest (OI) refers to the total number of unsettled Bitcoin derivative contracts, such as options and futures. Before the wipeout, on February 20, Bitcoin’s OI was recorded at $61.42 billion. However, a sharp 19% drop brought it down to $49.71 billion by March 4. As of now, Bitcoin’s OI stands at $49.02 billion, showing a slight recovery of 6.5% over the past five days.

Political Uncertainty and Market Volatility

This market shakeout coincided with increased volatility triggered by political uncertainty surrounding former U.S. President Donald Trump’s tariff decisions and concerns over the country’s interest rates. As a result, many leveraged positions on Bitcoin were liquidated, leading to sharp price declines.

Between February 25 and February 27, Bitcoin’s price fell below crucial support levels. It briefly dropped below $90,000 before sinking further to under $80,000 for the first time since November. Currently, Bitcoin is trading at approximately $83,400, marking a 14.58% decline over the past 30 days.

The Role of the Federal Reserve’s Decision

Looking ahead, analysts are keeping a close watch on the upcoming Federal Open Market Committee (FOMC) meeting on March 19. Bitget chief analyst Ryan Lee stated that Bitcoin’s price and open interest could face further volatility depending on the Federal Reserve’s stance on interest rates. While the market expects the Fed to keep rates steady, any unexpected hawkish signals could put additional pressure on Bitcoin and other risk assets.

A Buying Opportunity?

Despite the recent downturn, historical trends indicate that such shakeouts often lead to strong recoveries. Investors and traders may see this as a chance to accumulate Bitcoin at lower price levels before the next potential rally.

With Bitcoin’s OI stabilizing and market conditions expected to become clearer after the FOMC meeting, traders should remain cautious yet optimistic about the asset’s long-term trajectory. If history is any indication, this reset could set the stage for Bitcoin’s next big move.