- Bitcoin experienced a volatile trading session, dropping to $74K before rebounding to $78K amid rising macroeconomic uncertainty caused by President Trump’s tariff policies.

- Despite the fluctuations, Bitcoin’s market dominance increased, with experts remaining optimistic about its potential as a safe-haven asset in the face of global economic instability.

Bitcoin experienced a dramatic rollercoaster ride on Monday, plunging to $74K before making a swift recovery to hover above $78K. This volatile movement comes amid rising macroeconomic uncertainty, exacerbated by President Donald Trump’s trade policies and ongoing market fluctuations.

Bitcoin’s Turbulent Trading Session

Bitcoin, the dominant cryptocurrency, started the trading day on a shaky note, hitting a low of $74K. However, by midday, it managed to reclaim some ground, stabilizing above the $78K mark. At the time of reporting, Bitcoin was priced at $78,385.02, reflecting a 4% drop over the past 24 hours and a 6% decrease in the past week. The trading range fluctuated between $74,436.68 and $81,119.06, signaling heightened market volatility.

The Influence of Macro Uncertainty

The sharp drop in Bitcoin’s price comes amidst rising global uncertainty, particularly triggered by President Trump’s aggressive tariff policies. These policies have roiled traditional markets, leading to a temporary decline in Bitcoin’s price to its lowest levels since November 2024. However, this volatility provided Bitcoin with a slight advantage in terms of market capitalization dominance, as altcoins experienced even more significant losses.

Trading Volume and Market Impact

One of the most significant developments in the market was the sharp rise in trading volume. Bitcoin’s trading volume surged by a staggering 582.44%, reaching $100.29 billion—likely fueled by both the usual post-weekend trading uptick and the market chaos induced by Trump’s tariff announcements. Despite Bitcoin’s price falling by 4.20%, its dominance in the crypto market rose to 63.41%, highlighting the struggles of altcoins in comparison.

Additionally, Bitcoin futures open interest dropped by 4.84% to $50.72 billion, suggesting a reduction in leveraged bets. Liquidation data showed $9.22 million in positions were wiped out, indicating that many traders were caught off guard by Bitcoin’s sudden price drop.

The Federal Reserve’s Response

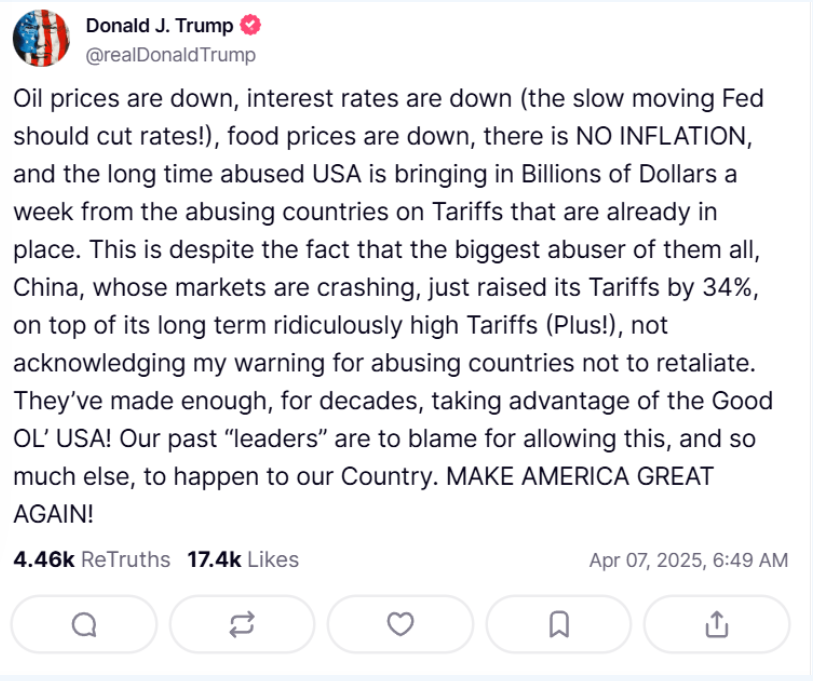

Compounding market concerns, Trump’s call for an interest rate cut added another layer of uncertainty. In a post on Truth Social, he criticized the U.S. Federal Reserve, urging a rate reduction, which he argued was necessary as the economy wasn’t facing inflation. This, coupled with the Fed’s scheduled closed board meeting to discuss discount rates, sparked further speculation about a potential rate cut in the near future.

The Future of Bitcoin

Despite the current turbulence, experts remain optimistic about Bitcoin’s future. Geoffrey Kendrick, head of digital asset research at Standard Chartered, believes Bitcoin will serve as a safe-haven asset amidst the broader economic volatility. According to Kendrick, Bitcoin’s resilience could make it an attractive hedge against the risks associated with Trump’s tariff policies and the weakening of traditional fiat currencies.

In conclusion, while Bitcoin’s journey remains unpredictable, its role as a potential safe haven in uncertain times could solidify its position in the long run.