- Bitcoin dropped to $112,700 after the Fed kept interest rates unchanged and Trump announced new trade tariffs.

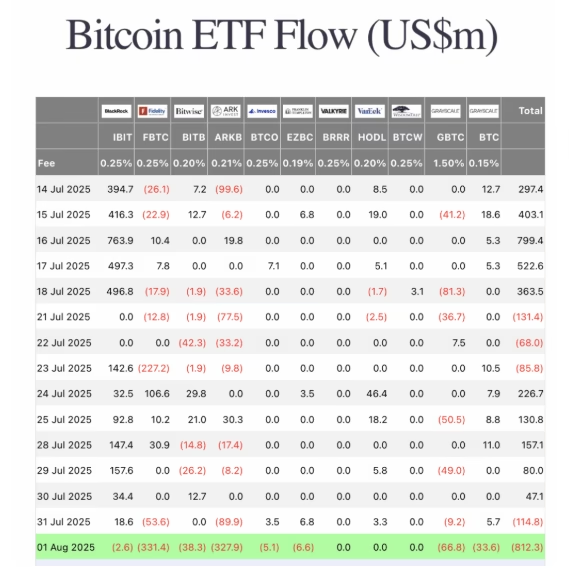

- The news triggered record outflows of $812 million from Bitcoin ETFs, signaling deep investor uncertainty.

Bitcoin’s recent price crash has rattled both retail and institutional investors. The leading cryptocurrency dropped from $119,000 to $112,700 — a sharp 3.5% fall — as a wave of economic uncertainty gripped global markets. The decline reflects a loss of faith in riskier assets as political and financial pressures mount.

Interest Rate Uncertainty Sparks Market Anxiety

The slide began after the U.S. Federal Reserve chose to keep interest rates unchanged. While that might sound neutral, investors had priced in hopes of a rate cut — something that didn’t materialize. Federal Reserve Chairman Jerome Powell added to the tension by delivering a hawkish statement, highlighting that inflation remains stubborn and unpredictable.

This statement dampened sentiment across speculative markets, especially cryptocurrencies like Bitcoin, which typically thrive on lower interest rates and favorable monetary policy.

Trump’s Trade Tariffs Add Fuel to the Fire

Just as the market was processing Powell’s remarks, President Donald Trump announced a fresh round of import tariffs. These apply to countries lacking formal trade agreements with the U.S. and are intended to strengthen American trade leverage — but the timing couldn’t have been worse.

Trump’s tariff move sent shockwaves beyond crypto. The S&P 500 dropped by more than 1.5%, while the AEX index in Amsterdam lost 1.91%. The combined effect of economic caution and geopolitical tension left investors scrambling for safety.

Bitcoin ETFs Suffer Historic Outflows

The fear gripping the market wasn’t limited to Bitcoin’s spot price. Institutional investors, who had been fueling Bitcoin’s rally through exchange-traded funds (ETFs), suddenly reversed course. Over $812 million flowed out of Bitcoin ETFs in just one day — a record-breaking withdrawal.

These outflows show just how fragile confidence in the market has become. ETFs had recently brought new legitimacy and capital into the Bitcoin space. But the current environment has turned inflows into outflows almost overnight.

Bitcoin’s drop to $113,000 serves as a reminder that macroeconomic factors — especially U.S. interest rates and trade policy — continue to dominate crypto market direction. Until inflation cools or political stability returns, Bitcoin may struggle to regain investor trust.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.