- Bitcoin Cash has jumped to an eight-month high of $522.40, driven by strong buying pressure and bullish indicators.

- If demand holds, BCH could rise to $556.40, but profit-taking may pull it back to $490.80.

Bitcoin Cash (BCH) has surged to an eight-month high, making it the top gainer in the crypto market today. As of writing, BCH is trading at $522.40, climbing over 4% in the past 24 hours. This latest rally is fueled by rising investor interest, bullish technical indicators, and increasing institutional confidence—all pointing to the potential for more gains in July.

Bullish Indicators Signal Strengthening Uptrend

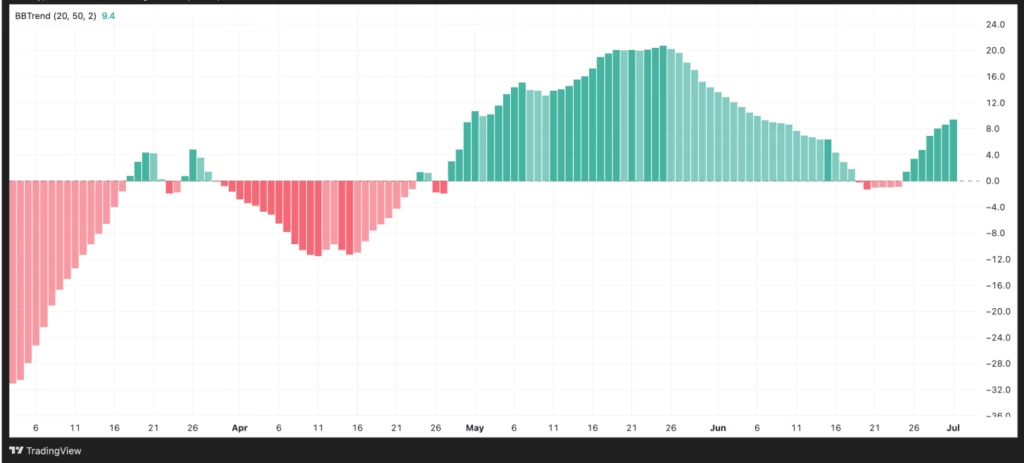

Key technical indicators are flashing green for BCH. The BBTrend, currently at 9.4, suggests a strong uptrend as the green histogram bars continue to grow in size. This indicator tracks Bollinger Band behavior to measure market direction and strength. A rising BBTrend typically reflects increasing volatility and a stronger upward push—exactly what BCH is experiencing.

This bullish setup means buyers are clearly in control. If the trend continues, BCH could push higher, potentially targeting the $556.40 mark in the near term.

Smart Money Index Supports Bitcoin Cash Rally

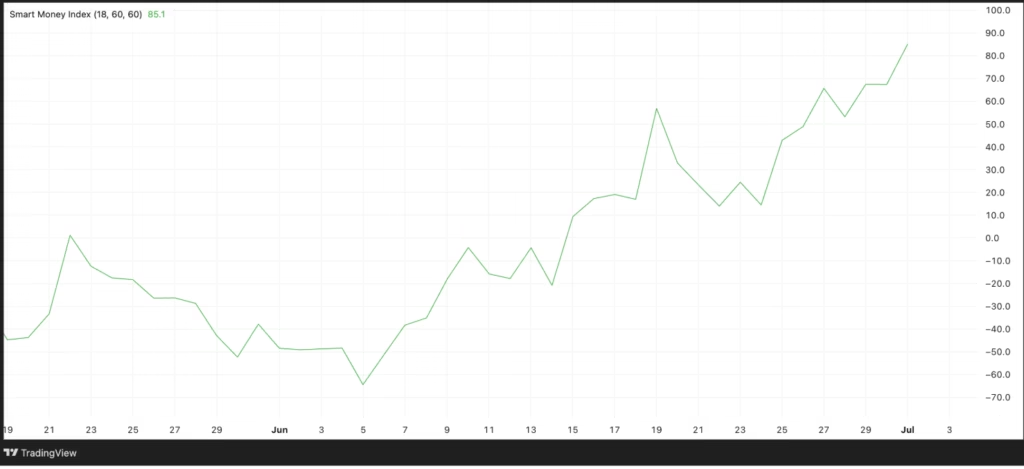

The Smart Money Index (SMI) adds more weight to the bullish outlook. It has climbed to 85.1—a 220% increase since June 5—indicating growing interest from institutional investors. A rising SMI signals that experienced players are buying rather than selling, reflecting growing confidence in Bitcoin Cash.

When both retail traders and institutional investors align in support of an asset, it often lays the groundwork for sustained rallies.

Potential Scenarios Ahead

While the outlook remains positive, traders should stay alert to profit-taking. If bullish demand stalls, BCH could retrace to $490.80. A further drop below this level might push the price toward $444.70, its next major support zone.

However, if current buying pressure holds, Bitcoin Cash may extend its run and test higher resistance levels this July.

Bitcoin Cash’s eight-month high is more than a short-term spike—it’s backed by strong technical signals and institutional backing. As bullish indicators strengthen, BCH could climb toward $556.40 and beyond. Still, investors should watch for any signs of reversal as the price tests key levels in the days ahead.