- The article highlights the potential for a 40% drop in XRP’s price due to a bearish descending triangle pattern and economic pressures from upcoming tariffs, which could drive inflation and delay a Federal Reserve rate cut.

- This combination of technical and macroeconomic factors creates a challenging outlook for XRP in the near term.

The XRP market faces a turbulent period as a combination of technical and macroeconomic factors suggests a potential drop in price by as much as 40%. Recent developments, including a bearish descending triangle pattern and looming tariffs from the Trump administration, have cast a shadow over the cryptocurrency’s near-term prospects.

Descending Triangle Pattern Hints at Major Price Drop

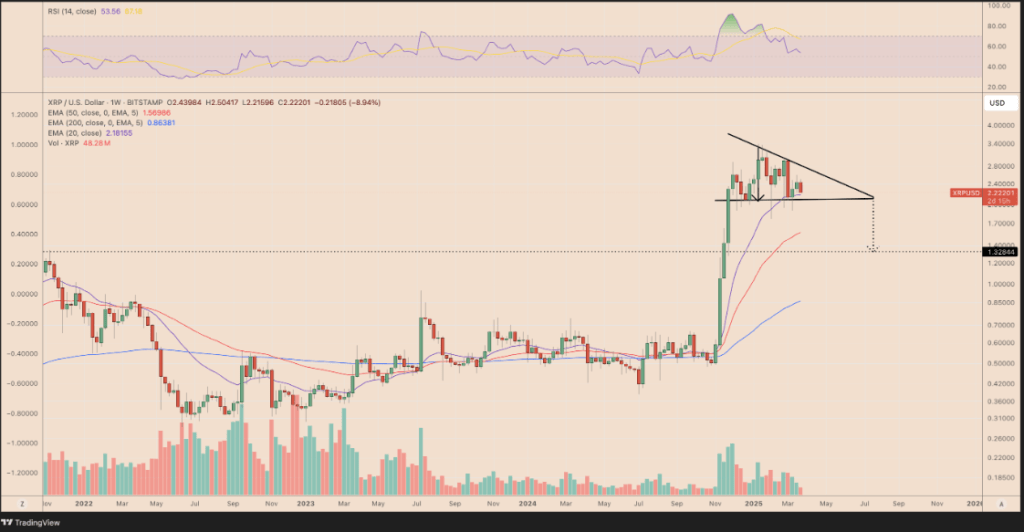

Since its rally in late 2024, XRP’s price chart has been forming a descending triangle pattern on the weekly timeframe. This pattern, marked by a flat support level and a downward-sloping resistance line, often signals a bearish reversal when formed after a significant uptrend. The setup indicates that if XRP breaks below its support level, it could plummet toward the $1.32 mark by April 2025, representing a 40% decline from current price levels.

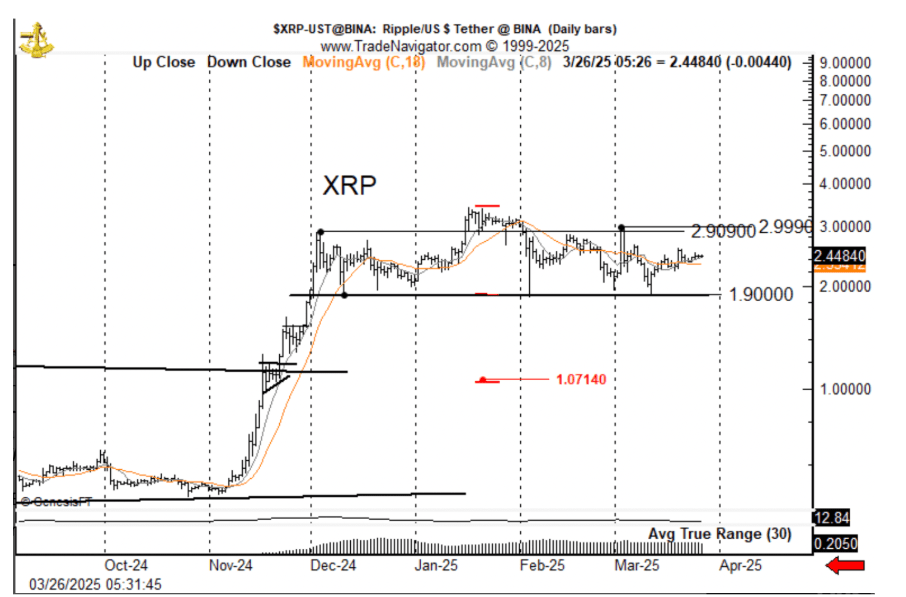

Veteran trader Peter Brandt has echoed this sentiment, highlighting a “textbook” head-and-shoulders pattern on the daily chart, which could drive XRP’s price even lower to $1.07 if validated. On the flip side, a successful rebound from support could propel the price toward $2.55, with a potential breakout to $3.35 if bullish momentum prevails.

Trump Tariffs and Inflation Concerns Weigh on Markets

Macroeconomic factors further complicate XRP’s outlook. President Donald Trump’s 25% tariffs on auto imports, effective April 3, are expected to drive up prices for American manufacturers and consumers. According to St. Louis Federal Reserve President Alberto Musalem, the tariffs could add 1.2 percentage points to inflation, with direct and indirect effects contributing to the increase.

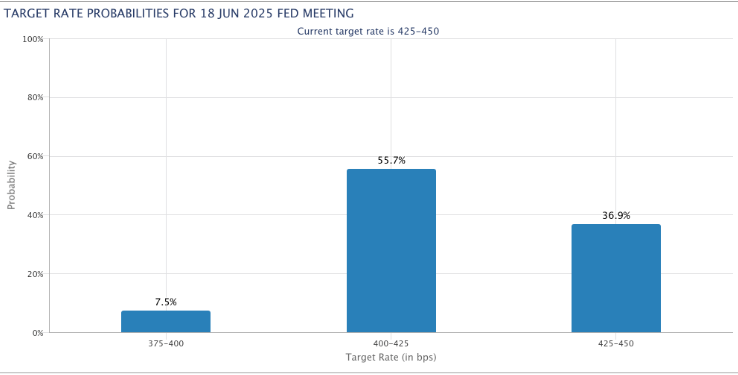

Higher inflation could deter the Federal Reserve from cutting rates in June, as previously anticipated. The probability of a rate cut to a target range of 400–425 basis points has dropped to 55.7% from 67.3% a week ago. A delayed rate cut would reduce capital flows into speculative markets, potentially stalling momentum for XRP and other digital assets.

With technical indicators aligning with bearish predictions and economic factors compounding the uncertainty, XRP traders face a challenging period ahead. A decisive breakdown from the descending triangle pattern could trigger a sharp sell-off, while a successful rebound could revive optimism. The coming weeks will reveal whether XRP can withstand these pressures or succumb to a significant price correction.