- Bitcoin experienced a sharp decline to $91,300 following U.S. tariff announcements but rebounded past $100,000 after Mexico reached a temporary trade agreement with the U.S.

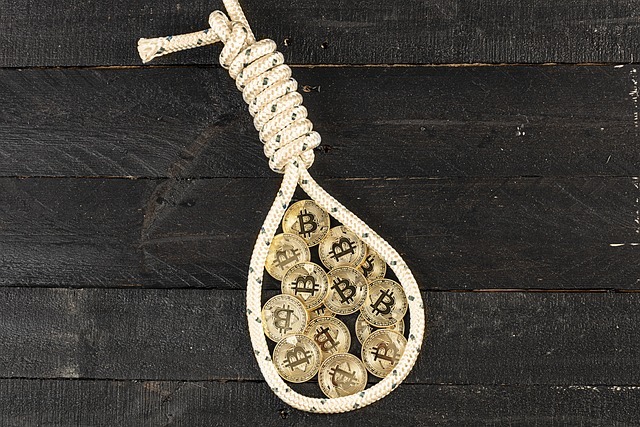

- The incident highlights Bitcoin’s volatility and sensitivity to geopolitical events, reinforcing its role as both a hedge and a risk-prone asset.

The cryptocurrency market has once again showcased its volatility, this time responding dramatically to global trade tensions. Bitcoin (BTC), the world’s largest digital currency, experienced a wild price swing due to the ongoing tariff disputes involving the United States, Canada, Mexico, and China.

A Tumultuous Start

Over the weekend, Bitcoin remained stable above the $102,000 mark. However, its stability was short-lived as U.S. President Trump announced a 25% tariff on imports from Canada and Mexico, alongside a 10% tariff on Chinese goods. The immediate aftermath saw a ripple effect across financial markets, including cryptocurrencies.

As a reaction, Canada’s Prime Minister swiftly retaliated, China sought a resolution via the World Trade Organization, and Mexico considered its next course of action. The uncertainty led to a sharp decline in Bitcoin’s value, plunging to a three-week low of $91,300. The digital asset struggled for stability, hovering around $95,000 for most of Monday before making a remarkable comeback.

A Swift Rebound

Bitcoin’s fate took a positive turn when Mexico’s president, Claudia Sheinbaum, announced that her country had reached an agreement with the U.S. to temporarily pause the tariffs for a month. Alongside this, Mexico committed to strengthening its border security, deploying 10,000 National Guard soldiers to curb drug trafficking, particularly fentanyl, into the U.S.

This news sparked a strong bullish reaction in the crypto market. Within minutes, Bitcoin’s price surged past $99,000, climbing toward the much-anticipated $100,000 mark. Investors and traders breathed a sigh of relief as the leading cryptocurrency demonstrated its resilience once again.

The Bigger Picture

The rapid price movements highlight the increasing influence of geopolitical events on the cryptocurrency market. Bitcoin has often been viewed as a hedge against economic uncertainty, and recent events reaffirm this notion. However, its susceptibility to major policy decisions also underscores the inherent risks associated with digital assets.

With Bitcoin now surpassing the $100,000 threshold, market participants are eager to see whether this upward momentum will continue or if another wave of volatility awaits. Regardless, the latest price action serves as a reminder that in the world of crypto, anything can happen in the blink of an eye.