- Bitcoin accumulation addresses saw a decline following the 2024 halving, dropping to 815,000, reflecting cautious sentiment among long-term holders.

- However, a gradual recovery has stabilized these addresses around 822,000 by August, indicating cautious confidence amid market volatility.

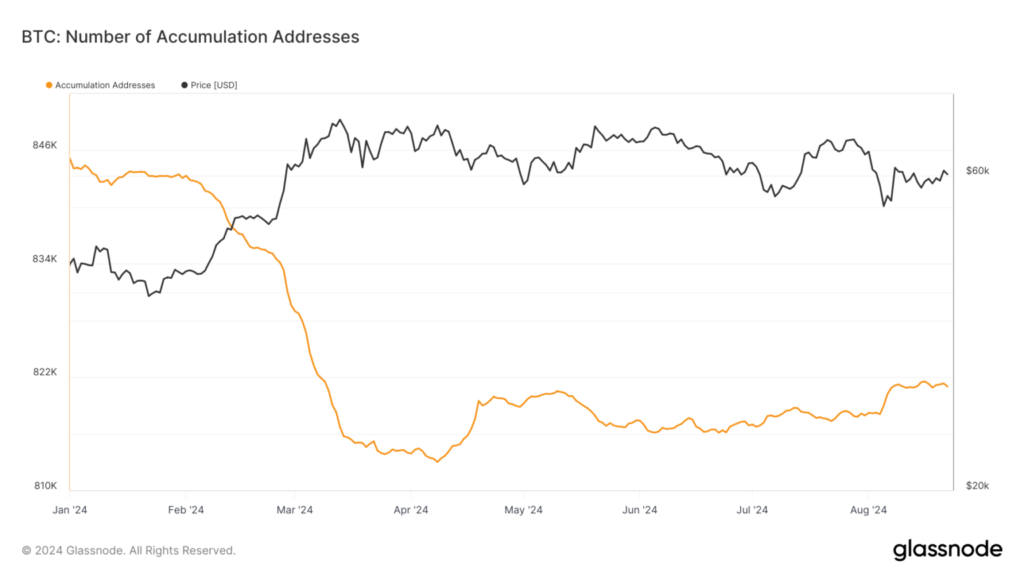

Bitcoin’s accumulation addresses have long been a critical indicator of market sentiment among long-term holders. These addresses, defined as those receiving at least two non-trivial transfers without ever spending funds, reflect the conviction of investors who are in it for the long haul. However, recent shifts in the number of these addresses are raising questions about how market participants are responding to the evolving landscape in 2024.

A Surge in Accumulation Through the Years

Over the past decade, Bitcoin’s price growth has been accompanied by a steady increase in accumulation addresses. By the end of 2022, the number of these addresses was nearing 800,000, a level that signaled strong confidence from long-term holders. The momentum carried into 2023, with the number of accumulation addresses peaking at approximately 846,000 by early 2024. This growth was seen as a positive indicator, showing that more investors were locking in their Bitcoin with no intention of selling anytime soon.

The Halving Impact and a Sudden Drop

However, April 2024 brought a pivotal moment for the Bitcoin network—the halving event, which reduced the reward for mining new blocks by half. Historically, halving events lead to increased scarcity and, eventually, higher prices. Yet, the months following the April halving saw a sharp decline in accumulation addresses, dropping below 815,000 by March. This drop coincided with Bitcoin’s price correction from its March highs, signaling that some long-term holders opted to liquidate or reduce their positions amid market uncertainty.

Recovery and Stabilization Amid Caution

Despite the initial downturn, a modest recovery in accumulation addresses began in May 2024. By August, the number had stabilized around 822,000. This recovery suggests that long-term holders are gradually regaining confidence, although the growth is slower and more cautious compared to previous years. The post-halving environment has proven volatile, leading many to adopt a more measured approach as they navigate the changing dynamics of Bitcoin’s supply and demand.

A Mixed Outlook for Bitcoin Holders

The fluctuation in Bitcoin accumulation addresses highlights the cautious sentiment among long-term holders in 2024. While the initial drop following the halving was concerning, the gradual recovery hints that confidence is slowly returning.

However, the overall trend remains one of caution, as investors await more stability in the market. As Bitcoin continues to evolve, the behavior of accumulation addresses will remain a crucial metric for gauging the long-term outlook.