- Bitcoin dropped to 83,000 after failing to break the 85,000 resistance, triggered by President Trump’s tariff announcement, which led to 200 billion in market losses and liquidated 178 million in BTC.

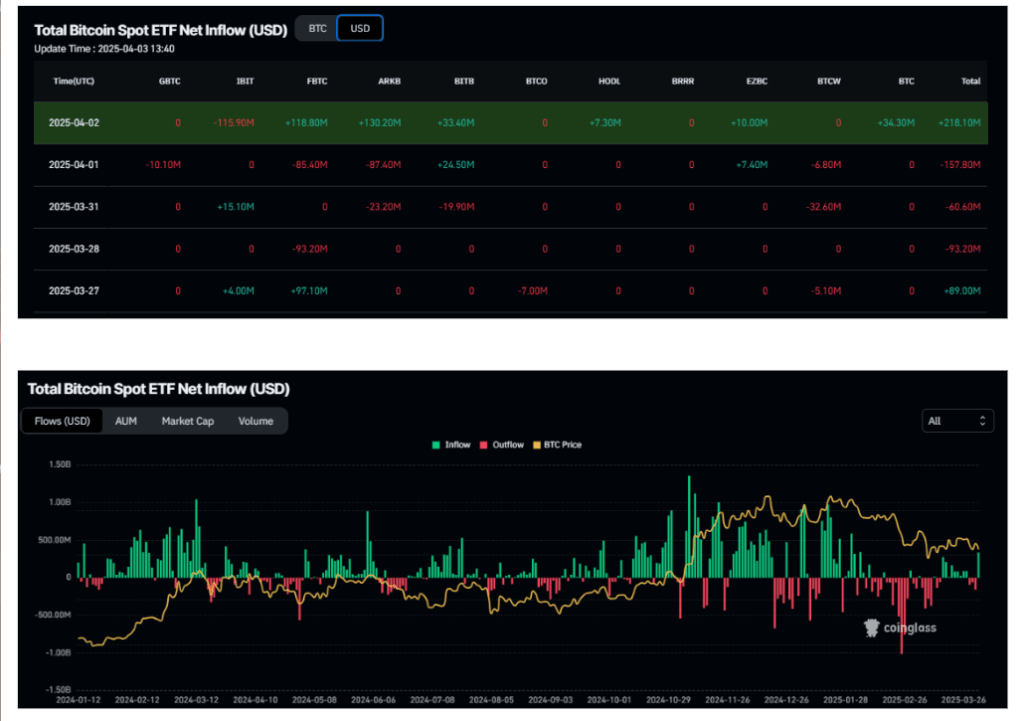

- Despite the volatility, institutional investors took advantage of the dip, with 218 million flowing into Bitcoin ETFs, signaling confidence in the cryptocurrency’s long-term potential.

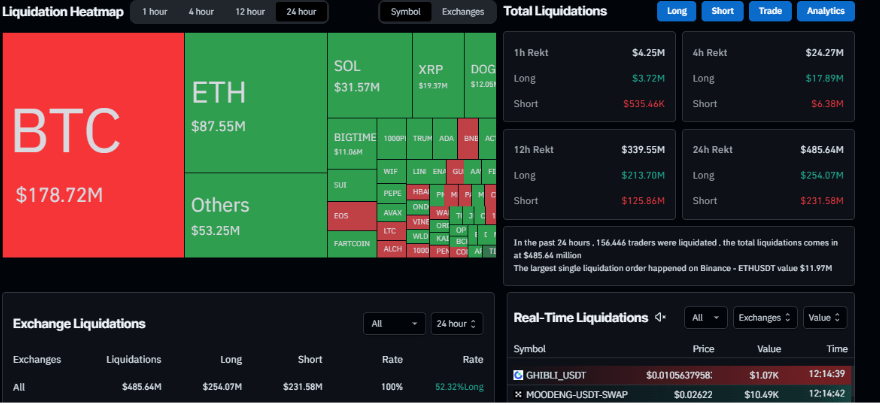

The cryptocurrency market experienced a whirlwind of volatility this week as Bitcoin (BTC) struggled to maintain its momentum above the critical $85,000 resistance level. On Thursday, BTC hovered around $83,000 after failing to secure a decisive close above the resistance the previous day. This turbulence resulted from US President Donald Trump’s sweeping tariff announcement, which erased $200 billion from the total crypto market capitalization and liquidated over $178 million in Bitcoin holdings.

BREAKING: Crypto markets have now erased -$200 billion in market cap since their after hours high. pic.twitter.com/6cbIOugaSK

— The Kobeissi Letter (@KobeissiLetter) April 3, 2025

The Impact of Tariffs on the Crypto Market

The shockwaves began on Wednesday’s so-called “Liberation Day” when President Trump announced tariffs on 185 countries simultaneously—the harshest tariff measure in over a century. Initially, markets reacted positively to reports of a 10% baseline tariff, pushing BTC to a high of $88,500. However, the optimism was short-lived as the full details emerged, revealing significantly higher tariffs, including a 34% rate for China and 20% for the European Union.

As traders processed the news, a rapid market reversal ensued. By 4:42 PM ET, US equity futures had plummeted by 4%, and Bitcoin’s price slid from $88,500 to a low of $82,320, wiping out billions in value from the crypto market.

Institutional Investors Buy the Dip

Amidst the turmoil, institutional investors seized the opportunity to buy Bitcoin at lower prices. The US spot Bitcoin Exchange Traded Fund (ETF) recorded an impressive $218 million in inflows, marking a potential turning point after a series of outflows. This strategic accumulation suggests confidence in BTC’s long-term potential, even as short-term volatility persists.

Bitcoin Price Forecast: A Critical Juncture

Despite the buying spree, Bitcoin faces a crucial test. The 50% Fibonacci retracement level at $88,211 and the daily resistance at $85,000 have proven challenging to breach. If BTC fails to reclaim these levels, it could risk a further decline to $78,258. On the other hand, a decisive close above $85,000 could pave the way for a recovery rally to the psychological level of $90,000.

Technical indicators paint a mixed picture: The Relative Strength Index (RSI) sits at 46, hinting at mild bearish momentum, while the Moving Average Convergence Divergence (MACD) shows indecision. Traders remain cautious, and all eyes are on BTC’s next move as market forces collide.

Trump’s sweeping tariffs have sparked a wave of uncertainty in financial markets, and Bitcoin is no exception. The ongoing geopolitical tensions and economic measures will likely fuel more volatility, making it crucial for traders to stay vigilant and adapt to rapidly changing market conditions.