The cryptocurrency market has experienced significant volatility in recent days, with a staggering $495 million worth of digital assets liquidated over the past 24 hours alone, according to data from crypto analytics platform CoinGlass.

Also read: Ripple’s Surge: XRP Bulls Eye a Three-Year High of $1.96

A majority of these liquidations, approximately $382.7 million, stemmed from long positions, indicating widespread margin calls as prices shifted. This surge in liquidations affected 197,083 traders, with the largest single liquidation occurring on Binance, totaling $13.24 million.

Binance and Leading Exchanges See Massive Liquidations

Binance, along with OKX and HTX, had the most liquidation volume, underscoring the heightened pressure faced by traders during this turbulent period.

The recent liquidations come amid a broader market correction, which has seen several major cryptocurrencies experience significant price drops. XRP, for instance, saw a steep decline of over 10% early on Sunday, although it later pared some of its losses. Despite this, XRP is still up nearly 30% for the week.

Bitcoin’s Price Dip and Whales’ Continued Accumulation

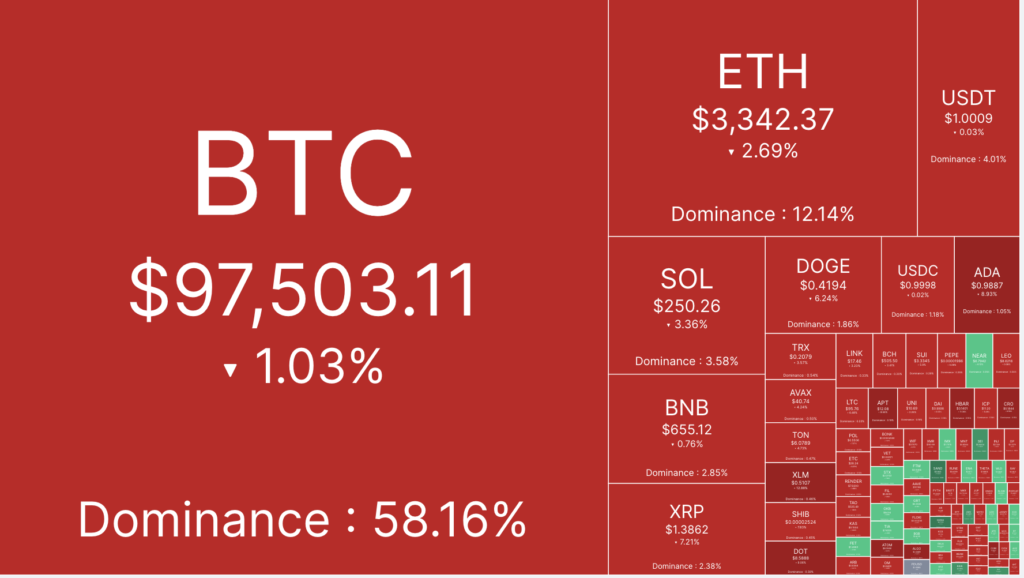

Bitcoin, the world’s leading cryptocurrency by market capitalization, also experienced a notable dip. After failing to break through the $100,000 barrier last Friday, Bitcoin plunged to around $95,000.

This price correction has led to warnings from figures like Galaxy Digital CEO Mike Novogratz, who has cautioned that corrections are inevitable due to the high levels of leverage in the market. However, he remains optimistic, predicting that Bitcoin will eventually surpass the $100,000 mark in the long term.

Related: XRP’s Dual Momentum: SEC Speculation and $100M Milestone Propel Token’s Rally

Despite the recent price drops, the actions of “whales” (large holders of Bitcoin) suggest confidence in the market’s future. According to recent reports, six new wallets withdrew a total of 1,110 BTC from Binance in just a few hours, signaling that institutional investors are continuing to accumulate Bitcoin at these lower price levels.

CryptoQuant’s Ki Young Ju emphasized this point in a social media post, urging traders to consider whether they are smarter than those accumulating vast amounts of Bitcoin during market dips.

While concerns about Bitcoin being overbought persist, analysts like Matthew Sigel, head of digital asset research at VanEck, have pointed out that similar conditions occurred during past market cycles. Sigel noted that Bitcoin has historically traded well above its 50-day moving average, at times even reaching 40% or more, and this trend could continue in the current cycle.

As the market grapples with corrections and liquidations, many traders and investors are left weighing the potential risks and rewards of navigating a volatile crypto landscape.